If you intend to drive your British vehicle in France – or anywhere else in the EU – you will now need a “UK” sticker on your car.

This replaces the GB sticker or magnet that was previously needed when driving abroad, and the UK government guidance states: “If you have a GB sticker, cover or remove it.”

READ ALSO Travel to France: What has changed since Brexit

The new rule came come into effect on September 28th, 2021 for British registered cars driving in the EU, with the exception of Ireland, which does not require a sticker or magnet.

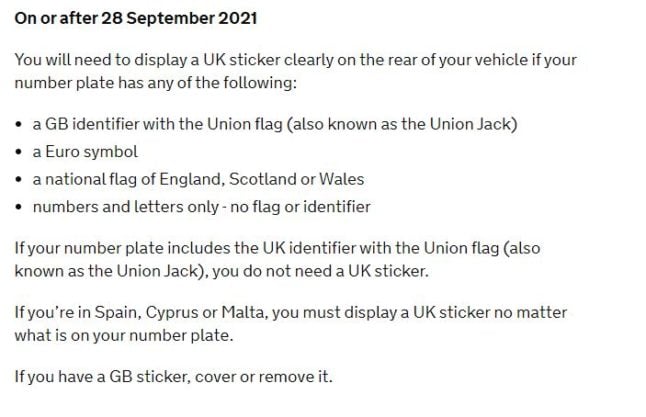

The UK government specifies: “You will need to display a UK sticker clearly on the rear of your vehicle if your number plate has any of the following:

- a GB identifier with the Union flag (also known as the Union Jack)

- a Euro symbol

- a national flag of England, Scotland or Wales

- numbers and letters only – no flag or identifier

“If your number plate includes the UK identifier with the Union flag (also known as the Union Jack), you do not need a UK sticker.

“If you’re in Spain, Cyprus or Malta, you must display a UK sticker no matter what is on your number plate.”

A screenshot of the UK government’s webpage on number plates.

The British government has also registered UK – rather than GB – as its new international symbol for traffic.

The UN said it had received “a notification stating that the United Kingdom is changing the distinguishing sign that it had previously selected for display in international traffic on vehicles registered in the United Kingdom, from ‘GB’ to ‘UK’”.

A spokesman for the British Department for Transport said: “Changing the national identifier from GB to UK symbolises our unity as a nation and is part of a wider move towards using the UK signifier across government.

“GB number plates will still be valid within the EU as long as drivers display a UK sticker on the rear of their vehicle.”

The difference between Great Britain and the UK is the inclusion of Northern Ireland – GB refers only to England, Scotland and Wales while UK is England, Scotland, Wales and Northern Ireland.

The new UK stickers will be available online, and in post offices and garages for around £1.50 (€1.75).

Clearly displaying the country of origin of your vehicle is an international requirement and if you are stopped by French police without one you can be issued with an on-the-spot fine (although it’s unclear how bothered French police will be about the intricacies of UK v GB).

Drivers coming to France from the UK also need to put correctors on their headlights, while French law states that all motorists must carry with them an emergency triangle and a high-vis fluorescent vest. The law requiring drivers to carry breathalysers has now been scrapped but if you are driving in most cities you will need a Crit’Air sticker.

Other changes

While most people are unlikely to be losing much sleep over a sticker, there are some other bigger changes that Brexit has ushered in.

Driving to France does not require any extra paperwork, motorists who are only visiting can continue to drive on their UK licence and the insurance Green Card is no longer required.

You must, however, make sure that your UK passport has at least six months left to run.

Pets can no longer use the European Pet Passport and instead need an Animal Health Certificate, which must be renewed before each trip.

Meanwhile UK nationals who are resident in France need to show their visa or residency card along with their passport every time they enter or leave the country, to avoid having their passport stamped as a visitor.

Also bear in mind restrictions on what can be brought in to the EU from the UK, which includes high-value items, food and plants.

Find the full list of travel changes HERE.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Are the UK government dropping GB because of ridicule over Global Britain? If only…

As for showing a united country, I can’t imagine when it’s ever been more polarised. Looking forward to Nicola Sturgeon getting her teeth into it. Or Sinn Fein in Stormont.

It’s so embarrassing.

Pathetic!

OMG – ridiculous, quite, quite ridiculous. Unbelievable!

Don’t tell me, some Tory donor has got the contract for printing all the new stickers.

Yeah, that was also exactly my own thought.

Also, from memory, NI voted against brexit. The “D”UP was pro-brexit (at least after May offered them bribes to support her). Presuming my memory is correct, and the majority brexit non-support in NI hasn’t changed, the “NI is not part of GB hence ‘U’K” claim, whilst pedantically true, is more of a message to the anti-brexit majority in NI to go f— yerselfs.

Agreed

Perhaps, like the GB/UK passports, they’ll end up being printed in the EU!

So this is how the Govt intends to reunite a country disunited by Brexit. I cringe with shame and embarrassment.

Too awful, extraordinary foolishness. I wonder who ordered it?

•fluorescent• please – no floury jackets needed

What complete and unneccesary tosh! Perhaps the Tory tosspots are worried that GB will become ‘Garbage Britain .’

How long before people start sticking some small letters ‘dis’ before UK?

This article is incorrect as far as pet passports are concerned. You And Yours on BBC Radio 4 has just covered this (https://www.bbc.co.uk/programmes/m000z6cs) because the cost of the health certificate is so high.

You need the UK health certificate to travel from the UK to France but you can then obtain an EU Pet Passport in France which is much cheaper, can be used for multiple journeys and is recognised by the UK when you return. Apparently the French vet may ask for your residence in France but generally they aren’t bothered.

Hi Richard, it’s true that Brits living in France can continue to use the EU pet passport, but the scheme is only open to pets (and owners) who are resident in an EU country – more details here https://www.thelocal.fr/20210903/pet-passports-what-pet-owners-need-to-know-about-travel-between-france-and-the-uk/

This article is inaccurate to the point of being dangerously jingoistic

The facts:

https://www.gov.uk/displaying-number-plates/flags-symbols-and-identifiers

One can still use a GB sticker if you have not got identifiers on the number place

As a Norn ‘Irn remainer – although I had always wanted to remain part of the Union, this article strikes me as proving my suspicision the backers of the local push agendas, rather than FACT (