The name France Titres might be new, but the platform itself already exists – it’s merely getting a revamp and an expansion of the services that it offers.

The site was previously called ‘Agence nationale des titres sécurisés’ (ANTS) – it’s used for various French admin tasks and will probably already be familiar to anyone who has swapped their driving licence for a French one or bought, sold or given away a car.

The body operating the platform will continue to use the title ‘ANTS’ and the URL for the website will also remain the same – ants.gouv.fr.

Why does this website exist?

The ANTS platform was initially set up in 2007 to simplify administrative processes. In recent years, it has spearheaded the push for more bureaucratic tasks to move online, decentralising certain procedures that were previously handled at the local level, such as swapping your foreign driving licence for a French one.

It’s expanding its services too – it has now been integrated with the ‘France Identité’ programme, which can be used to obtain a digital copy of one’s French driving licence (note: currently this is only available to French citizens).

READ MORE: Who can use France’s new digital driving licence?

Similarly, the agency has been involved with establishing the new ‘European digital identity wallet’, which the EU’s council and parliament gave a provisional green light for in November 2023.

This will eventually facilitate life for EU citizens to demonstrate their national identity when accessing things like driving licences and bank accounts in other countries, as well as logging onto official websites for other EU member countries.

How do I create an account and use the platform?

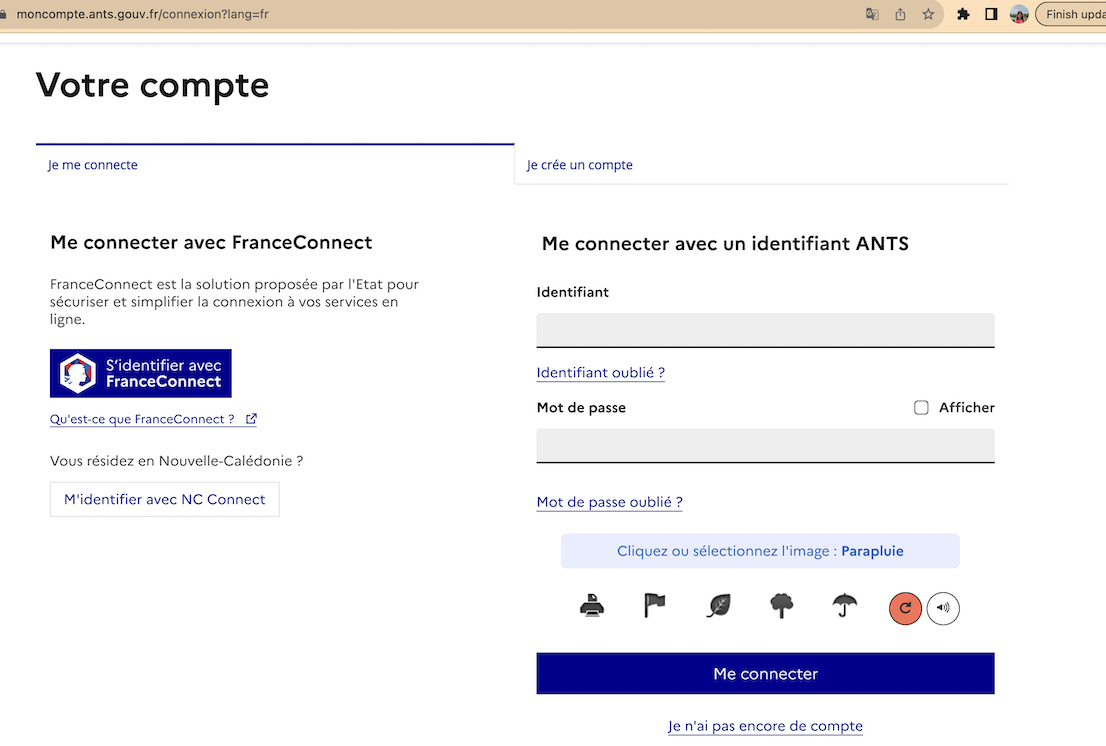

You can either create an account, or you can log in using the ‘France Connect’ tool.

To access services via FranceConnect, you need to already have an online account for another French government platform, such as a personal account for taxes or healthcare – more info in our guide on to use FranceConnect.

Once you are logged on, the welcome page will allow you to click on various administrative procedures that can be accessed via France Titres.

At the bottom of the page, you can find Frequently Asked Questions, as well as the nearest ‘France Services’ location that might be able to help you complete a complicated online task.

READ MORE: What is ‘France Services’ and how can it help foreigners in France?

What can you use it for?

The website is particularly useful for motorists in France, as it is the gateway for several procedures related to vehicles and driving licences.

Swapping your foreign driving licence for a French one

After a certain period of living in France, holders of non-EU driving licences will have to swap them for a French one – you can find full details about this here, including the ‘special deal’ for UK and NI licence holders.

In good news, the website itself is fairly easy to use – ANTS was the site of horrifically long waits for driving licence swaps during 2021 and 2022 (a knock-on effect of Brexit) but the backlog now appears to have been cleared and users report a wait of about four months on average.

Once you have created your account you head to the Permis de conduire (driving licence) section of the website and select Echanger un permis étranger (exchange a foreign licence).

Fill out of the form with your details and the details of the licence that you want to swap. You will also need to upload the supporting documents, which include ID, residency card, proof of address and your current driving licence, as well as a photo, which you can either have taken digitally at a government approved photo booth or send separately by mail.

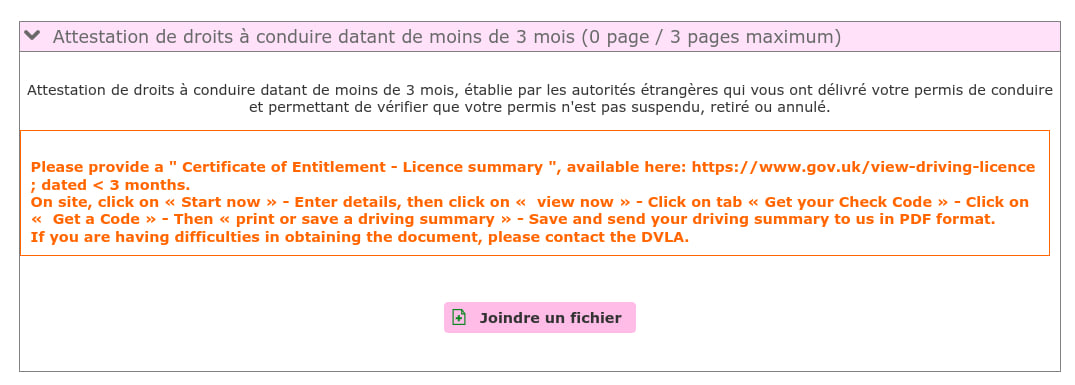

You’ll also be asked for a document (‘Certificate of entitlement’) from your home country attesting that you hold the right to drive, as shown below. If you are British, the platform helpfully gives instructions for accessing this certificate via the DVLA website.

READ MORE: Do I have to swap my driving licence in France?

There are fuller instructions on the exact process of filling out the form – which varies slightly according to the type of licence you need to swap – at the Facebook group Applying for a French Driving Licence.

Registering a vehicle in France for the first time

You have 1 month to register any new vehicle in France, regardless of whether it was acquired in France or abroad. If you buy from a dealer it’s possible that they will deal with the registration for you, as part of the service, but you will still need to check that it has been done.

Registration is done on the France Titres platform. You will need several documents (justicatifs), which you will find listed on the site. These include;

- Cerfa 13750*07 (the application form for vehicle registration)

- A valid identity document

- The certificate of conformity (certificat de conformité) issued by the manufacturer or equivalent

- Proof of address less than 6 months old

- Tax receipt, or le quitus fiscal, for vehicles purchased abroad

READ MORE: ‘Be prepared to be patient’ – Registering your British car in France after Brexit

Selling or giving away your car

When getting rid of your car, there are several administrative steps, including giving the buyer a statement of technical inspection if the car is more than four years old.

You also have to inform ANTS within 15 days of the transfer.

To do this, you will need to supply the transfer form (la cession papier – cerfa 15776*02), the confidential code connected to your vehicle registration (le code confidentiel lié à la carte grise), and an administrative status certificate (le certificat de situation administrative détaillé via Histovec).

All of these are available on the France Titres platform.

Buying or receiving a used car

On the other hand, if you are buying or receiving a used car, you will have one month to register the change of holder and this must be done via France Titres (unless you are buying from a dealership, who may offer registration as part of their service).

You will be able to find the list of necessary documents on the France Titres dedicated page, but you’ll likely be asked for the ‘code cession’ (the transfer code given to the seller once the change has been registered by ANTS).

You may also need the old, crossed out ‘carte grise’ (vehicle registration document), signed and dated by the seller, as well as the paper declaration of the transfer, an application for a registration certificate (certificat d’immatriculation), the administrative status certificate and a roadworthiness test that is less than six months old.

READ MORE: Reader question: Can I buy a car in France if I’m not a resident?

Becoming French

If you have successfully gained French citizenship, you will probably want a French passport and/or a French ID card – and France Titres is the place to do this.

Once you have confirmation that your request for citizenship has been accepted, you can request your first national French ID card (carte nationale d’identité or CNI), or make any changes to it, via this website. It is also where you would request or renew a French passport.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments