Italy’s international residents are often unsure about what the work of a notary (notaio) actually involves. And you may also have heard people say that Italian notaries are members of an elite profession – perhaps even one that’s open only to members of the nobility.

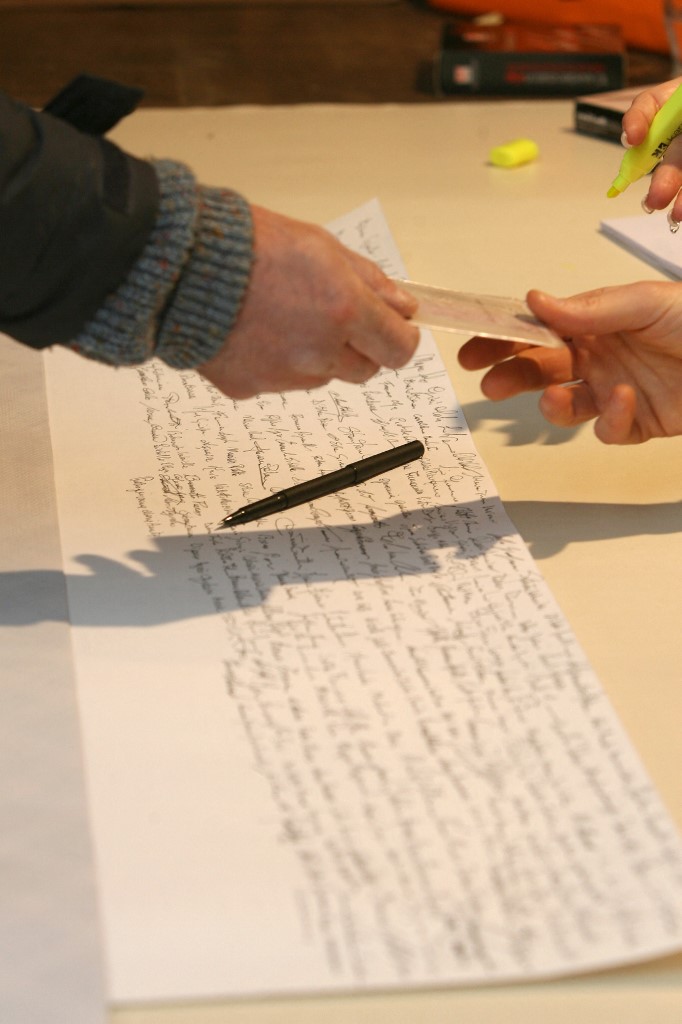

It’s no secret that notaries are an important part of Italian bureaucracy. Whether you’re buying a new house or want to legalise something within a business, chances are you will need a notary to sign and validate your documents – a service which can cost anything from around €500 to €5,000.

This is a lot steeper in price compared to the UK or US, where generally the figure for getting documents notarised is around $100 or lower.

But Italian notaries themselves say there are two reasons for the dramatically higher sum: the model used and the length of training.

“It is a very old profession. In the 1200s many teachers were notaries at the University of Bologna,” says notary Carmelo di Marco. “But the role didn’t really evolve until the Renaissance period when more documents and paperwork were being produced.”

Di Marco has been a notary for almost 30 years and has his office Di Marco Carmelo Studio Notarile in Milan.

He says the Italian notariat is widely considered the oldest in the world and, because of this, 86 countries at present follow the Italian-born, Latin notary model. The model means notaries must be appointed by the state, trained in law and, above all, must be impartial.

“The same cannot be said for the UK or the US which operate under common law and therefore do not have a Latin notary model,” he says.

“There, the notary is only responsible for the authentication of signatures. Here the notary’s work is more in-depth and we operate in different matters such as real estate, family, companies and commerce.

“The notary’s role is to act as a third person. For instance buying a home and applying for a mortgage, donating your home to your child, setting up a company, or making a will.

“What are the risks in carrying out these operations? Can one be aware of all the obstacles and pitfalls caused by constantly evolving laws that are not always easy to understand?”

The road to becoming a trained notary is just as in-depth, and it’s perhaps for this reason that the profession is seen as being elite, as it is costly and time-consuming.

Similarly to the UK and elsewhere, you need to be trained in law to enter the field. Upon graduation, notary trainees need to undertake an 18-month-long apprenticeship.

It doesn’t end there. In the third and final stage, the trainees enter a concorso (‘competition’) run by the Ministry of Justice, in which they complete three written and oral tests in Rome.

READ ALSO:

- What is an Italian commercialista and do you really need one?

- What is Italy’s patronato and how can they help you?

If they pass, the Ministry of Justice assigns an office to the newly qualified notaries. If they don’t, they can retake the exam when it opens again. This final step can be done five times maximum.

“The timeline for the competition is subjective,” Di Marco adds. “Firstly, the Ministry of Justice says when there is enough space for the competition to be open again so the dates aren’t concrete.

“Secondly, you have to be accepted to enrol in the competition, which is a competition in itself. Then you have to wait for the results of the competition which can take more or less one year.”

The process should take five years, but Di Marco says this could take longer for some people.

Today, technology and increased global movement are changing the field.

While Di Marco says technology helps speed up the process of finding information and signing document, and this makes the job easier, global movement has made it more complex.

“The world seems to be a bit more accessible now than it was back in 1200,” he says.

“We have to be aware of people from other countries, too. Take these examples: you get married to a foreign national or you want to buy a second home in Italy but don’t live here. We notaries have to be aware of laws surrounding this before validating documents.

“Global movement has added more strands to our work. I predict this area will grow more in the future.”

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Hmm, they are too expensive as our estate agents, they really are expensive.