The French government is developing a new ‘anti-scam filter’, intended to inform the public whether they are visiting a website designated as a “scam site”, according to Jean-Noël Barrot, the minister in charge of the country’s digital transition.

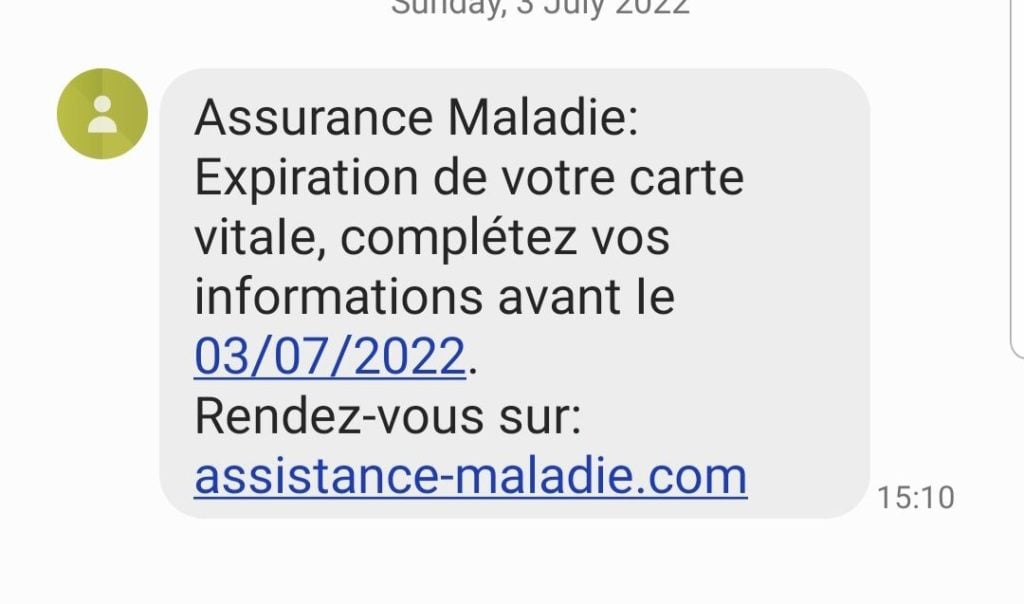

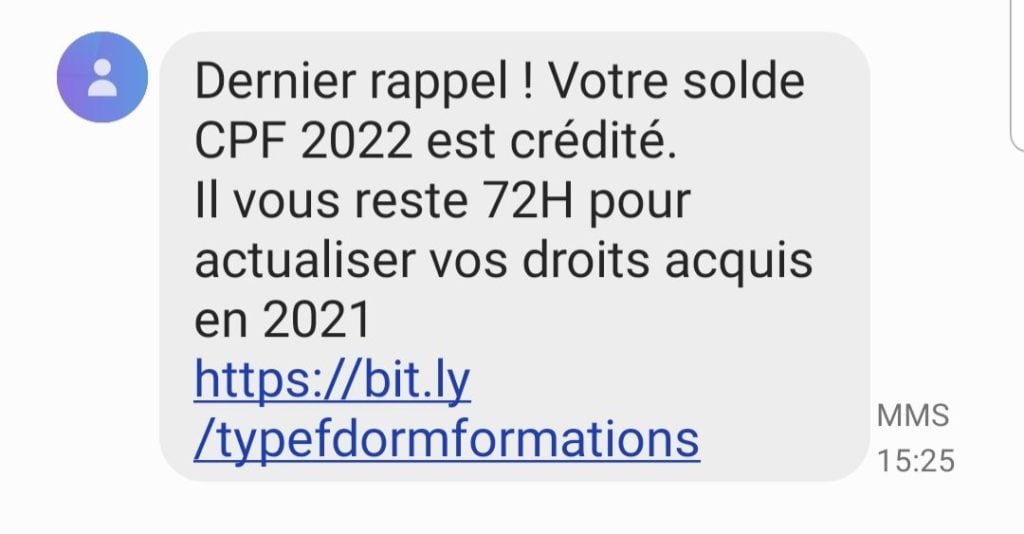

“Who among us has not received a fake text message about their compte formation (training budget), or healthcare, or about Crit’Air stickers?” It is simply unbearable,” he told Franceinfo on Monday when announcing the system.

How will the device work?

While the device has not yet been deployed, the minister envisions it functioning as a warning to keep internet users from going on unsafe websites, which could collect their personal details.

This should also help to decrease the number of fake text messaging scams that circulate around France, Barrot added.

On top of the anti-scam filter, the French government is also building a “cyberscore” device which will indicate to internet users whether it is safe to input personal data on certain websites. The metric will judge the website with a “green to red” ranking, which will help the user know whether they should avoid including personal information, such as their name, address, phone number, or e-mail.

The French government hopes for these devices to be available in the coming months.

Barrot told Franceinfo that it will first be tested during the Rugby World Cup in September, hosted in France, since “during international events, scams multiply. We need to be ready”.

The cyberscore is set to appear on most popular French websites by the end of the year, and for the system to also be used for Paris Olympics ticket sales.

How prevalent are scams in France?

They’re very common, unfortunately.

READ MORE: Warning: 6 of the most common scams in France to watch out for

Oftentimes, these scams come in the form of a text message reminder. Recipients will be encouraged to click a fraudulent link, which will lead them to a dodgy website where they will be asked to enter their personal bank account information.

France’s fraud and financial crime watchdog, Tracfin, published its annual report in July, and it found that fraudulent activity has become both more frequent and more evolved in the last year.

In particular, it found that CPF (Compte Personnel de Formation) scams represented a significant proportion of the fraudulent activity registered this year.

If you are contacted by a company and you are not sure if it is genuine, the French government has compiled a ‘blacklist’ of dodgy companies that frequently try and defraud people – you can find it here.

If you think you may have fallen victim to a scam, particularly if you have shared your banking information, the first step is to contact your bank. You can learn more about what to do in this scenario, HERE.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

What would help more is if they actually correctly enforced GDPR regulations. It is very telling that there is always a spike in spam calls and texts immediately after engaging with a government service – most notably CPAM.