The early retirement scheme, commonly known as the “Arne pension”, was a prominent part of the Social Democratic party’s campaign platform when it was elected in 2019.

Since it was formally introduced last year, 37,700 people have already been granted an early pension under the new rules, Employment Ministry figures, released on Wednesday, reveal.

More than 50,200 people have submitted applications for the new ‘Arne pensions’ since August last year.

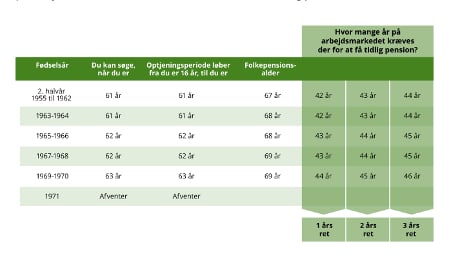

The scheme allows people aged 61 or older who have spent more than 42 years in the labour market to retire before the age of 67, which is the current age to draw Denmark’s state pension, folkepension.

Workers who have logged 44 years in the labour market by the age of 61 can retire three years ahead of schedule, while 42 and 43 years earn you a one- or two-year advance, respectively.

The age at which the early retirement can be taken will, however, increase in years to come, alongside the general retirement age, which is also scheduled to increase.

People born from 1965 onwards will be able to apply for the early pension at 62, while that increases to 63 for people born from 1969 onwards. The number of years needed on the labour market to qualify increases concurrently.

Graphic: borger.dk

“We are both pleased and proud that we have created a scheme which allows people who have had a long and tough working life to step back before they get too sick or are so worn down by the labour market that they have no choice,” Employment Minister Peter Hummelgaard told news wire Ritzau.

The Social Democrats announced a proposal to introduce an early retirement scheme a part of the party’s 2019 general election platform. In the campaign, a picture of brewery worker Arne Juhl was used along with the text Nu er det Arnes tur (“It’s Arne’s turn now”). The early pension scheme subsequently became known as the “Arne pension”.

The scheme is not popular across the board. Conservative party leader Søren Pape Poulsen has called is “pure socialism”, while conservative parties have also criticised it for reducing the labour force at a time of shortage.

Early retirement should be based on individual assessment, according to critics.

People in the building and abattoir sectors are among those who have used the scheme most, according to Ritzau.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments