More easing of Covid restrictions

Italy on April 26th began the first cautious easing of some of its coronavirus-related rules, and further changes are planned in mid-May.

Lidos, beach clubs and outdoor pools are to reopen, with safety restrictions in place including limits on the number of customers allowed.

Shopping centres, which currently are allowed to open on weekdays only, will be open on weekends again.

In mid-May the government will also review the 10pm curfew rule which is currently in place nationwide.

Gyms and indoor dining will have to wait until June 1st, according to the government’s timetable.

Italy’s government has not yet said when it plans to start lifting the travel restrictions.

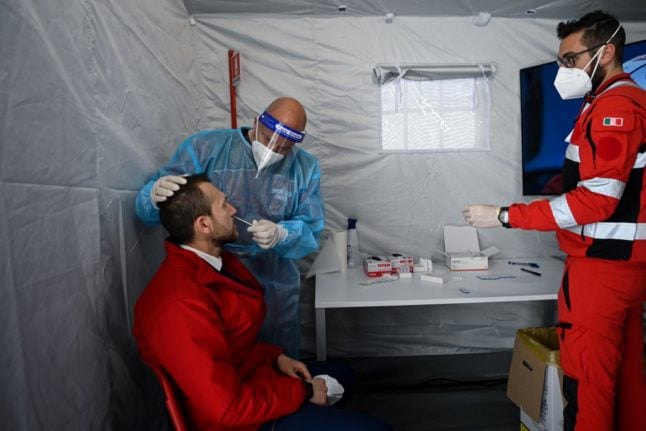

Coronavirus home test kits go on sale, plus more free testing

Shops in Italy will be able to sell Covid-19 home testing kits to the public from May.

The autotest or ‘self-test’ was approved in a recent update by the health ministry and is expected to go on sale in pharmacies, supermarkets and other shops.

The health ministry also gave the green light for pharmacies to begin performing rapid antigen swab tests.

Meanwhile, Italy’s Red Cross (Croce Rossa Italiana) plans to carry out up to 3,000 free rapid antigen swab tests a day across 11 of the country’s biggest cities from May.

It has already begun giving the tests at Rome’s Termini and Milan’s Centrale train stations, and plans to set up facilities at stations in nine more cities next month: Bari, Bologna, Cagliari, Florence Santa Maria Novella, Naples Centrale, Palermo, Reggio Calabria, Turin Porta Nuova and Venice Santa Lucia.

Find more information about each testing option here.

Vaccination campaign to speed up?

Italy’s vaccine rollout has suffered a string of setbacks, but authorities insist this will improve as more supplies are expected in May.

The Italian government’s Covid emergency commissioner, Francesco Figliuolo, said the country’s vaccination programme will speed up “significantly” in May thanks to increased deliveries, after missing its target of having half a million doses administered daily before the end of April.

The commissioner added that family doctors and pharmacists will now be able to administer vaccinations, which will help pick up the pace further.

READ ALSO:

- IN CHARTS: Who is Italy vaccinating fastest?

- ‘We need ammunition’: Jabs for over-60s postponed as Italian regions run out of vaccine doses

- OPINION: Bureaucratic barriers must not stop Italy vaccinating its foreign residents

End of freeze on paying tax bills?

It looks as though tax payments suspended amid the first wave of the pandemic in 2020 could be due for collection in May.

Italy’s ‘support decree’ last spring put a pause on the collection of many tax payments until April 30th, 2021. While there could be an extension, nothing has yet been announced.

If the tax freeze applies to you, contact your accountant (commercialista) or the local tax office (Agenzia delle entrate) to find out what you may be liable for and when.

Public holidays in May

May 1st, which marks Workers’ Day in Italy as it does in other countries, falls on a Saturday this year and won’t count as a day off work.

Mothers’ Day in Italy falls on Sunday May 9th.

International ‘vaccine passport’ to launch

It’s not known whether the Italian government will sign up to it yet, but in May, the “IATA (International Air Travel Association) Travel Pass” will be the first to test travel with a vaccination certificate.

The smartphone app allows travellers to store and manage certifications for Covid-19 tests or vaccinations. It aims to facilitate air travel under pandemic conditions, and help travellers avoid quarantines whenever possible.

The data should remain under the control of the passengers, the association assures. The app is available now for iOS, and a version for Android is also expected to be available soon.

For travel in certain parts of Italy meanwhile you will need the domestic “green pass”, launched at the end of April.

New rules on tyre markings

If you drive in Europe this may be relevant to you. An EU directive comes into effect on May 1st requiring tyre manufacturers to put more specific labelling on their products. Producers will also be obliged to enter specifications on an EU database.

Consumers will be able to use this database to compare products, with the aim of making the market more transparent and easier to find safe and environmentally friendly products. See more details on the European Commission’s website.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments