Health Minister Alain Berset announced moves to reduce pay-outs to specialists for operations that do not require a hospital stay.

By reducing medical tariffs, the minister hopes to slash health costs by 470 million francs – or 1.5 percent of health insurance premiums, according to media reports.

It comes as the government seeks to rein in spiralling health costs.

Earlier this month it was announced that health insurance premiums could rise by up to five percent next year.

READ ALSO: Swiss health insurance premiums set to rise again next year

Berset had wanted to save 700 million francs, but his earlier plans for a revision of the medical tariff rules came in for criticism from doctors and hospitals.

Under the new rules that come into effect from January there will less paid out for procedures that now take less time than previously thanks to technical innovations.

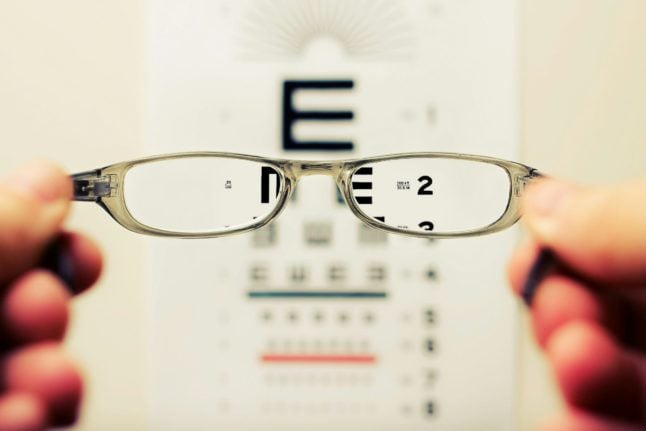

These include cataract operations, colonoscopies and radiotherapy.

Doctors carrying out these procedures will receive around ten percent less in fees than previously.

The government hopes this will result in fewer unnecessary operations and patients will not suffer as a result.

“There will be no reduction in services to insurance policy holders,” Berset said.

It was anticipated that the move could result in lowered health insurance premiums from 2018 as insurers take the changes into account.

However, on Friday, the umbrella organization of health insurers, Santésuisse, cast doubt on this, saying the savings had to be seen first, the Blick newspaper reported.

Please whitelist us to continue reading.

Please whitelist us to continue reading.