After a spate of falling prices, demand is increasing significantly on Germany’s property market, according to real estate experts.

Property platform ImmoScout 24 found that purchase demand in cities, had “reached a new high since 2017”, with the platform noting a sharp increase in financing inquiries in April to June.

“The purchase market for real estate is continuing to gain momentum. The wait-and-see phase is over on the buyer and seller side,” said ImmoScout24 managing director Gesa Crockford, adding that people “want to buy again”.

Interest (measured by contact requests) in buying properties in Germany’s “top eight” cities is particularly keen – it’s up 47 percent year on year in Berlin, Düsseldorf, Munich, Leipzig, Frankfurt, Hamburg, Cologne and Stuttgart, ImmoScout 24 found.

But the trend isn’t only confined to the big cities, purchasing interest has also increased in city outskirts and rural areas, the platform said.

Commerzbank’s analysis at the end of August came to a similar conclusion. The bank is seeing an increasing number of property transactions and more people applying for mortgages.

However, the previous fall in prices should be taken in context as the market varies greatly in different parts of the country.

For example, price drops weren’t as large in inner-city areas of Germany’s largest cities, where demand is always strong, compared with rural areas, which were affected by the crisis to a far greater extent, Maren Boerdeling, asset manager at Quantum Immobilien, told The Local.

READ ALSO: EXPLAINED: What fees do you have to pay when buying a home in Germany?

So what does this mean for property prices?

Despite increased interest, Commerzbank anticipates that prices will only rise “moderately” in the short term as inflated mortgage interest rates will offset the lack of housing stock.

But it said that the property price fall triggered by the European Central Bank’s hike in interest rates may have come to an end.

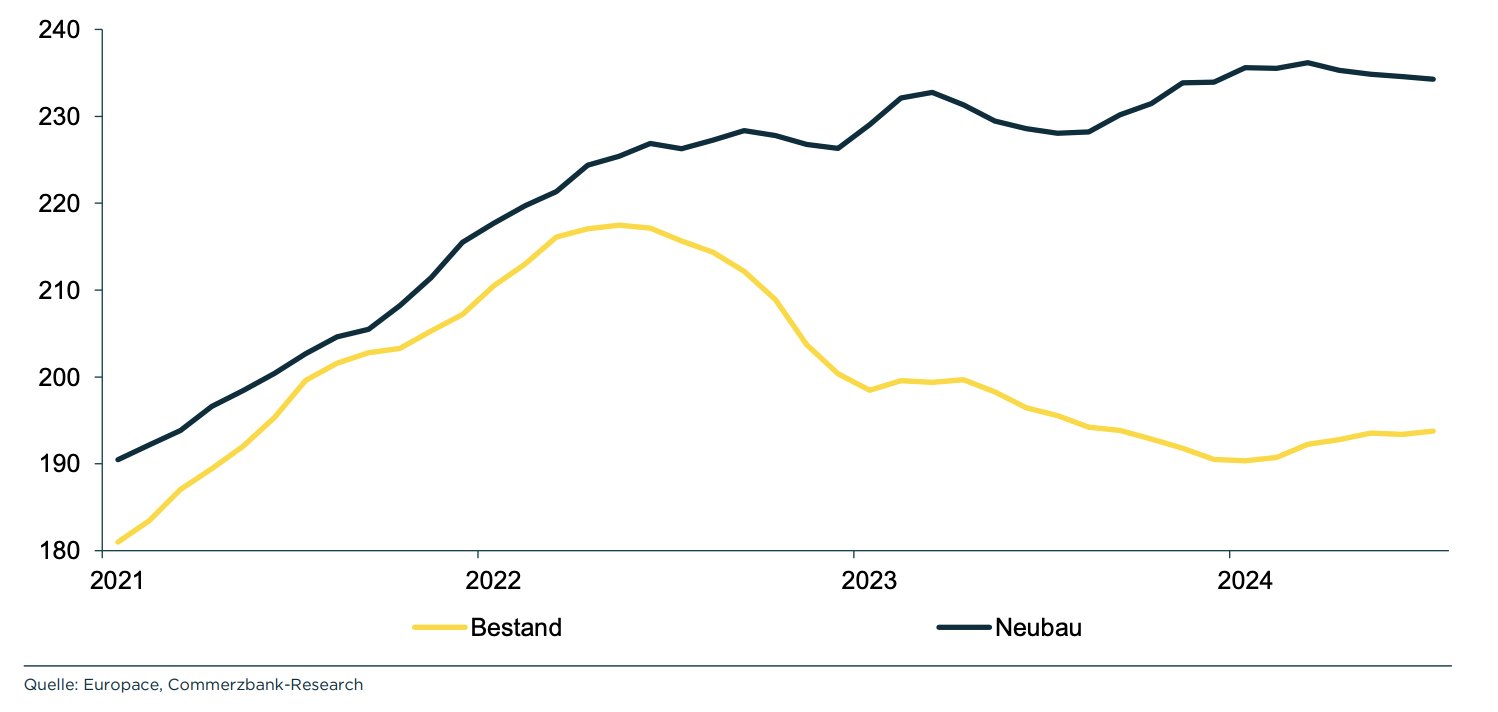

“Prices for older properties have risen again slightly since the start of the year after falling over 12 percent since spring 2022. This would mean the price correction has ended sooner than we expected.” Commerzbank said in a research note on its website.

Another factor that could drive higher prices is the lack of housing stock in many regions across Germany.

For example, the Cologne Institute for Economic Research estimates that 370,000 new apartments are needed up to and including 2025 and around 300,000 for the years up to 2030. However, less than 200,000 will be built by 2026, according to forecasts from Munich’s Ifo Institute for Economic Research.

READ ALSO: Can you get a mortgage in Germany without permanent residency?

As well as immigration, changes in how people are living is also boosting the need for more available property.

Decreasing numbers of people living together in one household are driving the demand for more homes, according to the Association for Contemporary Construction.

But it’s also worth noting that when property portals report rising house prices in their online ads, these are usually asking prices that still have to go through the buying process. Flats may end up being sold for less than they were initially advertised online – or not at all if buyers and sellers cannot reach an agreement.

Is there a difference when buying a new-build or an older property?

As a rule, new-build houses or flats directly from a property developer are unlikely to be any cheaper at the moment – especially because of the high construction costs.

According to Destatis, Germany’s statistics office, new-build prices rose 2.7 percent year on year this May, driven by rising costs among most building materials.

But many buyers are still opting for these. In Hamburg, for example, there’s declining demand for condominiums, but a preference for energy-efficient new-build apartments, which don’t need the renovation work required by older buildings.

However, there are fewer of these available and they are comparatively more expensive, according to a survey by IVD Nord.

And there’s high demand for new-build flats and houses in Berlin and Leipzig, ImmoScout found.

If you’re thinking of buying an older property, it’s worth keeping in mind that banks sometimes ask for risk premiums in the form of higher interest rates for homes that are likely to need refurbishments due to the ‘heating law’ and CO2 taxation.

Furthermore, it is unclear which renovations the German government will give subsidies for in future as part of EU legislation aimed at climate-neutral construction.

READ ALSO: ‘Get help and don’t rush’: Your top tips for buying property in Germany

So, is it a good time to buy a home in Germany?

Property experts have changed their tune in the last months.

Commerzbank, for example, had previously anticipated that prices would continue to fall until the end of 2024 as it believed property prices to still be overvalued by some 5 to 10 percent.

The bank is still ruling out any kind of property boom, but it does think it’s now likely that prices will continue to rise moderately for the rest of the year. This is because interest-rate developments are unlikely to provide much of a price boost.

“The ECB is likely to cut its interest rate by a further 100 basis points by next summer. However, this would be somewhat less than the market is currently expecting, so the downward potential for…interest rates on 10-year mortgage loans is likely to be limited,” the bank said.

Interest rates are “unlikely to be much lower than they are now in the coming months and into next year, at around 3.5 percent, and may even rise slightly in the second half of 2025,” it added.

Others agreed that prices had bottomed out, but only in some locations.

“Since the interest-rate level has stabilised and the ECB is expected to lower interest rates, the bottom seems to have been reached in stable locations,” said Boerderling from Quantum Immobilien.

However, she cautioned that the same was not necessarily true for areas affected by demographic change and socially less advantaged areas (such as in the east outside big cities).

READ ALSO: IN CHARTS: How German property prices are forecast to rise over next decade

Price and rate predictions aside, ultimately, buying a home is a personal decision and depends on many factors, including your financial situation, needs and the area you live which will have its own property market trends.

If you fancy checking for yourself what you might expect to pay for a home in your region, the Kiel Institute for the World Economy (IfW) also handily publishes the Greix (German Real Estate Index). The data is collected on the basis of actual, notarised sales prices so it’s worth looking into while you’re doing your research.

It may also be a good idea to chat to a professional real estate expert in your area when deciding on whether to buy a home.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments