National statistics agency Insee has published a new report into the patrimoine (wealth) of the French population, showing that the average person has assets (money, property, other possessions) worth €177,200.

However it’s important to note that this is patrimoine brut – gross wealth – and so doesn’t take into account any outstanding loans such as mortgages.

When we look at net wealth (the value of property with any outstanding loans/mortgages subtracted) the value falls, but perhaps not as much as you would expect – €124,800 is the average net wealth in France.

One explanation for this could be the French inheritance system, whereby parents cannot disinherit their children so it’s common for French adults to inherit the family home, often mortgage free. Second homes are not only the preserve of the wealthy in France, many average-income families have a second home, which has often been inherited from family members.

Throughout the country 3.2 million homes are classed as maisons sécondaires, the vast majority of them owned by French people.

The overall assets assessment doesn’t take into account income or savings – so you could have a valuable home but no money in the bank.

In 2022, the average salary in France was €39,300 per year, after taxes (or €2,340 net per month).

Just for fun, French news site BFMTV has created this wealth calculator, where you can enter your total wealth (including the value of any property you own even if it’s mortgaged, other assets like a car, any savings or shares you have) and it will tell you how many people are wealthier than you.

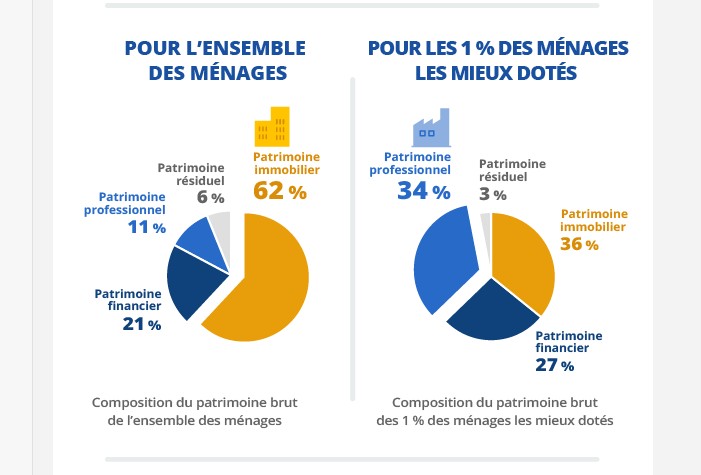

For the average household, property (whether mortgaged or not) represented 62 percent of their wealth, followed by financial wealth such as savings or shares at 21 percent, business assets at 11 percent and all other assets (eg cars, household equipment, artworks) at 6 percent.

To be in the richest 10 percent of the French you need to be worth €716,300 and to be in the top one percent you need €2.24 million.

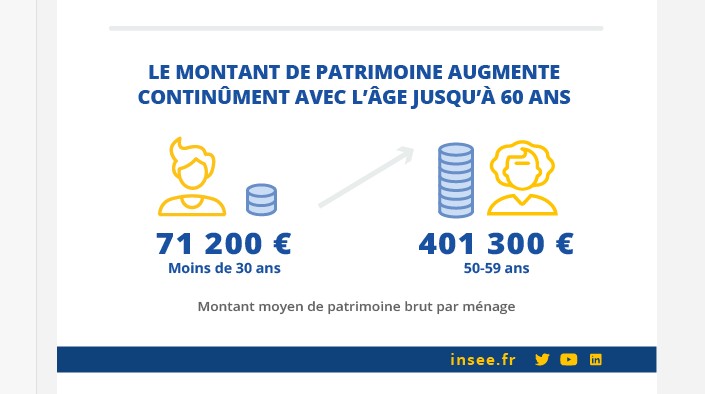

And wealth is heavily concentrated among the older generation – under 30s have on average assets worth €71,200 while the 50-59 age group are worth on average €401,300.

The land of égalité? Not quite, the poorest 50 percent of households own just eight per cent of the country’s wealth, while the richest half own 92 percent of the assets.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

The article states “the average salary in France was €39,300 per year, after taxes (or €2,340 net per month.” However, just to be clear, “after taxes” means “net,” so €39,300 divided by 12 [months] equals €3,275, which considerably higher than the monthly net stated in the article.