All four of the parties backing Moderate leader Ulf Kristersson as Sweden’s next prime minister said in the run up to September’s election that they would either suspend or reduce the so-called “amortisation requirement” once in government.

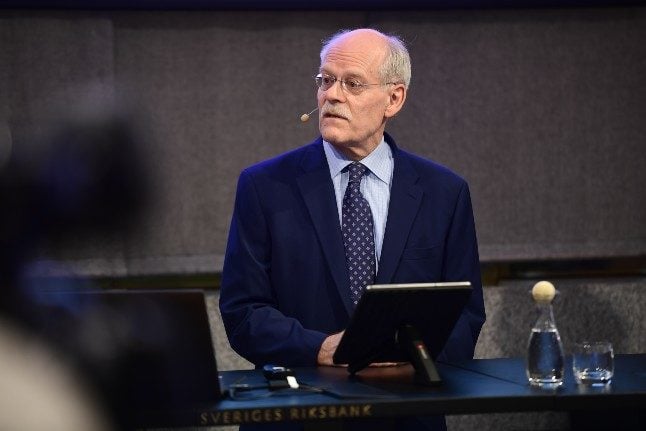

But in an interview with the Aftonbladet newspaper, Stefan Ingves, who steps down as the bank’s governor at the end of this year, said that the measure would be poor economic policy in the current inflationary situation.

“This is an inappropriate measure which would harm Sweden if you did it,” he said. “You’ve got to understand that we have enormous amounts of mortgage debt in the Swedish economy and that the mortgage market represents a risk for the economy.”

“It would send an extremely unfortunate signal to say that as soon as it gets a bit more expensive to borrow, then you should stop amortising [paying off the interest],” he said.

Ingves’s statement came as Erik Thedéen, the general director of Sweden’s Financial Supervisory Authority, also criticised the proposal.

“To use the amortisation tool in the same direction as during the pandemic would quite simply be a wrong measure,” he told Sweden’s state broadcaster SR in its regular Saturday interview.

He said that if the new government wanted to help those who risk personal bankruptcy as a result of rising interest rates, there were much better ways of doing.

“Only half of households have mortgages, and they typically have fairly strong finances,” he said. “So if we want to help those with the tightest margins, then this is an extremely poor measure, when there are a lot of better measures you could come up with when it comes to finance policy.”

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments