Rising inflation is a problem affecting economies the world over. Economists and politicians are proposing ways to slow inflation, to cut taxes, and to soften the impact on consumers.

In Spain, things are no different.

In late July, Spain’s National Statistics Institute (INE) reported that the Consumer Price Index (CPI) – the index used to measure inflation – rose by 10.8 percent in July, up from 10.2 percent in June and the fastest rate since September 1984, a 38 year high.

READ ALSO: Spain’s July inflation rate reaches new 38-year high

The prices of anything and everything from fruit and eggs to olive oil and petrol have jumped up, and the increases have been particularly pronounced in fuel and utility costs due to the double-pronged pressures of inflation combined with global fuel prices rising as a byproduct of Russia’s invasion of Ukraine.

Electricity costs have been reaching historic highs over the past year, with prices on Wednesday, July 20th, 124 percent higher than the same time in 2021, according to recent data from OMIE, operator of the Iberian energy market.

According to a survey by Sigma Dos, 43 percent of Spaniards have been forced to cancel, shorten, or change their holiday plans for the months of July and August.

And then, on top of all that, the European Central Bank (ECB) announced last week that it is raising interest rates at the end of July, in order to try and slow inflation, which will have a direct impact on consumers paying back loans and mortgages.

READ ALSO: How will rising interest rates affect my life in Spain?

According to the Family Budget Survey (EPF) conducted by the INE, the average Spanish family’s spending on food has increased by €620 year-on-year.

All in all, the perfect storm of pressures of family budgets has hit hard in Spain.

That in mind, The Local has put together a list of tips to help you fight inflation and save some money in Spain this summer.

1. Natural light

Spain is well known as one of the sunniest countries on the planet. Not only does its roughly 15 hours of light a day make it hot during the summer, but it also means there’s an abundance of natural light.

With electricity bills through the roof, an easy way to save on energy is to keep the lights off during the day and take advantage of the light by keeping curtains and blinds open.

It’s worth remembering, of course, that many properties in Spain are built to withstand the scorching summer temperatures, and, as a result, may have rooms that are dark and gloomy in order to keep the temperature down.

Though that’s good for the heat, it’s not ideal for energy savings.

If that’s the case, and you really need to put the lights on during the day, consider switching to LED bulbs, since they can save as much as 80 percent on the bill compared to traditional bulbs, and they last much longer – years longer, in some cases.

2. Regulate the aircon

Keeping the curtains and blinds open may be good for saving on electricity bills, but what about the heat?

With Spain in the midst of record-breaking summer heatwaves, during the hottest months Spaniards are dependent on their fans and air-conditioner units.

Regulating your use of air-con can help you save on bills. The ideal temperature should be between 24C and 26C and remember that for each degrees you drop the temperature, the energy output goes up by around 8 percent.

READ ALSO: Ceiling fan vs air con in Spain: Which offers the better price-coolness ratio

At night, many Spaniards opt to open the windows and keep the room ventilated as opposed to falling asleep with the aircon or fan on and racking up the bill.

READ ALSO: Spain to cut electricity tax by half to ease inflation pain

3. Shop around

An age old saving trick: shop around.

Food prices in Spain have jumped over the course of 2022.

According to INE figures, in June the prices of 46 household products were more expensive and above the overall CPI rate of 10.2 percent.

These include eggs (23.9 percent more expensive); butter (23.1 percent); whole milk (21.1 percent); fresh fruit (19.3 percent); baby food (16.7 percent), poultry meat (14.1 percent), bread (13.9 percent); beef (13.1 percent) and or cheese (10.5 percent).

Being more creative with your shopping can help save on prices.

Fruit and veg shops (fruterías) are often far cheaper per kilo than the chain supermarkets, as are discount shops like Lidl and other local supermarkets. Consider going to the butcher (la carnicería) to save on meat.

Before going shopping, look online and compare prices between the different supermarkets. Make a list, and consider going for the supermarket’s line of own-brand products as opposed to more expensive brands.

As a famous British supermarket chain always reminds us – every little helps

4. Loyalty cards

That in mind, another way to soften the impact of inflation is to take advantage of promotional offers and loyalty cards. Spanish supermarkets often have 2×1 or 3×2 promotions, discounts, and savings when buying in bulk – particularly on dairy and poultry products.

Consider getting loyalty cards at your local supermarket to make savings, and even at clothing stores, hairdressers and restaurants if they offer them. Loyalty cards not only offer discounts; you can often accrue a free service or product – shopping delivery, haircut, meal – by giving them repeat business.

5. Washing machine – know the peak and off-peak hours

With electricity bills historically high, Spain suffering heatwaves throughout the summer, and all this talk of fans and air-conditioning and keeping rooms ventilated, knowing the peak and off-peak electricity tariffs in Spain is an essential way to make savings and help right inflation.

The washing machine is well known as an appliance that uses a lot of electricity and takes a long time. With bills skyrocketing, and the price of electricity on the wholesale market exceeding €200 per megawatt hour (MWh), rising to €300/MWh during peak hours of the day, many Spaniards have taken to using their washing machines at times of the day that offer the cheaper tariffs.

READ ALSO: Inflation hack: what time should I use the washing machine in Spain?

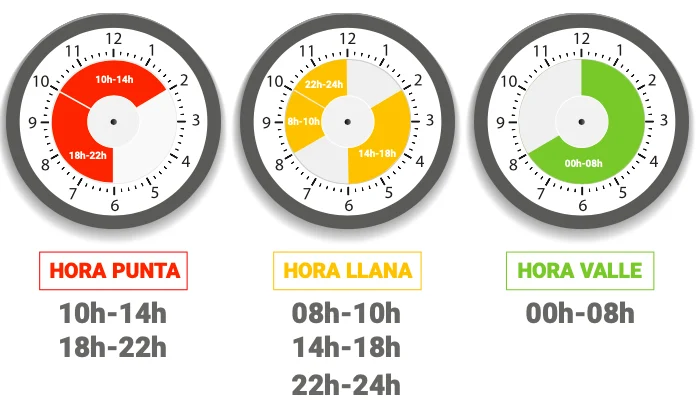

From Monday to Friday, the cheapest time to use the washing machine is during the flat and off-peak slots. It may not be ideal, but by putting the washing machine on during the night, from 00:00 to 8:00 (off-peak), or in the morning, from 8:00 to 10:00 (flat), the kWh price can be significantly lower than during peak hour.

Similarly, another good time to use the washing machine, and perhaps the most convenient without being too costly, is after lunch from 2:00 p.m. to 6:00 p.m during another flat-rate session.

Fortunately, weekends and holidays correspond uninterruptedly with the off-peak time slot and there is, as a result, very little variation in prices depending on the time of day you use the machine, so you can wash your clothes at the weekend with worrying about racking up a huge bill.

Peak and off-peak times:

Horas punta – peak hours (most expensive): 10-14:00h and 18-22:00h on weekdays.

Horas valle – off-peak (cheapest): 00-8:00h on weekdays; 24h on weekends and national holidays.

Horas llana flat rate (intermediate tariff): From 8-10h, 14-18h and 22-24h on weekdays.

6. Electronic devices

Although the pandemic jump started the working from home trend (teletrabajo in Spanish) and has many advantages, in the context of record-high inflation and utilities bills, it also has its negatives, like increased bills because you’re continuously using electrical devices such as computers.

If you work from home, consider using LCD screens – which save, on average, up to 37 percent more energy than normal screens – and try not to leave devices on standby.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments