France has set itself a goal of attracting more foreign talent to universities, and the government is also keen for these highly qualified graduates to stay and become part of the French workforce.

Students who have an EU passport can stay with minimal paperwork, but non-EU students will need to change their student visa to ensure that they have the correct documents to live and work in France.

This is neither simple nor paperwork-free (of course) but there are several routes that recent graduates can take in order to stay.

Immigration lawyer, Maître Haywood Wise, who practices in the Paris area, explained some of the options:

Recherche d’emploi et création d’entreprise (RECE) – Job Seeker/ New Business Creator

If you did a vocational degree or masters level (or above) the ‘job seeker’ residence permit might be the best bet for you.

The goal of this card is to allow you to “have a first professional experience or start a company in a field that corresponds to your training.”

On this residence permit, you will be allowed to search for and hold a job in connection with your degree or research for one year.

According to Maître Wise, there are several “advantages” to this residency permit. You are permitted to work full-time while on this titre, in contrast to the part-time requirements of the student visa.

Maître Wise explained that the benefit of this permit is that while on it you “do not need a work permit” as a foreigner, as you have the legal right to work while on it – making you instantly more attractive to employers who are spared the burdensome task of security your work permit.

In order to qualify, you must have received one of these degrees, and during your studies you must have held a student visa (VLS-TS):

- a Licence Professionelle (vocational degree),

- a master’s degree or equivalent (such as an engineering degree, a degree from an institute of political studies (IEP), the higher diploma in accounting and management, a veterinary diploma, etc

- a Specialised Master’s degree

- a Master of Sciences (MSc) accredited by the Conférence des Grandes Ecoles

Keep in mind that this also applies to researchers who completed their research in France (meaning you previously held the residency permit: “Carte de séjour “passeport talent – chercheur”)

If you are worried that the above-criteria might not apply perfectly to your situation, Maître Wise explained that the legal code regarding who exactly qualifies is “rather ambiguous,” and that you might still be able to consider applying for this permit even if you do not come “directly under the terms of the legislation.” However, it is recommendable to seek legal advice in this scenario.

If you completed an undergraduate degree in France, unfortunately this will “most likely not work” for the ‘job seeker’ permit.

READ MORE: Visas and residency permits: How to move to France (and stay here)

How much does it cost?

For students, the cost is €75, for researchers, the cost is €225.

What rules should I be aware of?

You are not obligated to do this directly after graduating – in fact, you can apply for the ‘job seeker’ permit up to four years after completing your degree.

How long does it last?

This residency permit is valid for 12 months – even if you get a permanent job during this period, there is no need to change the permit until the 12 months are up.

At the end of the 12 months, if you have found a job (in your field) or started a business in France, then you must switch onto a different titre.

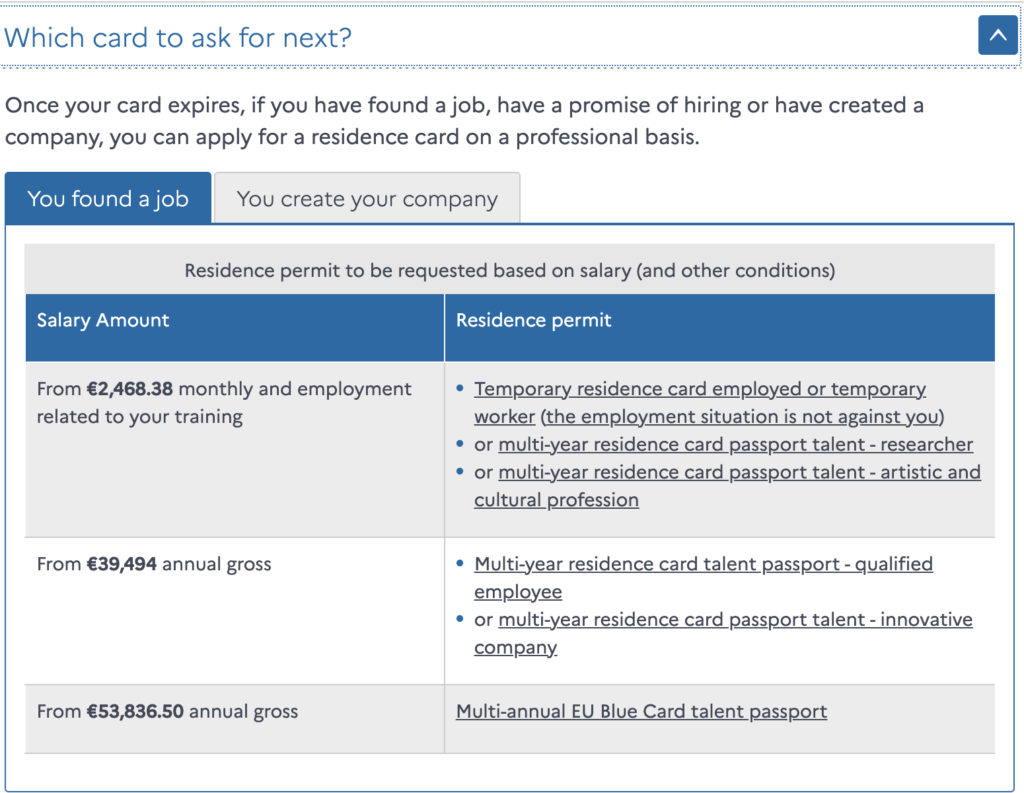

When switching onto the next residency permit, if you’ve set up your own business or set up as a freelancer, you can look into the “temporary residency card: entrepreneur/professional.” For those who were offered a job, the next residency card will depend in part on your salary and field, as shown below courtesy of French government website service-public.fr. Keep in mind that exact salary amounts may differ from year to year, so it is best to check with official government websites.

Carte de séjour: salarié/travailleur temporaire – Employee or temporary worker

If you did any type of higher education in France, you can apply for this visa once you have been offered a job in the field you studied.

The employment contract you must have been offered for this work is either a CDI (permanent position) or CDD (temporary position), but cannot be a stage (internship) or as a pigiste (casual worker).

Normally people getting this type of permit also need a work permit, for which employers need to demonstrate – among other things – that there is no local candidate who could do your job. However if you switch onto this permit type from the RECE card, demonstrating this is not necessary, assuming you meet the other requirements (the job meets the income threshold and is in your field of study).

You will still need to have your employment contract validated by the DIRECCTE (the Regional Department of Competition, Consumption, Work and Employment) when applying for an “employee” or “temporary worker” residency permit.

You’ll likely also need to provide proof of your current residency permit, your passport, proof of residence, three passport compatible photos, and your autorisation du travail (work permit).

How long does it last?

The first time you apply for this residency permit it is valid for one year (12 months). It is renewable, and can be renewed for a period of up to four years.

Passeport talent : carte de séjour pluriannuelle d’un étranger en France – Talent Passport

This residency permit is aimed at highly qualified candidates and for recent graduates it is issued based on your study field and salary level, and there are several different categories within it.

It’s less common for students, although some researchers qualify for it. For someone who has just finished their studies in France, you most likely would fall under one of these categories: “qualified employee”, “artist” , or “creation of a company.”

If you’re applying as an employee (rather than freelancer or business start-up) you need to have graduated from a professional degree or a Specialized Master’s/Master of Science (accredited by the Conférence des Grandes Ecoles) or at least equivalent to a Master’s degree, and have been offered an employment contract with a gross annual salary of more than €39,494 or more (as of 2022).

You can find the other requirements HERE. Keep in mind your employer will need to fill out a Cerfa form to request that you fall under the ‘passeport talent’ category.

How long does it last?

This is a multi-year residency permit, and also allows you to bring a spouse and/or family members with you.

Final tips

Check official government websites to see when you must begin the application process for a ‘changement de statut’– sometimes this varies by préfecture, and if you are still waiting on your diploma certificate from your French university you can ask them for a provisional letter attesting you have met the graduation requirements and passed your grand oral (if that applies to you).

Maître Wise recommends the RECE permit if you qualify for it: “Stay on this titre de séjour until its expiration,” he said, adding the reminder that “each préfecture works differently. Some of these applications are easier in Paris.”

According to the immigration law expert, it is best to take the residency permit process “extremely seriously, particularly because the préfectures lack transparency and are not functioning well.”

His final tip is to “get on it in advance, and be prepared for confusion regarding how you’re going to get employment. If you have an employer, solutions are easy. If you don’t then it’s not going to be so easy.”

Basically, do your homework before going and be prepared for a potentially bumpy ride. If your situation is complicated or atypical, it might be best to spend some money on legal advice.

* Maître Haywood Wise works for the HAYWOOD MARTIN WISE law firm. They offer consultations in English and French. You can find their website HERE.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments