Taxes in Spain can be very confusing, particularly if you’re new here or you have multiple sources of income.

So if you have any doubts it may be advisable to contact a gestor to go over your situation and help you complete la declaración de la renta.

However, if you want to cut out extra costs and your income source is fairly straightforward (you’re a contract worker), this guide will help you with the different steps to fill out and submit your annual income tax declaration.

You can do it online, provided you have a Digital Certificate or a Cl@ve pin.

Anyone resident in Spain who earned over €22,000 from a single employer in 2023 must present an income tax return (over €15,000 if you earn from multiple clients).

If you’re self-employed, it’s important to remember you will now be obliged to file an income tax return regardless of how much you earned, even if you made a loss.

The campaign for filing your taxes for 2023 opened on April 3rd 2024 and will close on July 1st 2024.

To begin, click here to access the Agencia Tributaria website, then click the link that says ‘Servicio de tramitación borrador/declaración (Renta WEB)’, under Gestiones destacadas. This will take you to the declaration form.

READ ALSO – EXPLAINED: The key changes to Spain’s 2023/2024 annual tax return

Step 1:

The first screen will ask you to identify yourself using your Digital Certificate or Cl@ve pin. You are also able to identify yourself with your NIE, but only if you completed the Declaración de la Renta in the previous year and have the reference number.

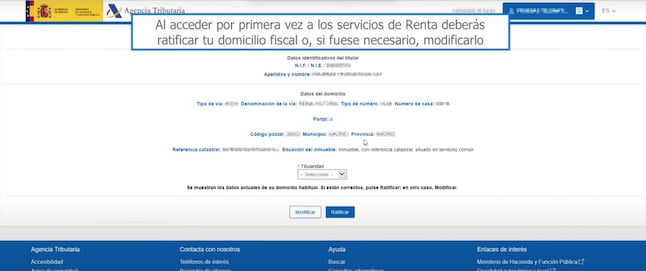

If you’ve identified yourself with your Digital Certificate or Cl@ve pin, you will be taken to a screen containing your personal details, such as name and address. If everything is correct, you want to click on the button that says ‘ratificar’. If you need to change certain details, click on ‘modificar’, then press ‘continuar’ to continue to the next page.

Step 2:

If you identified yourself with your NIE and reference number, you will be taken directly to the next page.

Here, you will see a page listing the different ‘Servicios Disponibles’ or Available Services. Click on ‘Borrador/Declaración (RENTA WEB)‘ to access and complete your tax return.

On the next screen, you will again see a summary of your personal details – name, address, birthdate, NIE etc. You will need to make sure that these are correct before continuing. You will also need to know the referencia catastral of the property you’re living in. If you own your property, this should be on the deeds to your house, but if you are renting, you can find it out here.

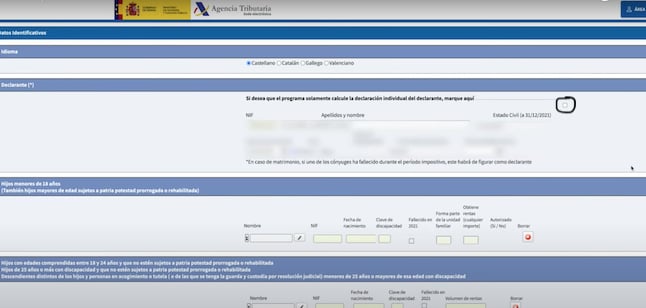

The form will also ask you questions about your marital status and give you the option of declaring as an individual or together with your spouse. You may want to contact a gestor or a tax lawyer to find out which would be best for you, because it could mean paying more or less tax, depending on your individual circumstances.

READ ALSO: Is it better to do a joint or separate tax declaration if you’re a couple in Spain?

If you want to do it as an individual, check the box that says ‘Si desea que el programa solamente calcula de la declaración individual del declarante, marque aqui’.

When you’re done checking and completing all your personal details, click on ‘Aceptar’ to continue.

Step 3:

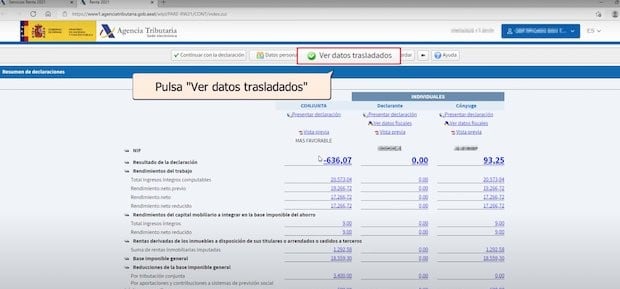

On the next page, you will see lots of numbers, detailing all the tax deductions and payments made by you in 2023. If you were employed, rather than self-employed you can click on ‘ver datos fiscales’ in order to check that everything is the same as on the certificado de retenciones or withholding certificate issued by your employer.

If you are self-employed, you can check that all the amounts match the amounts you declared and paid in each trimester of 2023 as you should have already submitted tax returns for the four trimesters of last year.

If there is anything you need to add in manually, you can do this by clicking on the button at the top which says ‘Ver datos trasladados’. Here, you can add anything that was not already incorporated. When you’re done with this click on ‘Volver’ to return to the main page.

Step 4:

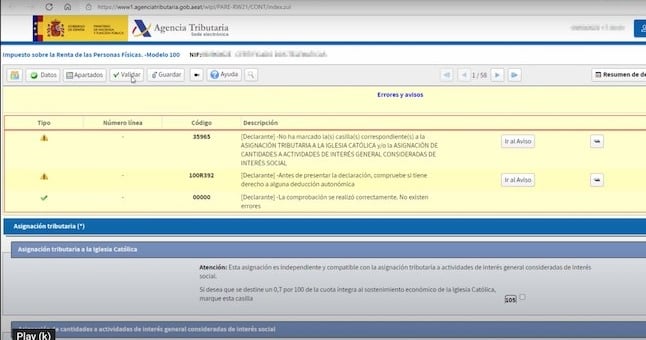

You will now see a 58-page document featuring a wide range of questions and scenarios. This includes everything from asking if you want to donate money to the Catholic church to any interest you may have earned on savings or anything you might have inherited during the previous year. You can click the arrows to move through each page or click on ‘Apartados‘ in the top left-hand corner to see a drop-down menu of each section and go directly to different parts of the form.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments