In recent years, Spanish tax inspectors have been stepping up their investigations into irregular address changes and may ask taxpayers in Spain to prove their tax address to make sure they’re complying with the law.

In a Spanish tax report published in June 2021, more than half of the 900 Spanish tax advisors interviewed said they believed that changes of fiscal address to another country or region in Spain were primarily theoretical, so only on paper without physically moving.

READ ALSO: More than half of tax address changes in Spain are fake

But it’s important to remember that in many cases notifying your change of tax address is both necessary and important. Here’s what you need to know.

What is your fiscal address (domicilio fiscal)?

If you live for more than 183 days per year in Spain you will be considered a tax resident. Your fiscal address or tax domicile is the address where you’re registered for tax purposes, even if you’re not working.

By default, your tax address is registered as being in the region in Spain where you habitually live for most of the year, however, it could also depend on other factors including:

- Which region you spend the greatest number of days a year in.

- Where your main centre of interests lie such as where your family live and where you work.

- Where you last declared your income tax from.

If you work in one region but live in another for example, or split your time equally between properties in two different regions, this could be a bit of a grey area and the best thing to do would be to contact a gestor or a tax lawyer to get advice as to where you are registered for tax purposes.

READ ALSO – Reader question: Can I be a non-resident for tax purposes with Spain’s non-lucrative visa?

Why does updating a change of fiscal address matter in Spain?

While national taxes are the same for everyone, regional taxes are not and they can differ quite a bit depending on which region of Spain you live in.

For example, according to a recent study by the General Council of Economists ‘Panorama of Autonomous and Provincial Taxation 2020’, in Extremadura and in the Valencian Community you pay more for inheritance, donation and wealth taxes, compared to Cantabria or Madrid, where you pay very little or nothing.

There are also important regional differences in personal income tax. In Madrid, you pay between 9 and 21 percent, whereas in Catalonia, you pay between 12 and 25.5 percent.

READ ALSO: Why you should move to this region in Spain if you want to pay less tax

As a result of these differences, some people decide to move to a different region in order to avoid paying more tax, while others simply try and change their fiscal address to a different region, even when they don’t actually live or work there.

Is changing your fiscal address in Spain legal or illegal?

If you simply want to change your fiscal address to a different region in order to deliberately pay less tax or benefit from more favourable tax laws in another region, then no, this is not legal.

If found out, you could face prosecution and hefty fines from the Spanish Tax Agency. These penalties can vary but when Hacienda considers it to be a “serious” case of fraud, the fine can be higher than €30,000 and for “very serious” cases it can be above €300,000.

However, if you need to change your tax address to another region because you moved house or changed jobs, then you’re required to change it and it’s perfectly legal.

Even if you don’t move to another region with different fiscal requirements and just move to another part of your city or province, you should technically make sure to change your fiscal address as Spain’s tax agency needs to have an updated address to which to send you notifications by post.

This applies to contracted workers and in particular self-employed workers, as they are entirely responsible for handling their own fiscal matters.

If you simply forget to change it and are not purposely trying to defraud the Tax Agency, you could still be fined €100, so make sure that you remember.

READ ALSO – Reader question: Can I be a resident in Spain and the UK?

How can I request a change of tax address?

If you meet the conditions, such as moving to another part of Spain or workplace, requesting a change of tax address is simple and mandatory.

One of the easiest ways to do this is online on the Tax Agency’s own website and can be done if you have a Digital Certificate or Cl@ve account. You can find the page here.

READ ALSO – Access all areas: how to get a digital certificate in Spain to aid online processes

You will need to enter your NIF número de identificación fiscal (fiscal identification number) which is the same as your NIE and then check that your personal details such as name, date and place of birth etc. are correct.

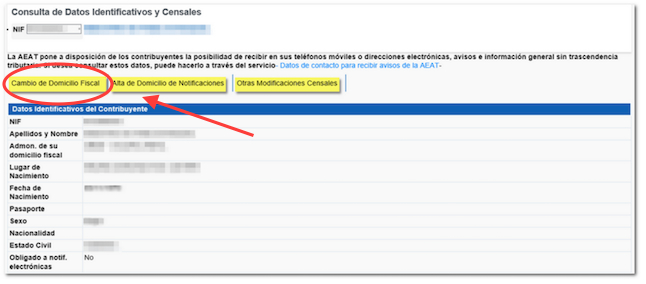

Under these details, you’ll see three buttons – the one on the left says ‘Cambio de Domicilo Fiscal’ (change tax address). Click on this and then update your new address details, before clicking on ‘Confirmar Modificacion’ (confirm modification).

This is the screen you’ll see when you want to change your tax address. Source: Agencia Tributaria

If you do not have a Digital Certificate, you can download and present the Modelo 030 (form 30) in person at the Administration or Delegation of the Tax Agency that corresponds to you. You can find information on where to download it and how to fill it out here.

If you are still having problems submitting your change of tax address, the Tax Agency has also set up a telephone number exclusively to process changes or modifications of tax addresses. The number is 901 200 345.

An equally good alternative is to use the government’s cambio de domicilio (change of address) website, which will send your new address to different public administrations, such as the DGT traffic authorities, the social security department and of course the Agencia Tributaria tax agency.

How to prove your tax address if Hacienda contacts you?

If for example, you live in one region but have your tax address in another due to your work or other reasons, this might raise flags with the Spain’s tax agency and you may need to prove your tax address so you don’t face problems.

Keep in mind that if you don’t have your padrón (town hall registration) at the fiscal address you claim, Hacienda will not necessarily believe that you’re actually based there.

There are several ways of proving that a home is indeed your fiscal address, such as showing your household receipts and bills.

Make sure to store these in case of the unlikely event that you are taken to court and need to prove where you spend the most amount of time.

In conclusion, it’s definitely not worth the risk of changing your fiscal address simply for tax benefits.

If Spain’s Hacienda tax agency does open up an investigation against you and conclude your change of tax address was fake, apart from the possible penalties and blacklisting yourself on the system, you will have to pay back everything you saved in taxes.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments