Because the USA is not part of the EU digital travel pass, American vaccination certificates do not have QR codes that are compatible with the French health pass.

This means that visitors from the US need to obtain a European code before they can use the health pass, and the process for doing this has changed several times since the health pass was rolled out in August.

The French government has now shut the online portal for this, and introduced a new system.

Here’s how it works:

Who?

This applies to anyone who was vaccinated outside the EU. What passport you hold is largely irrelevant, although French citizens vaccinated in the USA do have their own separate system.

In order to apply for the French code you must be

- Over the age of 12

- Fully vaccinated with either Pfizer, Moderna, AstraZeneca or Johnson & Johnson vaccines

Those vaccinated with Sinopharm or Sinovac can get a French code if they have had a single top-up dose of either Pfizer or Moderna.

Those vaccinated with Sputnik or any other vaccines not recognised by the WHO need two doses of either Pfizer or Moderna before they are accepted as fully vaccinated in France.

Why?

The health pass is now compulsory to access a wide range of venues and if you cannot prove your status as fully vaccinated you face having to either take a €22 Covid test every three days or avoid all bars, cafés, cinemas, tourist attractions, gyms, leisure centres and long-distance trains.

How?

The new system is a really a thrown-back to the very first system, only a little more formalised.

Previously tourists and visitors were told to email or apply online in advance of their trip to get their code, but now codes can only be issued by pharmacies.

This means that tourists will have to wait until they have arrived in the country and then sort out the necessary code, which is available on a walk-in basis from pharmacies.

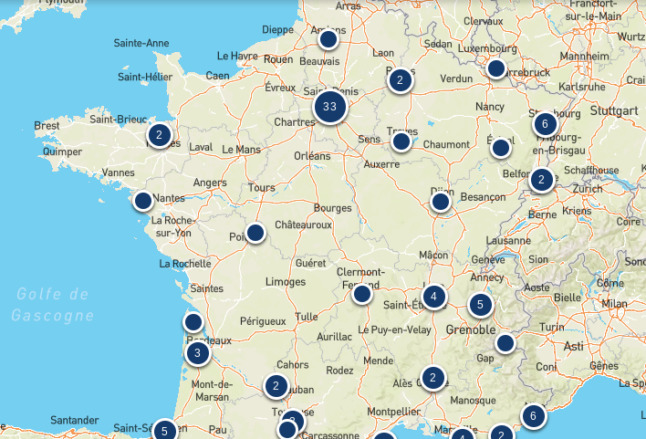

Not all pharmacies offer this service, visitors will have to go to a participating pharmacy and, as the map below shows, there are not many of these and they are heavily concentrated on cities, especially Paris.

You can find an interactive version of the map HERE to find the closest pharmacy to you.

Once at the pharmacy, you show your original paper vaccination certificate and your passport and the pharmacist will give you a QR code. The code can then be scanned into the French TousAntiCovid app and this creates the health pass.

Find full details on how the health pass works HERE.

Charles de Gaulle airport

If you are coming to France by air and you are flying into Charles de Gaulle airport, there is a pharmacy at the airport that offers this service.

It’s called Pharmacie Bonassoli, but it does not operate 24/7.

How much?

Previously the swapping service was free, but now pharmacists can charge up to a maximum fee of €36.

Why the change?

The process for tourists and visitors from outside the EU to get the necessary code has never really worked very well, and The Local has received dozens of emails from people who were unable to get the code, or who waited weeks for their application to be processed, leaving them without a pass on their holidays.

Most of the rollout of the health pass has gone very (some might say surprisingly) smoothly, but this areas has definitely been a weak spot.

The most recent system was an online application form, but many people reported that it took weeks to get their code so it was probably understaffed.

By moving the task back to pharmacies the government has at least provided a service that is accessible on a walk-in basis, and hopefully more pharmacies will sign up to the scheme in time.

What if you are still waiting?

If you already applied online for the code and are still waiting, the government says that existing applications will be processed.

However if it has not arrived by the time you get to France, you can also go to the pharmacy to get your code.

Other options

If this system doesn’t work out for you there are a couple of other options.

The health pass also works with a negative Covid test, so you could take regular tests. Tests are available on a walk-in basis from virtually all pharmacies in France and for tourists cost €22 for an antigen test or €44 for a PCR test. Both types work with the health passport.

We’ve also received anecdotal reports of foreign vaccine certificates, especially the American CDC card, being accepted as proof of vaccination by staff at bars or cafés. However, this is not officially recognised.

French vocab

Pass sanitaire – health passport

Attestation de vaccination étranger or Certificat de vaccination étranger – Foreign (ie non-EU) vaccination certificate

Code QR (pronounced coo-aire) – QR code

Conversion de certificats de vaccination étrangers en format européen – Conversion of foreign vaccination certificates into a European format (this is the formal name for this service, so look out for pharmacies offering this)

Bonjour, pouvez-vous tranformer mon certificat de vaccination étranger en un QR code français pour le pass sanitaire ? – Hello, can you swap my foreign vaccination certificate for a French QR code for the health pass?

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Is it possible to get a health passport if you have had Covid and took the monoclonal antibody treatment? We were told we have immunity for 8 months.

Does anyone have experience with updating the Passe Sanitaire for the booster? I got the QR code back in September. I am over 65 and just got the booster in the US. I am going to France In December and my Passe Sanitaire will be invalidated on the 15th so I will have to update it with my US CDC card I guess.

I have heard anecdotally that the deactivation won’t affect non-French qr codes.