Germany has the lowest level of property ownership in the EU, with just over half of the population owning their own home.

But while in many cultures – particularly in English-speaking countries – home ownership is an almost universal (if sometimes unattainable) dream, this is not always the case in Germany.

What is going on here? Why are Germans so content to rent?

Can Germans not afford their own homes?

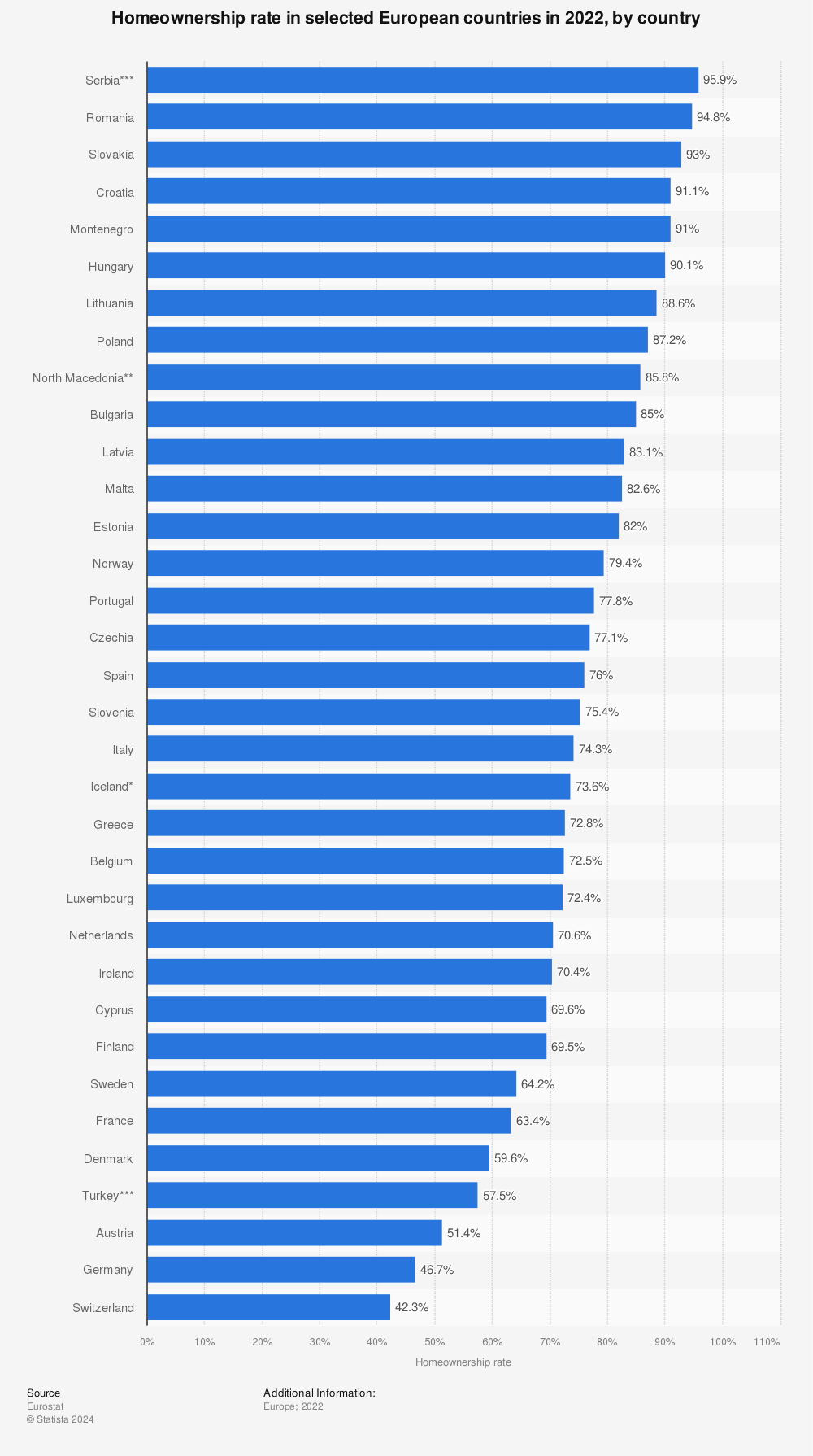

According to the European Union’s statistical agency ‘Eurostat’, 51.1 of homes are owner occupied in Germany – well below the 70 percent European average.

This is quite a surprising statistic for the economic powerhouse of Europe. One would think that Germans would have few problems being able to buy their own homes.

But the fact that the former communist countries Romania and Hungary have the highest home ownership rates on the continent (96 percent and 92 percent respectively) indicates that the correlation between economic strength and home ownership isn’t as strong as it seems.

Indeed, Germans are in a better position than many Europeans to buy.

Calculations in the Deloitte Property Index show that buying a property in Germany is comparatively cheap. The costs of a house is roughly equivalent to five pre-tax incomes, whereas in the UK the average house costs the equivalent of nine years’ salary.

But there are also clearly price concerns that make a big difference.

There are big differences in home ownership across the 16 federal states.

SEE ALSO: Here’s where rent prices are going up (and down)

The tiny state of Saarland in the southwest has the highest rate of home ownership in the country. Close to two-thirds (64.1 percent) of residents of the former coal-producing region live in their own properties.

At the other end of the scale is the capital city where less than every fifth person owns their home.

The wide gap between ownership in cities like Berlin and Hamburg and rural areas like the Saarland reflects a difference in property prices.

The Deloitte Property Index states that “the purchase price index between city property prices and those in the countryside gaps further than ever and continues to show the increasingly divergent development of purchase prices between urban and rural regions.

“Property prices in German metropolises such as Berlin, Frankfurt and Hamburg exceed the national average by half, while Munich records the highest German value at 130 percent.

So, why are Germans not so keen on buying?

There are historical reasons for the German preference for renting.

After World War II, there was an acute need for living space, but little private money around to finance it.

“That’s why the state quickly built lots of rental housing and later slowly withdrew from the sector,” poverty expert Tobias Just told Business Insider in 2019. “Because the rents remained cheap for a long time, people also liked to stay in rental housing for a long time.”

One study looking at the low rate in Germany, found four major historical factors which have contributed to a preference for renting over buying: a large supply of high-quality social housing, a lack of subsidies for homeowners (unlike Spain or the Netherlands), strong protections for renters, and long-term stability of rental prices.

Germany has a strong system of rent controls that ensures that landlords can’t charge an arm and a leg for living space.

Hamburg and Berlin are two of many cities that have enacted “rental brake” laws in recent years to ensure that rents are tied to the quality and age of the property, while reflecting overall rents in the neighbourhood.

That all means that Germany has some of the most affordable rents in Europe – although prices are creeping upwards especially since Berlin’s rental cap law failed in 2021.

“Rental costs per square metre in Berlin, at a relatively moderate rate, are lower than Frankfurt, Hamburg and lastly Munich, which charges the highest rents. But a comparison of European cities clearly shows how favourable the average rent level is in German cities,” comments Deloitte.

Then there are the hidden costs of buying. In Germany interest on mortgage payments is not tax deductible, as it is in other European countries.

And while it is true that rental prices have been increasing strongly in almost every German city in recent years, property prices have been rising even more rapidly.

Is this likely to change in the future?

Over the past two decades the number of Germans who choose to buy their own property has been slowly rising.

According to information published by the national statistics agency Destatis, the proportion of Germans who live in her own home has risen from 40.9 percent in 1998 to 46.5 percent in 2018.

Especially in recent years, buying has become a better investment.

A recent study by the Cologne Institute for Economic Research (IW), found that in 393 of 401 German districts, buying is now more profitable than living as a tenant.

For anyone moving house, “it is more attractive to invest in residential property than to rent,” says Michael Voigtländer, real estate economist at the IW.

SEE ALSO: Renting versus buying in Germany – What is actually cheaper?

One of the major reasons why buying is so attractive is the low interest rates that have been set by the European Central Bank over the past decade. These have made it cheaper than ever before to take out a mortgage.

According to analysis by the IW, even in German metropolises, where purchase prices have risen particularly sharply, home ownership is now the cannier choice.

In Berlin, living in your own home is currently about 35 percent cheaper than renting, while in Hamburg the figure is 43 percent, the institute estimates.

So over the next few years we can expect to see ever more Germans calling themselves Eigentumer and ever fewer calling themselves Mieter.

EXPLAINED:The words you need to know before renting a flat in Germany

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments