On a broad front mortgage rates have increased by up to 40 basis points, newspaper SonntagsZeitung said in an online report.

“The interest rates for fixed-rate mortgages have risen dramatically since the end of last week with all suppliers, Concetta Caselli, of independent mortgage provider Hypoplus, told the newspaper.

People renewing existing mortgages or those taking out a new one are faced with a sharp rise in costs, according to the report.

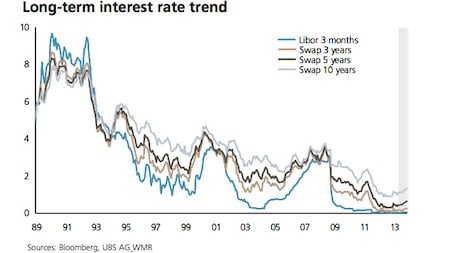

The jury appears to be out over whether this is a short-term or longer term development but most experts believe that rates hit rock bottom in December and will not return to those levels.

“Market participants have realized that this is the beginning of the end of low interest rates,” Fredy Hasenmalle, head of property research at Credit Suisse, told SonntagsZeitung.

One factor influencing markets was the recent comment by Ben Bernanke, chairman of the US Federal Reserve, hinting that the American economy would not need continued support from monetary policies that have kept interest rates low.

On the other hand, the Swiss central bank has said it would maintain low interest rates, in part to prevent the Swiss franc from strengthening in value.

SonntagsZeitung said experts saw other reasons for the recent sharp mortgage rate increases.

“The banks are trying to increase their margins,” Werner Egli, a partner at consulting firm Hypothekenbörse AG told the paper.

Other factors include stricter regulations on mortgages, the growing risks of a market that has seen prices rise faster than the overall economy and warnings from the Swiss National Bank about an overheated property market in Switzerland.

The SNB has indicated that bank margins up until recently had fallen so low that the financial institutions were unable to put enough money aside to cover the risks, SonntagsZeitung said.

Banks seem to be less interested in offering long-term fixed rate mortgages at low rates, the newspaper said.

But some observers expect that some mortgage providers will nudge down rates again by the end of the year.

Stefan Heitmann, of financial advisors My Money Park, warned against hasty judgments.

Heitmann said he sees “no swift turnaround in interest rates that leads us back quickly to the high levels of the past”.

Last month, UBS advised customers that it expected Swiss interest rates to remain very low because investors are prepared to accept low rates on "safe Swiss franc investments".

It also indicated that the lack of inflation (forecast at zero percent for this year) "may well limit the upward pressure on interest rates for the time being".

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments