El Defensor del Pueblo (what we’d call a public ‘ombudsman’ in English) is a High Commissioner of the Spanish Cortes Generales.

They are basically in charge of defending the rights and public freedoms of all people in Spain by supervising the Spanish public administrations. A good way to think of it is as like a sort of mediator between the Spanish state and the people.

As such, the scope of their work is very wide, as they monitor all parts of the state and government, including the Treasury, Migration, Health, Education, Culture, Sport, Transport and Housing, among many others.

READ ALSO: What’s the difference between a gestor, a lawyer and a notary in Spain?

El Defensor del Pueblo is elected by the Congress of Deputies and the Senate, and their mandate lasts for five years. Crucially, they do not receive orders or instructions from any state authority, meaning they perform their duties independently and impartially from government influence.

The position was first created in 1981, and the Spanish Congress elected the first Defensor del Pueblo in December 1982. The post is currently held by Ángel Gabilondo Pujol, who took office in November 2021.

Anyone in Spain can turn to El Defensor del Pueblo for help and support, a service which is free of charge. The office supports citizens and looks into alleged irregular or improper activity by any branch of Spanish public administration or its employees on their behalf.

This is particularly useful for foreigners in Spain, who may, whether it be for reasons such as a language barrier or unfamiliarity with Spanish administrative processes, require support when it comes to dealing with the Spanish state.

How Spain’s Defensor del Pueblo can help foreigners

The sorts of services provided by the Defensor del Pueblo, particularly the different arms of government it scrutinises, can potentially impact foreigners in several ways.

According to the Defensor del Pueblo official website, which you can find here, “foreigners, regardless of their documentation status in Spain or their age, turn to the ombudsman when they believe that the actions of Spanish administration have violated their rights.”

This means foreigners who feel they’ve been treated poorly or ignored by the Spanish say can request the help of the ombudsman’s office.

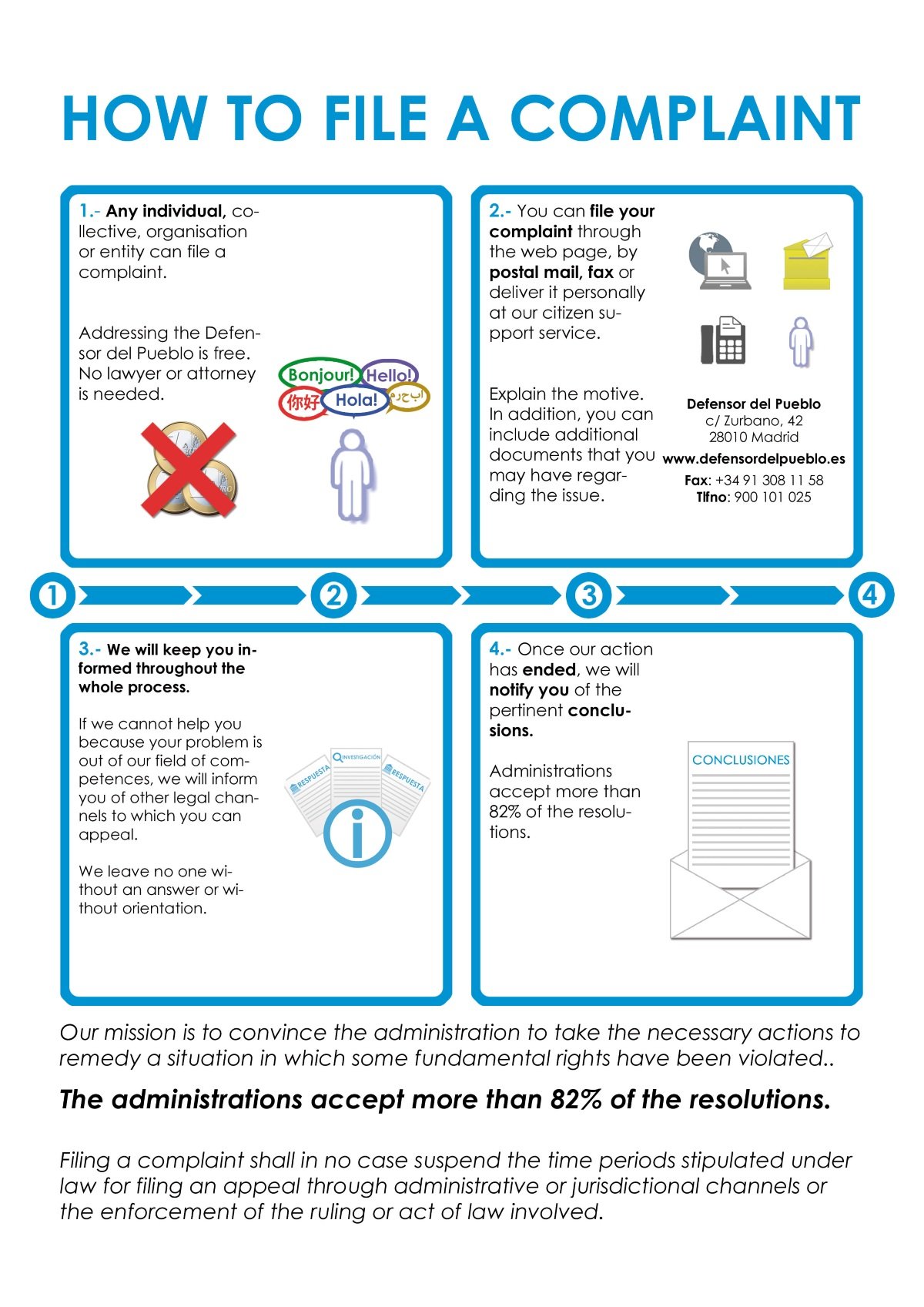

The following image by the Spanish ombudsman explains how to file a complaint with them, explained in more detail in the English version of their website.

Among the sorts of responsibilities the public ombudsman works on in Spain are supervising the actions of Spanish consulates abroad, dealing with complaints by foreigners about processing delays for those applying for Spanish citizenship, and it also carries out actions such as turn up unannounced to do checks on detention centres for foreigners or call for greater protections for migrant workers.

Recent cases where el Defensor del Pueblo has defended foreigners include investigating four Valencia police station which tried to fine foreigners for trying to file a complaint, forcing Navarran authorities to offer help to unaccompanied migrant minors, and denouncing the lack of residency application appointments in Castellón (Valencia).

In a summary of the varied roles and responsibilities of the Defensor del Pueblo fulfils, the website also lists managing digital services for disabled people; helping with appointments and services accessed through Spanish public administration; supporting consumer rights and assisting in making compensation claims, especially against energy companies; supporting women in prison; supporting unaccompanied minors, especially those arriving in the Canary Islands; as well as working on issues such as minimum wage and the prevention of forest fires.

READ ALSO: What’s the difference between a gestor, a lawyer and a notary in Spain?

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments