Norway has a tax scheme for new arrivals. Most new foreign workers are sorted into the PAYE (Pay As You Earn) tax scheme by default.

The scheme has a flat tax rate of 25 percent and aims to simplify the process for new arrivals.

READ MORE: What foreigners need to know about Norway’s PAYE tax system

This scheme is instead of Norway’s typical tax for employees, which encompasses a flat rate for 22 percent for everyone and then a progressive tax based on earnings.

The progressive portion, called the bracket tax, ranges between 1.7 and 17.5 percent. Those in the PAYE scheme do not pay bracket tax.

Therefore, in some cases, you will pay less tax than if you were in the regular scheme.

As the PAYE scheme is voluntary, you can opt out of it.

There are several reasons why someone would wish to opt out of the scheme. For starters, while it may seem that you are paying less tax than if you were paying a mix of bracket and flat income tax, this might not be the case.

This is because employees in Norway are also deducted social security contributions from their salary.

That means that in some cases, once social security is added to the mix, you pay more tax as a member of the PAYE system.

The Norwegian Tax Administration uses figures on its website to illustrate different tax schemes.

If you were to have a salary of 120,000 kroner after six months in Norway you will have paid 30,000 including social security contributions under the PAYE scheme compared to 17,920 kroner under the regular scheme.

Were you to earn 240,000 kroner you will have paid 60,000 kroner in tax, including national insurance contributions, under the PAYE scheme compared to 58,399 under the general income tax rules, plus national insurance contributions.

Those who are set to earn 270,000 kroner over six months would pay 67,500 kroner under the PAYE scheme, compared to 68,599 through the regular tax and national insurance scheme.

Therefore, there are some cases where choosing to be taxed under the general rules will result in lower tax payments.

The Norwegian Tax Administration has an online calculator that lets people work out how much tax they will pay. This allows you to determine whether it will be better for you to be in the general scheme or the PAYE scheme.

Some workers, such as those who earn more than 670,001 kroner, must pay tax under the general tax rules and are not eligible for the PAYE scheme.

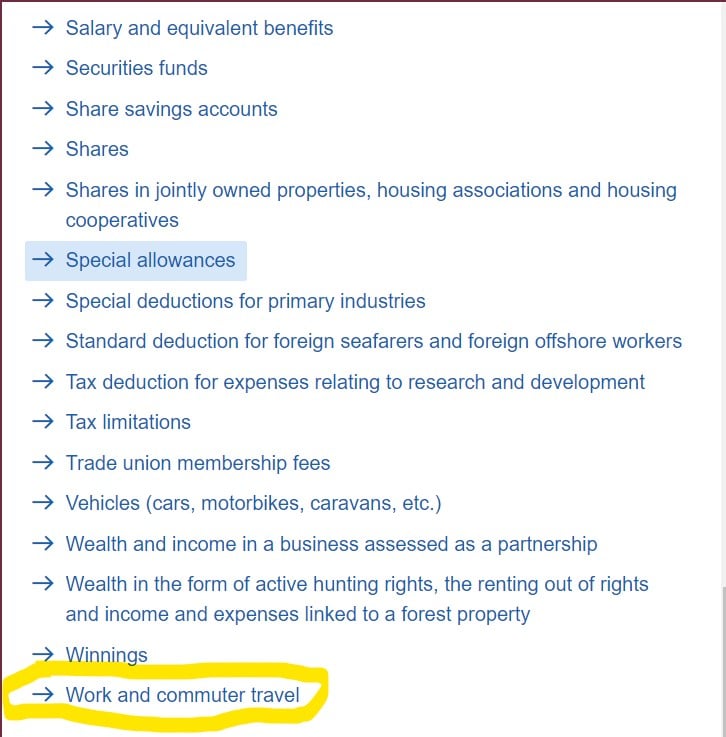

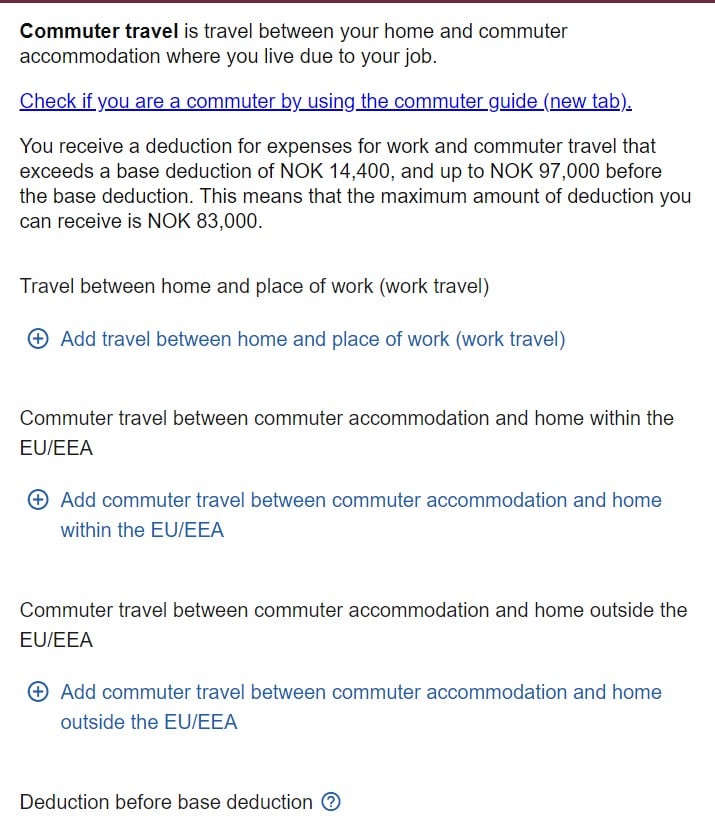

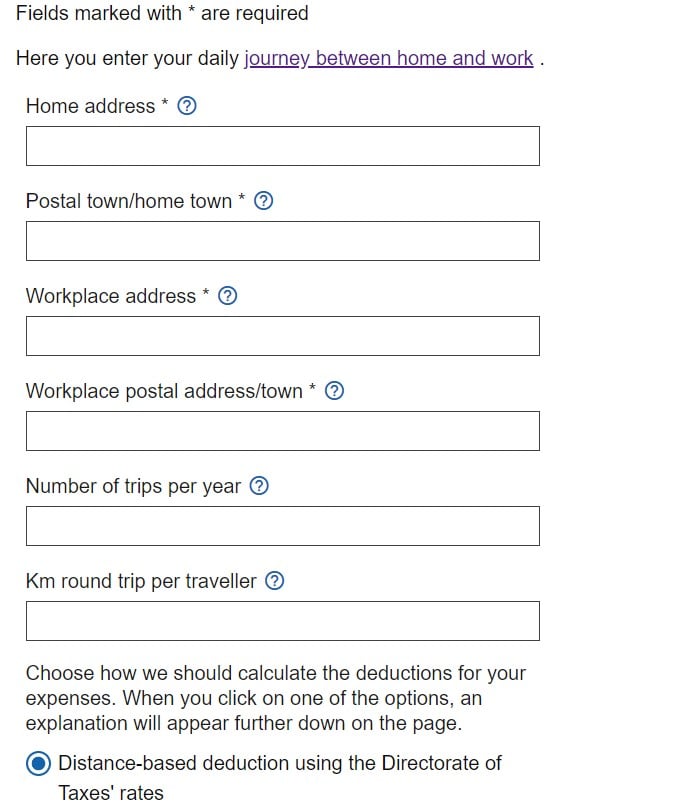

Another factor could be potential deductions. You cannot make deductions for things such as childcare, interest paid on loans, union membership, or charitable donations on the PAYE scheme.

This means that you may be better off under the general tax scheme when you account for deductions.

How to opt out of the PAYE scheme

You can opt out of the PAYE scheme up to three years after you entered it. Therefore, if you were in the scheme in 2024, you can opt out by the end of 2027, and your tax contributions will then be recalculated.

The reason why you will have three years is because tax reutrns in Norway can be edited up to three years later.

To opt out of the PAYE scheme, you will need to log in electronically. For this, you will need an electronic ID, such as BankID or Commfides.

It is also possible to send in the form on paper. You must download and complete the RF-1209 form and send it to the tax administration.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments