Spain and the United States have signed a new agreement that improves the way in which pensions are calculated and extends social security protections for people who have lived and worked in both countries.

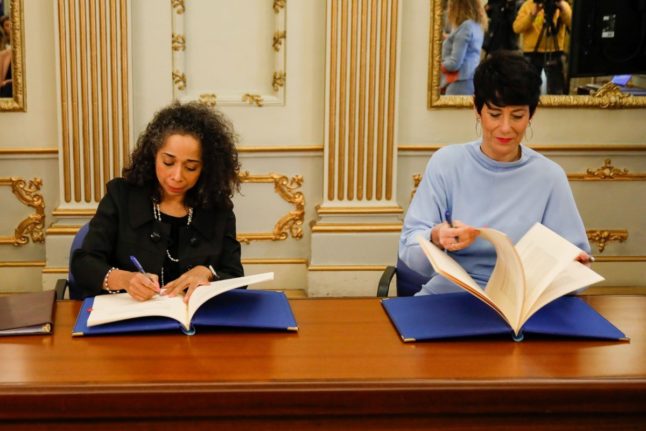

Spain’s Minister of Inclusion, Social Security and Migration, Elma Saiz, presented the agreement with U.S. Ambassador to Spain, Julissa Reynoso, at the formal signing on Monday.

The new deal updates the first bilateral agreement between the two countries, signed back in 1986 and in force since 1988.

Americans are increasingly moving to Spain to live, and the relaxed pace of life and relative affordability compared to many parts of the U.S. attracts pensioners in particular. In late 2022 there were 41,953 US nationals officially residing in Spain, according to Spain’s national statistics agency (INE).

READ ALSO: Where in Spain do all the Americans live in 2023?

The new deal will also benefit many of the hundreds of thousands of Spaniards living in the US. The United States is the third country in the world with most Spaniards living there, behind Argentina and France. As of 2023 there were 192,766 Spaniards living in the U.S, according to INE figures.

At the signing, Saiz said that “thirty-six years after the signing of the first agreement, we are taking another step forward in promoting international labour mobility, which will undoubtedly be a powerful lever to continue stimulating our bilateral economic activity.”

✍️ Os quiero dar algunas claves del Convenio de España y EEUU que hemos firmado hoy.

El acuerdo vigente se firmó el 30 de septiembre de 1986 y actualmente beneficia a cientos de miles de personas que han desarrollado su actividad laboral entre ambos países. pic.twitter.com/GxSA5cD0Kj

— Elma Saiz (@SaizElma) April 8, 2024

The Minister emphasised that the deal will have an “impact on the lives of hundreds of thousands of workers”. Among the changes, the new agreement allows for the easier application and implementation of social security benefits in the two countries, eliminates coverage duplication, provides relief from double taxation and avoids gaps in the social security system for many workers.

According to a government statement: “The main changes included in the new text effect, firstly, the calculation of Spanish social security pensions, which will be more beneficial. From now on, there will be two pension calculations. The first will be based solely on contributions in Spain, and the second will add the time contributed in the United States.”

After comparing the two calculations, the more favourable one will be paid. This benefits pensioners, the government says, because “until now, if you were entitled to a pension only with contributions in Spain, the benefit was paid without the second calculation being made by adding the contributions in the United States, even though it could have been higher.”

“In addition, the calculation of the regulatory base for benefits has been improved when contributions from Spain and the United States are added together, based on the actual contribution bases prior to the last working day in Spain.”

This will especially impact those who spent the latter part of their working lives in the United States.

The agreement also makes improvements for self-employed workers abroad, and extends the period for self-employed and employed workers posted abroad to 5 years, extendable by a further 2 years in exceptional circumstances and subject to authorisation by the relevant social security system.

It also includes civil service and military pension schemes in the scope of the agreement.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments