It should come as no surprise to those already living in Spain that rents have been skyrocketing in many cities around the country, particularly during the first four months of the year. And with the rise in the cost of living, many people here are struggling to pay their rent.

In order to help the situation, the Spanish government has recently brought in the new Ley de Viviendas or Housing Law, which includes measures to help cap rental increases.

READ ALSO: How Spain’s new housing law will affect you if you rent

Data from the Housing Rental Index from the Ministry of Transport reveals that 1,010 municipalities (out of a total of 7,592) will be affected by the new measure, which will cap prices in so-called ‘stressed areas’.

The government has defined stressed areas as those that meet one of two pieces of criteria. Areas that exceed the Consumer Price Index (CPI) of their respective province by five points and where families dedicate more than 30 percent of their salary to paying the rent.

The data reveals that 2,298 areas of Spain are considered ‘stressed’, fulfilling one of the two requirements or both. This equals 20.83 percent of the entire country.

Under the new law, all rentals will be regulated in these areas – where they rise the most, both for real estate contracts that were already on the rental market and for new contracts.

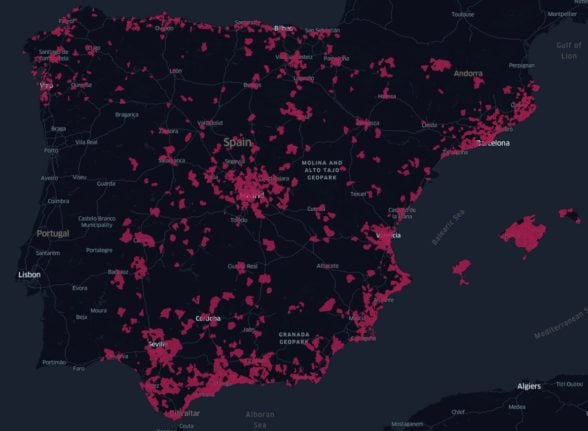

These maps by Atlas Real Estate based on government data show the ‘stressed parts’ of Spain which will be subject to rent control (Canary Islands below). You can download the study if you want to zoom into specific areas.

The province of Barcelona leads with 198 stressed areas, followed by Madrid with 179 and the Balearic Islands with 138.

This is followed by Valencia with 116, Málaga with 111 and Santa Cruz de Tenerife, where 67.68 percent of its area is stressed.

READ ALSO: What Spain’s new housing law means for you if you’re a landlord

These areas coincide with cities that have a high percentage of landlords who are legal entities that own more than 10 homes.

The provinces with the most municipalities affected by the increases in the cost of rented housing are Barcelona, Valencia, Madrid and the Balearic Islands.

And in the Madrid municipality of Pozuelo de Alarcón rents have risen to an average of €1,200, being the most expensive in Spain.

The Mediterranean coast stands out as one of the most ‘stressed’ areas in Spain, as well as the islands of the Balearics and the Canaries.

More inland, rents have also skyrocketed in the Andalusian cities of Granada, Seville and Málaga, as well as in Toledo, due to its proximity to the capital of Madrid.

READ ALSO: Where in Spain are rent prices rising the most?

The total number of houses in the areas that meet both criteria is 13,139,070. This means that 61.09 percent of Spanish households are located in one of these problematic areas.

Ten provinces have more than 40 percent of their population living in a ‘stressed’ area. The top five of these are the Balearic Islands with 94.74 percent of its population, Málaga with 94.4 percent of its population, Madrid with 89.94, Cádiz with 83.18, and Barcelona with 80.07 percent.

At the other end of the scale are Valladolid and Palencia in Castilla y León are the only provinces where less than 10 percent of the population live in a ‘stressed’ area.

Under the new law, the percentage of land dedicated to subsidised housing will increase from 30 to 40 percent on developable land and from 10 to 20 percent on unconsolidated urban land.

Any rent increases in 2024 will have a cap of three percent, one point more than the two percent in currently in force in 2023.

There will be a significant change to the law in 2024, however, as it will no longer take the CPI into account as a reference index for the annual rent update of the rental contracts, as is happening now.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments