That said, the complex tax structures and accompanying legislation that the country has developed over the last century can prove hopelessly confusing for outsiders. Without good advice and an understanding of where problems can arise, it’s easy to pay far more tax than you should – or be liable for a surprise debt.

For anyone making a new life in Switzerland, here’s a simple guide to three of the most significant tax traps international residents may encounter.

Beware the rules on residency and employment status

On arriving or returning to live in Switzerland, it’s important to understand how your residency and employment status dictate your tax liability – that is to say, whether you can be taxed on your earnings both inside and outside Switzerland.

If you’re searching for work upon arriving in Switzerland, you’re subject to unlimited tax liability after 30 consecutive days in the country. Without gainful activity, you’re liable to Swiss taxation after 90 consecutive days.

If you have a cross-border commuter permit, as you live in a neighbouring country but work in Switzerland, you’re liable to pay tax in both countries Double Taxation Treaties (DTTs) with the neighbouring countries ensure that the tax burden on income from employment is divided up between the countries so that no excess taxation results.

International weekly commuters who work in more than one country are usually subject to Swiss withholding tax, taken from salary payments at source. If this applies to you and you can show that your salary has been partly taxed outside Switzerland, you might be eligible for a tax refund for the days worked abroad.

The details can be difficult to get your head around and there are also some deadlines you need to know – so seeking professional advice may prove wise.

DTTs are formal agreements that exist to avoid international residents being taxed twice on the same earnings and assets across nations. While Switzerland is a party to many DTTs, there are a handful of countries across Africa, Asia and South America where no such agreement exists and it’s important to know whether your country is one of them.

You should also know that in some cases avoiding double taxation doesn’t require a DTT. Foreign assets and income, like properties, businesses and permanent establishments, will be exempt from Swiss taxation already based on Swiss law.

Finally, as an international resident of Switzerland, you can also be tripped up by not declaring your earnings properly to both the Swiss government and that of your home country. Individual countries have different requirements on what must be reported.

With a growing multicultural population working and studying in Switzerland, it’s therefore no surprise that services such as Taxolution Advisory have emerged to help individuals and businesses navigate taxation issues between nations.

How a ‘pension gap’ can leave you paying more tax

Like many countries, Switzerland has a broad, three-pillar structure of state, occupational and private pension plans to ensure people enjoy a comfortable standard of living in retirement.

If you’re working in Switzerland, you’ll be making mandatory contributions into the federal pension and through your employer’s occupational fund.

As an adult international resident, you may have what is known as a ‘pension gap’ – a shortfall in your projected assets for retirement, as you haven’t been paying into plans over your entire working life. As a result your occupational pension plan will periodically give you the opportunity to make extra payments to close this gap.

While you might think this is unnecessary – you may have other retirement funds, for example – these payments are tax deductible and can lower your tax burden significantly in the here and now.

Additional contributions can not only make for more immediate financial flexibility, but also help set you up for a comfortable retirement. As with any significant financial decision, seeking advice on the possible ramification of making these payments could help you make the best choice for you.

Wealth and windfalls: do you know what to declare?

Switzerland’s wealth tax applies to everyone living and working in the country and covers a much broader range of asset types than you may be used to back home, from property, investments, and loans, to precious metals and prestige vehicles.

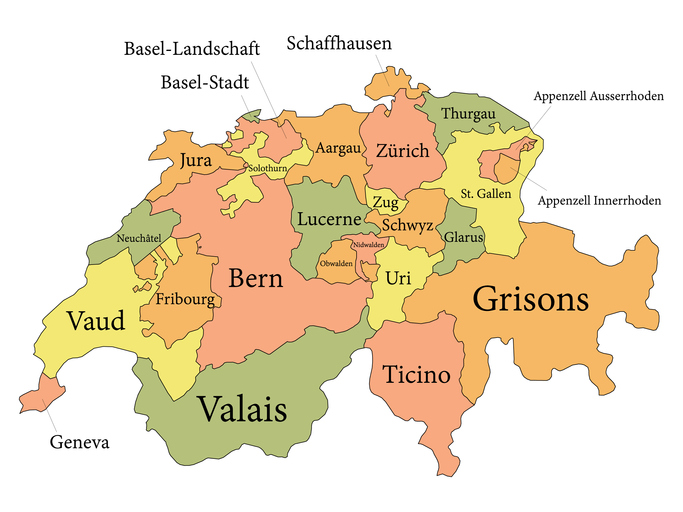

It’s not a federal tax, but is applied by the canton in which you live. While what is taxed is the same everywhere, cantons and municipalities have their own wealth tax rates and different exemption limits below which no tax on wealth is payable.

A common mistake is for international residents to fail to declare an asset, such as a foreign property, due to wrongly believing it isn’t relevant for Swiss taxation. It’s important to know that residence in Switzerland leads to an unlimited tax liability – meaning your worldwide income and wealth is subject to Swiss taxation.

Holders of Switzerland’s B permit earning below 120,000 Swiss francs need to be proactive about declaring foreign property. This is because your canton will only detect your obligation to file a tax return above this income threshold.

Sitting down with tax advisors to assess the net worth of your taxable assets is a sensible step to consider to avoid scrutiny and potential fines from cantonal authorities. With Taxolution, you can take a non-binding first step with its free tax return cost calculator.

Anyone who has settled down in Switzerland for the long term, perhaps marrying a Swiss citizen, may occasionally find themselves in the position of receiving a significant windfall. Both gifts and inheritances are taxed in Switzerland on a cantonal level, and the rate of taxation does vary, depending on who you are receiving the gift, or inheriting from.

While the rate of taxation for transfers from close relatives is usually very low, consulting a tax expert can help you identify any hidden costs.

All things considered, the Swiss tax landscape might seem complicated at first sight, but a long tradition of the rule of law and consistent case law also make it predictable and reliable. If you act wisely, it allows for advantageous and proven tax planning options that could put you on a firmer footing in life.

Avoid the tax traps that can complicate life in Switzerland by seeking fast, expert advice from Taxolution today

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments