In 2021— the last year for which official figures are available — 19 percent of Switzerland’s permanent resident population aged 15 or over had dual nationality, according to a study released on Thursday by the Federal Statistical Office (FSO).

Dual nationals are foreigners who gain citizenship of their country of residence while still maintaining the nationality of their place of origin.

Both countries consider these people as their citizens and neither regards them as foreigners. In other words, if a citizen of, say, the United States, becomes naturalised in Switzerland, then, under Switzerland’s law, that person is no longer American, or a foreigner, but Swiss.

This means that person no longer needs a work permit to live and work in Switzerland, even though they still have foreign passports.

Where do most dual nationals live?

In terms of residence, FSO’s findings are both surprising and not.

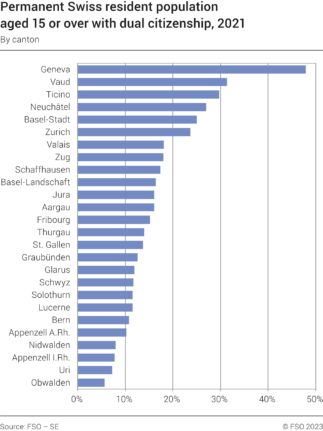

Not surprisingly, the majority live in cantons which are generally considered as most international: Geneva — where about 48 percent of dual nationals reside — and Vaud (just over 30 percent).

Not surprisingly, given Geneva’s proximity to France and its linguistic similarity, most bi-nationals living in the canton — 27 percent — are also French citizens, according to the Cantonal Statistics Office (OCSTAT).

READ ALSO: What do we know about Geneva’s dual nationals?

But other cantons such as Zurich, Basel-Stadt, and Zug, which have a high concentration of foreigners, and where you’d expect most dual nationals to live, have fewer residents with two passports — (24 percent, 25 percent, and 15 percent, respectively) — than Ticino (30 percent) and Neuchâtel (26 percent).

That may be because some of the foreigners who become Swiss are not immigrants who settle mostly in international cantons, but rather second and third-generation foreigners who were born here and may have always lived in less cosmopolitan areas.

They too must apply for naturalisation because — despite efforts by some politicians to change the system — Switzerland doesn’t recognise the so-called “birthright citizenship” which automatically grants a Swiss passport to anyone born here.

READ MORE: Swiss MPs reject move to grant citizenship to foreigners born in Switzerland

If their parents were born abroad and still hold foreign passports, a person will not obtain Swiss citizenship by birth, but must be naturalised.

Another category of dual nationals are foreign spouses of Swiss citizens who keep their original passports after becoming Swiss.

They too may not show up (statistically speaking) as living in international cantons.

What else does the FSO study reveal about dual nationals?

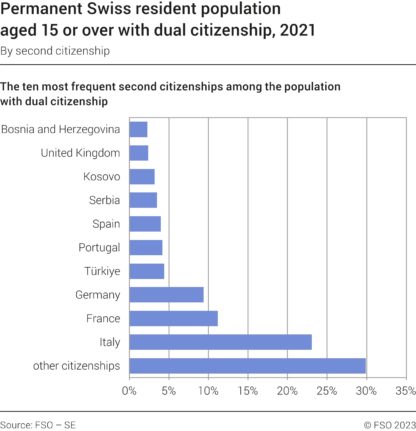

As this chart indicates, those with dual citizenship are most likely to come from neighbouring nations of Italy (over 20 percent), France (12), and Germany (9), followed by Turkey, Portugal and Spain.

READ MORE: Five ways you can fast-track your route to Swiss citizenship

What are the pros and cons of dual nationality?

On the positive side, the most obvious benefit of dual citizenship is the ability to live and vote in both countries, without having to give up any rights in either.

However, dual nationals also have obligations in two states.

They could include, depending on the country, tax liability and military service.

READ MORE: Do naturalised Swiss citizens have to do military service?

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments