Who?

If you have the passport of an EU country – including dual nationality – you are not covered by the 90-day rule and are free to come and go from France as you please.

Non-EU citizens fall into two categories – those covered by the 90-day allowance and those who are not.

Citizens of certain countries, including India, need a visa for any visit to France, even just a long weekend, but other countries allow up to 90 days of travel without the need for a visa.

Brits, Americans, Canadians, Australians and New Zealanders are all covered by the 90-day allowance – find the full list here.

What?

The 90-day rule states that you can spend 90 days out of every 180 in the EU or Schengen zone without needing to get a visa or residency card.

The allowance is for the whole Schengen zone, so if you’re travelling to multiple European countries your tally is for all the days you have spent within the Bloc.

For example, if you spent 85 days in France and then travelled to Spain for a fortnight, that would take you over your 90-day allowance because both France and Spain are Schengen zone countries.

The allowance means that in total over the course of a year you can spend 180 days in the EU/Schengen zone without needing a visa – but the crucial point is that your 180 days cannot be all in a single block.

This means that, for example, you can’t spend the summer in France and the winter in the UK, or vice versa.

How?

So – the crucial bit – how do you go about calculating your allowance?

The people most likely to be affected by this are second-home owners and freelance workers or contractors who make multiple short work trips to the EU.

If you travel for work, it’s important to note that your 90-day allowance covers all trips for all reasons – so you need to add in any European holidays as well as work trips to your total.

It’s when you’re making a series of short trips that things can get complicated, because the 90-day rule is calculated on a rolling calendar, so that at any point of the year you need to be able to count backwards by 180 days, and have only spent 90 of those days in the Schengen zone.

You also need to be aware that any time spent in the Schengen zone counts as one day – so even one-hour stopovers take one day off your allowance.

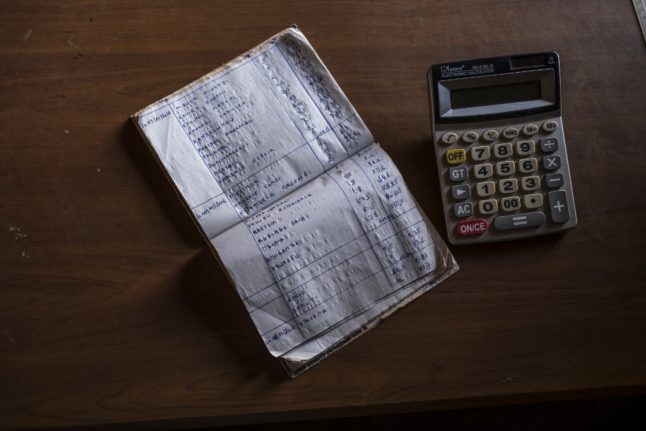

The easiest way to keep on top of this is to keep a diary (paper or electronic) with your travel days marked in it, and then use the online Schengen calculator to check that you’re within your allowances.

Short stays and stopovers can add up more quickly than you might think.

The online Schengen calculator can be found HERE – simply input your travel dates and it will tell you how many days you have left.

What if you have a visa?

People who want to spend more than 90 days at a time in France have two options – get a visa or move here full-time and get a residency card.

Visa – for second-home owners the 6-month visitor visa is a popular option. This allows you to keep your main residence in your home country, but spend plenty of time at your place in France.

For the dates when your visa is valid, your trips to France do not count towards your 90 day allowance – but trips to any other EU/Schengen zone country still count towards that 90-day allowance. Once your visa runs out, the 90-day clock starts again, unless your get a new visa – more details here.

Residency – if you take up permanent residency in France any time spent in France obviously does not count towards your 90 days. However, it’s worth pointing out that you are still bound by the 90-day rule when travelling to other EU/Schengen zone countries – full details here.

Overstaying

Many readers, especially Brits who were previously in the happy position of not having to worry about calculating 90 days, have asked us whether they really need to go through all this hassle.

The unfortunate answer is yes – passports are checked regularly as you enter and leave the Schengen zone, and upcoming technical changes mean this will only get stricter.

People who spend more than 90 days at a time in the Schegen zone without having a visa are classed as overstayers, and passports are likely to be stamped or flagged.

Overstaying is usually punished by a fine, but having that ‘overstay’ on your passport also means that future travel is likely to be a lot more difficult, and you may also have trouble with any future visa applications.

People who travel for work should note that keeping track of your 90 days is your personal responsibility, not your employers’. It seems that many UK employers are still pretty clueless about post-Brexit changes, so don’t rely on your company’s HR department to calculate your allowance.

At present passport checking and stamping at the border is varied and variable, but changes to EU travel coming in later this year will mean that the process becomes more automated, and overstayers will have nowhere to hide.

READ ALSO Passport scans and €7 fee: What changes for EU travel in 2022

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments