During the Cold War, the German central bank stashed away almost 15 billion marks’ worth of an emergency currency in a 1,500-square-metre nuclear bunker beneath the town.

A closely guarded state secret, the currency was codenamed “BBK II” and intended for use if Germany was the target of an attack on its monetary system.

After the Cold War, the bunker passed into the hands of a regional cooperative bank and then a real estate fund. In 2016, it was bought by German couple Manfred and Petra Reuter, who turned it into a museum.

Today, with Russia’s invasion of Ukraine stoking fears of nuclear conflict, interest in the bunker is growing again.

“Many people we know have pointed out that we have a safe bunker and asked whether there would be room for them in case of an emergency,” said Petra Reuter.

On tours of the bunker, “questions are naturally asked about the current situation”, which feels like “a leap back in time 60 years”, she said. “The fears are the same.”

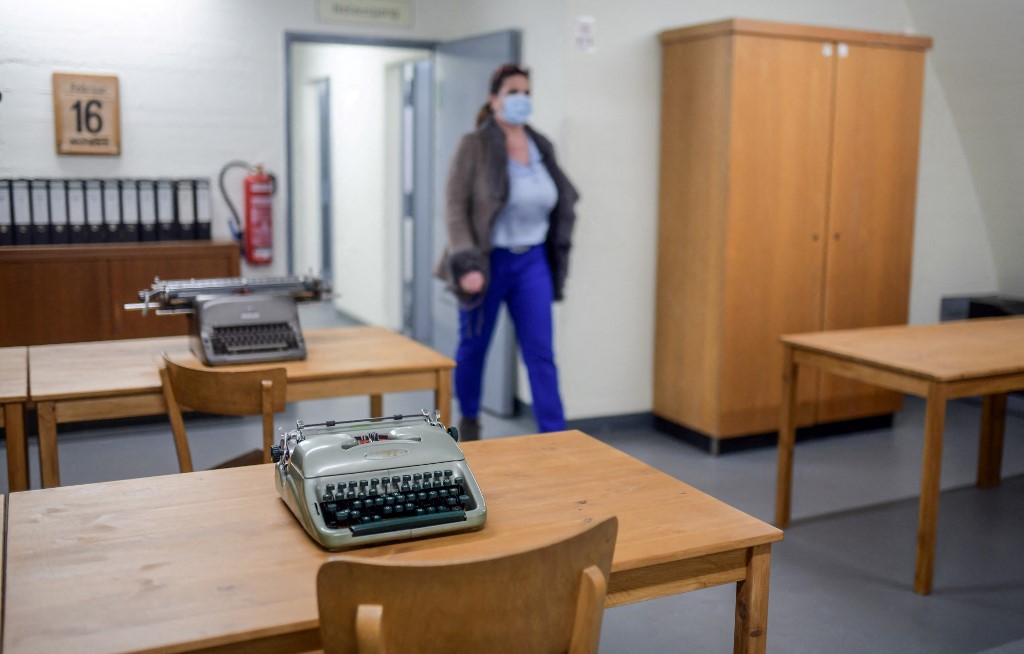

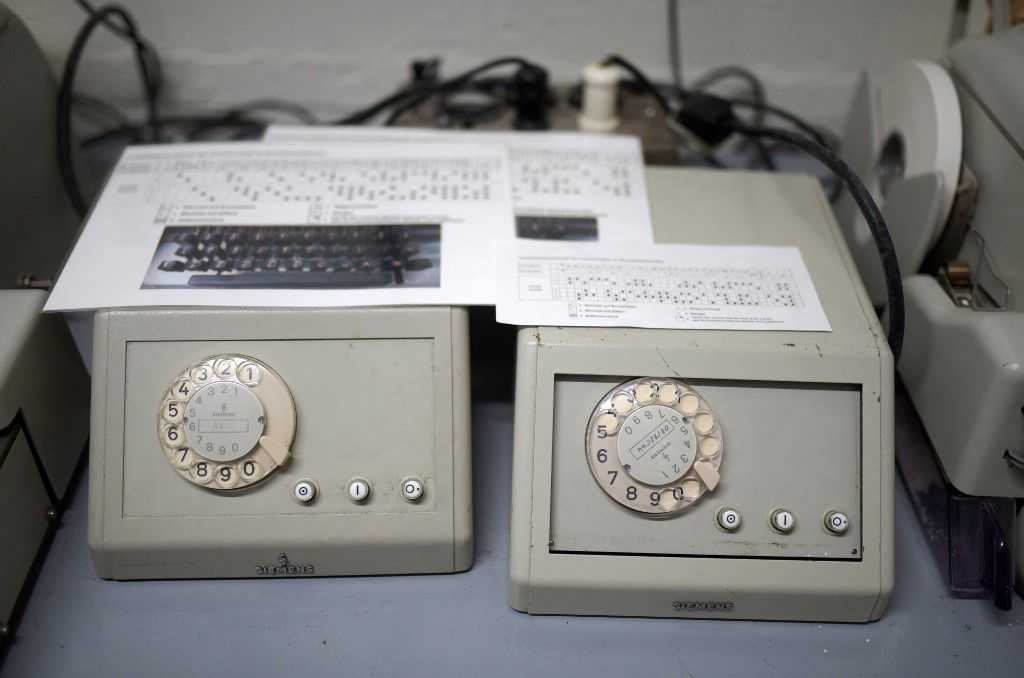

Inside, behind a heavy iron door, long corridors lead to decontamination chambers and offices equipped with typewriters and rotary phones.

The main room consists of 12 cages where, for almost 25 years, some 18,300 boxes containing millions of 10, 20, 50 and 100 mark banknotes were stored up to the ceiling.

Hundreds of trucks

On the front, the banknotes were almost identical to the real deutschmarks in circulation at the time, but on the back they were very different.

Starting in 1964, the notes were delivered to the bunker by hundreds of trucks over a period of about 10 years, with no one suspecting a thing — not even the East German Stasi secret police.

The bunker was accessed via a secret passage from what was ostensibly a training and development centre for Bundesbank employees in a residential area of the town.

Cochem, located about 100 kilometres (60 miles) from the border with Belgium and Luxembourg, was chosen because it was such a long way from the Iron Curtain.

“The citizens of the community were astonished to discover this treasure, which had been hidden for so long near their homes,” said Wolfgang Lambertz, the former mayor of the town, which has around 5,000 inhabitants.

Along with the 15 billion marks stored in the bunker, just under 11 billion marks’ worth of the alternative currency was also stored in the vaults of the central bank in Frankfurt.

Altogether, this added up to around 25 billion marks — roughly equivalent to the total amount of cash circulating in the German economy in 1963.

Operation Bernhard

Perhaps an extreme measure to ward off a merely hypothetical attack, but the German authorities had been guided by lessons from history.

During World War II, the Nazis had launched “Operation Bernhard”, in which prisoners in concentration camps were forced to manufacture counterfeit pounds with the aim of flooding England with them.

“The most plausible explanation was probably the fear that counterfeit money would be smuggled through the Iron Curtain in order to damage the West German economy,” according to Bernd Kaltenhaueser, president of the Bundesbank’s regional office for Rhineland-Palatinate and Saarland.

But creating a backup currency today “would no longer make sense because there is less counterfeit money in circulation and there are fewer cash payments”, according to Kaltenhaueser.

In the 1980s, with the Cold War winding down and technology evolving, it was decided that the replacement currency no longer met Germany’s security standards.

By 1989, the year the Berlin Wall fell, all of the notes had been taken out of the bunker, shredded and burned.

READ MORE:

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments