In Spain land is distributed into three categories: urbano, urbanizable and rústico.

Urbano land has official municipal accreditation for residential properties to be built on it, urbanizable is theoretically meant for residential purposes but needs accreditation and often isn’t connected to the water, sewage or electricity grid yet, and rústico is rural land where residential properties cannot be built, also called no urbanizable.

When looking to buy a terreno (plot of land) in Spain with the intention of building on it, it’s essential you check on the cadastre what the plot you’re interested in is classified as.

Otherwise, you may be bitterly disappointed to find out that the land you’ve bought in the Spanish countryside can only be used to plant olive trees.

This law has been problematic for many foreigners and locals in Spain who want to build a home from scratch, as many isolated plots far from other properties end up being rústico.

Fortunately for those in the southern region of Andalusia, and those intending to have a second home there, the laws are being changed to give more flexibility to prospective homeowners.

Andalusia’s new land law will allow people to build homes of up to two floors on rústico (rural) land, as long as it doesn’t lead to the development of new settlements.

The legislation will also help to regularise the situation of 300,000 properties built on rústico land across the region which up to now have been in a legal limbo, including the cave homes found in cities like Granada.

Each municipality will have the final say on how much space there must be between rural homes, but the Ley para el Fomento de la Sostenibilidad del Territorio de Andalucía (LISTA) legislation does state that rústico plots given the green light for construction must be very big, at least 2.5 hectares in size (25,000sqm). In forested areas, the requirement may be increased to 5 hectares.

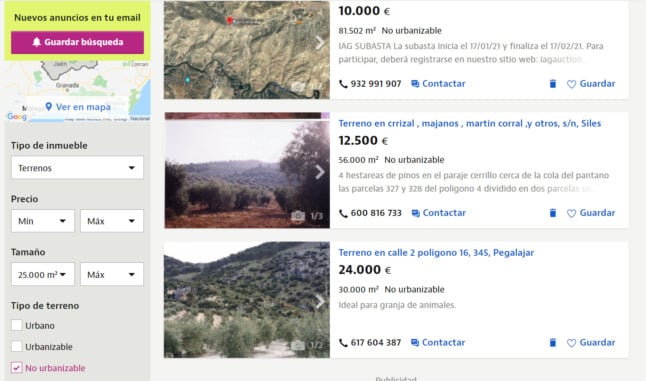

As large as that may sound, there are rústico plots over 2.5 or 5 hectares on sale in Andalusia for as little as €10,000.

Andalusia is after all the second biggest region in Spain in terms of surface area with 87,600 km², so there is plenty of space in el campo (the countryside).

And non-buildable land is also generally considerably cheaper than urbano land, opening up the possibility for people to get some good deals.

READ ALSO: A Spanish architect’s step-by-step guide to building a home in Spain

The legislation also stipulates that constructed houses must not be more than seven metres high (one or two floors) and that structures must not exceed one percent of the plot in rural areas and 0.5 percent of the plot in forested areas.

As for water and electricity, the regulation establishes that “they must be guaranteed in an autonomous and environmentally sustainable way”, which suggests being off the grid with everything from solar panels, individual water storage tanks and off-grid sewage systems.

It will also not be possible to level sloping land or change the topography of more than 30 percent of the plot.

Although this is evidently good news for people who want to build a house in rural Andalusia, regional authorities will require each person who is given a building permit to pay the municipality in question the equivalent of 15 percent of the total construction budget. It’s what they call in Spanish ‘una mordida’ (a bite), because this is Andalusian politics after all.

READ MORE:

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments