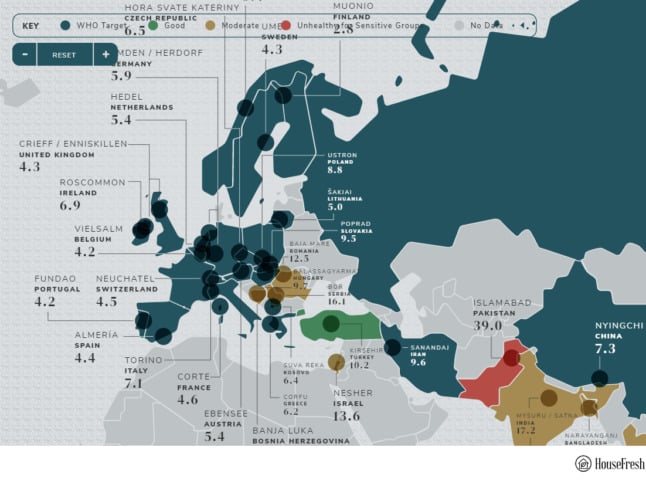

The Andalusian city of Almería in southeast Spain is among the towns and cities with the lowest levels of air pollution on the planet, according to the results of a study carried out by international air purifying company HouseFresh.

The coastal city of roughly 200,000 inhabitants recorded levels of harmful particles of 4.4 μg / m³, below the limit set by the World Health Organization (WHO) of 10 μg / m³.

This is the level from which the WHO makes an association between prolonged exposure to air pollution and the appearance of respiratory diseases, leukemia, heart disease, strokes and breast cancer.

Other towns and cities in Europe with similarly low levels of PM2.5 concentration included Fundao in Portugal with 4.2, Neuchatel in Switzerland with 4.5, Corte in France with 4.6 and Crieff in Scotland and Enniskillen in Northern Ireland, both with 4.3.

The PM2.5 concentration refers to atmospheric particulate matter (PM) that have a diameter of less than 2.5 micrometres, about 3 percent the diameter of a human hair.

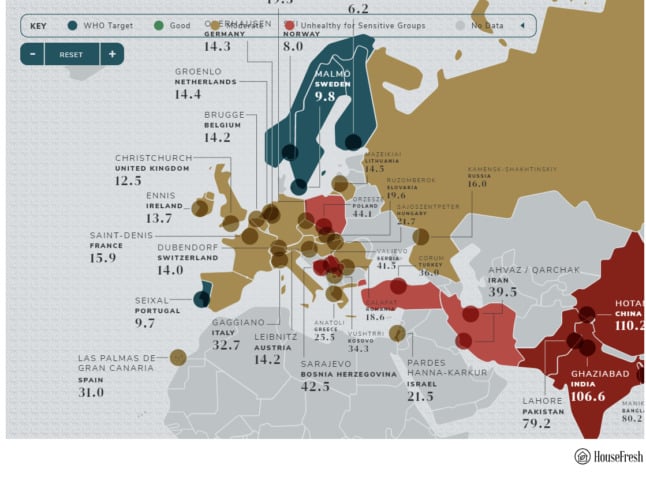

On the other side of the spectrum with the worst air quality in Spain was the city of Las Palmas de Gran Canaria in the Canary Islands with a level of 31 μg / m³, which could be partly attributed to the common presence of dust in suspension blown over from the nearby Sahara desert.

The Gran Canarian capital’s air pollution level is still classified as moderate by the WHO and lower than that of the Polish city of Orzesze (44.1) or Sarajevo in Bosnia Herzegovina with 42.5.

Housefresh used data collected in April 2021 by IQAir, a Swiss air quality technology company specialising in protection against airborne pollutants.

They have a real-time map and ranking of the cities and towns with the most polluted air in Spain, so you can check the current levels in your part of Spain here.

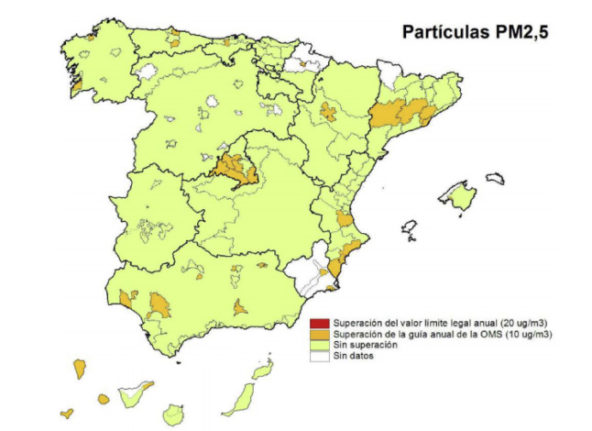

Screenshot of Spain’s air pollution map on August 11th 2021.

The average PM2.5 concentration in Spain’s air is currently double that of WHO exposure recommendations. In 2020 the country ranked 80th of out 106 countries for worst air pollution, meaning its levels were lower than the average globally.

But in big cities such as Madrid and Barcelona air pollution levels are regularly above what’s healthy, with a study published in January 2021 in The Lancet finding that the Spanish capital and its surroundings is the area of Europe with the most deaths associated with nitrogen dioxide (NO2). Barcelona and the nearby town of Mollet des Vallès came in sixth and seventh place.

“In 2020, 84 percent of all monitored countries observed air quality improvements, largely due to global measures to slow the spread of COVID-19,” IQ Air’s 2021 report states.

Barcelona’s Public Health Agency recently reported that 600 deaths could be avoided every year if the air pollution drop recorded in 2020 could be maintained in 2021 and future years.

“About half of all European cities exceed the WHO’s target for annual PM2.5 pollution. The highest levels of PM2.5 pollution was found in Eastern and Southern Europe, with Bosnia Herzegovina, North Macedonia and Bulgaria taking the lead,” IQ Air concluded.

Another air pollution study carried out by Spanish enviromentalist group Ecologistas en Acción found that “with the information currently available, the population affected by PM2.5 particles in Spain in 2019 amounted to 17.8 million people, 37.5 percent of the population.

“The affected areas were the industrial areas of the Bay of Algeciras and Carboneras, Malaga and the Costa del Sol, towns in Andalusia’s interior, Oviedo, Eivissa, the Santander Bay, The Plain of Vic, Alicante and southern Murcia (except the capital and Escombreras), the industrial zone of Huelva, Zaragoza, the Asturian central basins, Palma in Mallorca, the Torrelavega region, the south of Lleida, the southeast of Alicante, Castellón, the Community of Madrid and Pamplona”.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments