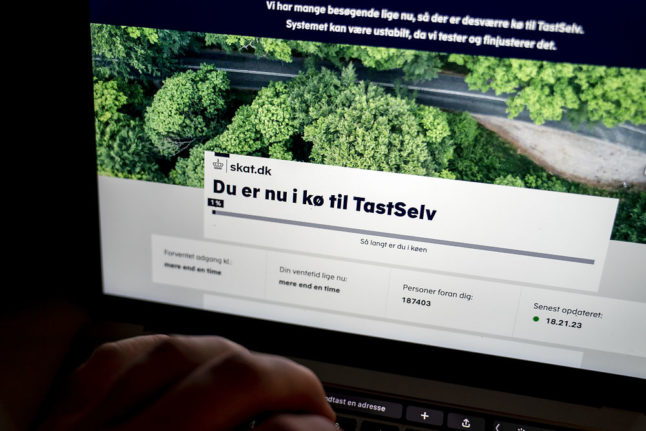

Accessing the annual tax return is a yearly event for taxpayers in the Scandinavian country.

The Danish Tax Agency tweeted that, since it began to allow access to the information via its website on Friday, taxpayers had logged on to its website 2,787,706 times and changed their tax information 748,925 times. The numbers represent unique clicks but not necessarily different users.

Siden vi åbnede for årsopgørelsen fredag aften kl. 18, har borgerne frem til kl. 7 i morges logget på TastSelv 2.787.706 gange, og der er foretaget 748.925 ændringer i årsopgørelserne. Tallene er antal klik og ikke unikke brugere. #SkatDK pic.twitter.com/NWqakYV0ko

— Skattefar (@Skattefar) March 15, 2021

The authority opened access to the yearly accounts on Friday evening and has experienced heavy traffic on its website since then.

Årsopgørelsen, literally ‘the annual calculation’ in English, is a summary of income over the preceding tax year, as well as deductions and taxes paid. It can be manually adjusted, such as by changing income or tax exemption information, until May 1st.

Normally, around three in four people receive money back from the tax authorities once the return is finalised. The amount paid back varies and depends on individual circumstances.

Rebates from the tax system are automatically paid back from April 9th onwards.

A larger number of people than usual are making changes to their returns this year, news wire Ritzau reports. That has been linked to the effect of the coronavirus crisis on the economy and consequently tax payments.

“We are seeing a pattern this year whereby far more people are going in and changing their annual return or adding deductions,” Danish Tax Agency deputy director Karoline Klaksvig told Ritzau.

That includes almost 500,000 changes to deductions related to transport.

“That is 180,000 more than at the same time last year,” Klaksvig said.

The transport deduction, kørselsfradraget in Danish, applies to journeys of more than 24 kilometres to and from workplaces. It is normally automatically included in tax returns where relevant but that has not been the case this year, with many people working from home during the pandemic. As such, the number of days of travel to work must be entered manually.

I’m a Danish taxpayer. What do I need to know about this and what should I do?

The annual tax overview, årsopgørelsen, shows your income, deductions and what you have paid in taxes in the last tax year.

The annual statement is released annually in March, when you can see if you are owed money back or if you paid too little in taxes during the preceding year. In most cases, rebates are automatically deposited into your bank account.

In 2021, you can view and correct your 2020 annual statement from March 15th.

Most of the information in the annual statement is provided automatically by your employer or bank. If the information is correct, you do not need to take any further action.

However, you may need to enter some things into the report yourself, depending on your income type and whether you are entitled to any deductions.

These include deductions for home improvements (håndværkerfradrag), transport (kørselsfradrag), child support (børnebidrag) and work clothing and equipment. You also need to enter details of income from shareholdings and properties you own.

More in-depth detail on how these deductions and declarations work can be found on the Tax Agency website (in Danish) with some detail also provided on the website’s English language version.

The Danish Tax Agency can be contacted via telephone in case of queries regarding your annual return. The telephone number to contact the agency is 7222 2828.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments