In France donating to charity can work out pretty well for the person donating as a result of French tax rules.

These rules mean that if you give money to charity you benefit from a tax reduction on the donation, with the level of the reduction depending on the kind of organisation you donate to.

Who?

It’s important to note the reduction in tax bills from charitable donations is only open to those who pay income tax in France (impôt sur le revenu).

Many workers don’t earn enough to pay taxes so don’t benefit from the reduction, and if all your income is from an overseas pension (eg from the UK or US) then you probably won’t pay impôts in France.

The reduction applies only to your annual income tax bill (impôt sur le revenu) – it cannot be applied to property taxes or to social charges (prélèvements sociaux).

How much?

If you donate to a charity that falls under the “general interest” umbrella, a tax reduction of 66 percent of the donation will be shaved off of your taxable income — as long as it is no more than 20 percent of your total taxable income (revenu imposable).

These charities include educational, scientific, sports, cultural and environmental charities, among others.

That means that if you donate €1,000 to a “general interest” charity €660 will be shaved off your total taxable income — as long as €660 is less than 20 percent of your overall revenu imposable.

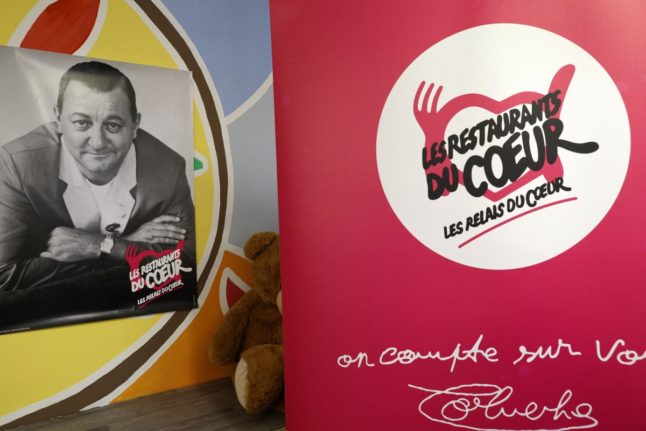

Meanwhile, France offers a larger tax reduction on donations to charities that help people in trouble, such as homeless charities including Restaurants du cœur, la Croix-Rouge, Secours catholique and Secours populaire.

In this situation, you get a tax reduction of 75 percent on your donation however there is a cap on the amount of your donation eligible for a 75 percent reduction.

The current limit is €1,000 so the maximum you can take off your total taxable income is €750

Then it gets a little complicated. If you have donated more than this limit to a charity then the remainder is eligible for a 66 percent tax reduction as long it doesn’t exceed 20 percent of your overall revenue imposable (taxable income). (More info in French here)

How?

You claim the deductions when you fill out your annual tax declaration in the spring/summer.

The declaration must be completed by almost everyone in France – even if all your income comes from abroad (eg you are living on a UK or US pension).

READ ALSO: How to fill out your French tax declaration

Most people now file the declaration online – if so, you will find the charity bit in step three of the declaration.

If you have donated to a ‘general interest’ charity, check the box ‘Réductions et crédit d’impôt‘ in the ‘Charges‘ section – click Suivant and then in box 7UF fill out the amount that you have donated.

For those who declare on paper, you fill out box 7UF of the 2042 RICI tax declaration form. You can download the form here.

If you have donated to a charity helping people in trouble, you follow the procedure as outline above, but instead of box 7UF you should fill out box 7UD.

If you don’t declare online, you can download the declaration form here.

Make sure you get a receipt for any donations – if you declare online you won’t routinely need to submit the receipt, but you can be asked for it at a later stage and you will not benefit from the reduction if you cannot provide the receipt.

The receipt rules mean that only donations made to organised charities can be counted – you cannot deduct any cash you have given to homeless people over the year or other informal donations (although can one really put a price on the knowledge that you have helped a fellow human being?).

When?

Tax declarations for the 2023 tax year will open on April 13th, 2024.

The deadline is either May or June, depending on where you live.

The French tax calendar for 2024

French words to know

Taxable income – le revenu imposable

Tax reductions – les reductions d’impôt

Income tax – Impôt sur le revenu

Charity – association caritative

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments