I have my favourite markets where I drink cañas and eat bocadillos de solomillo on a Sunday, cafés where I go for my café con leche and tosta con tomaté, plazas where I sit outside in the sunshine for a menu del día. I write for a living, walk everywhere, have some great, creative friends, dance swing and run an open mic. I have a Spanish husband and a daughter that is Madrileña. She is still very young and already, her Spanishness is coming out: one of her first words was Mamá.

I have made my home – and it is a lovely one – in the Spanish capital. But, while I have made my home here, I cannot escape the feeling that this isn’t my real home, or my original one. I am reminded when I’m called a forastera – meaning outsider – in my husband’s village. I’m reminded when I am a tad shy and don’t shout out at a bar, meaning others are served before me. I’m reminded when I’m buying something off Wallapop and someone replies to my haggling in such a rude, brutish way that I can’t help but respond that they needn’t speak to me like that. No sé de lo que hablas. Adios, they reply, baffled. (In my defence, I showed this message to my husband and he thought it was rude, too.)

READ MORE: 12 signs you have totally nailed the Spanish language

Alas, there are reminders that I’m an alien in Madrid all the time. Maybe not every day, but every week. But aren’t they what I came here for, in the first place? It was that difference, that exoticness, the sun, the language, the way of life – and that it was another way of life to the one I knew – that drew me here.

I love being an alien and I hate it at the same time. Sometimes, I just want a bag of Cadbury’s Buttons, or some salt and vinegar McCoys, or a trip to an M&S Food Hall. A taste of comfort, a taste of home. Sometimes I fancy a pub lunch and a walk in Hampstead Heath, or a pint, even though I’m not sure I could actually drink one any more.

The funny thing is that, when I was growing up in London, I didn’t know I was home. The daughter of Irish parents, I grew up listening to stories about ‘beyond’; about the green fields, the burning turf, the damp, the smell of the fire. ‘Home’ was the other side of the water. It was where our family was, where we would go every holiday, where my sister and I would run around during the summer and I would acquire an Irish accent and tell my cousins to ‘feck off’.

When we studied poets at school, I fell in love with Seamus Heaney’s vivid accounts of Irish country life; I recognized and loved them and their images, sights and smells. When I read Guyanese poet Grace Nichols’ Wherever I hang, which finishes with, ‘Wherever I hang me knickers – that's my home,’I recognized myself in that, too. Though I was not an immigrant, my identity was very much shaped by my parents’ Irishness.

While London was where I was born and where I lived, where I played in the park, went to school, did Irish dancing lessons, and spoke with my English accent, this connection I had with Ireland, which I came to understand as my real home, and our holidays that always ended too quickly, made me feel a longing. Galicians in the north-west of Spain have a special term for the nostalgia that Galician emigrants felt for their distant homeland; morriña.

Now, it is my turn to feel morriña, and remember my parents and my upbringing, and be aware that I’m doing it all over again, only I’m not driven by the lack of work and opportunity, I’m driven by my selfish desire to up sticks and settle somewhere I fancied. A few years down the line, with a child of my own, I can’t help but wonder the price of my choice. The fact that my daughter doesn’t have her cousins around the corner, nor her grandparents.

People have often assumed I mustn’t be close to my family in order to have moved abroad, but they couldn’t be more mistaken. I am very close to my family, and that is why the distance is so sharp. Why did you do it? You might ask. Because I wanted to, is the simple answer.

So, where is home?

Is it where my old family is, or where my new family is? Is it where I go in my dreams, or where I go in my day? Where my daughter is?

I don’t have the answers. What I do have is Grace Nichols’ poem in my head and a pile of washing. I’ll hang me knickers out – and in the hot Madrid sunshine, they’re sure to dry in two shakes of a lamb’s tail.

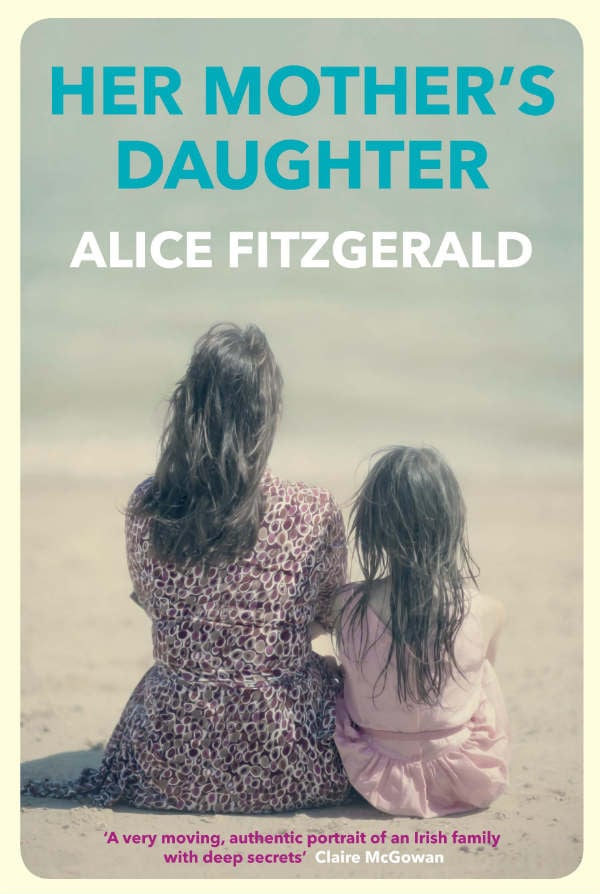

Alice Fitzgerald's debut novel Her Mother's Daughter is published this month. It's the tale of a troubled and emotionally abusive mother and her innocent ten-year-old daughter whose lives are changed after one summer holiday. Set across two decades against the backdrop of London and Ireland, it's a thought-provoking book-club read that deals with emigration, abuse and mental health, as well as mother-daughter relationships. It's now available on Amazon.

Please whitelist us to continue reading.

Please whitelist us to continue reading.