The British dream of selling up and moving to France is still very much a reality for thousands of property buyers and even more so with the current exchange rate.

But they are picky, it seems, when it comes to where in “la belle France” they want to move to.

Stats released to The Local from France’s National Statistics Agency INSEE showed that British expats, of which there are almost 160,000 in total, continue to congregate in certain parts of the country and almost ignore others completely.

According to the most recent available stats the most popular region of France for Britons is the Ile-de-France region – which includes the capital Paris – where 21,000 of them reside.

After the French capital the most popular regions for Brits are Poitou-Charentes in the west of of France where the 16,300 Britons make up 33 percent of the overall population of foreign residents there.

Next most popular is Aquitaine (16,100) in the south west, which includes the famous “Dordogneshire”, and neighbouring region Midi-Pyrénnées (15,800).

There are 13,500 Brits living in Brittany and a similar number living in Rhône Alps, in the south east which covers the country’s main ski resorts.

There are almost 12,000 Brits living in Provence, all of whom have probably read Peter Mayle's best selling book “A Year in Provence”.

But the statistics also reveal that Britons have little or no desire to move to certain parts of France, notably the north east, but also the place better known as the Island of Beauty.

The Mediterranean Island of Corsica is only home to around 200 Brits, while back on the mainland Champagne-Ardenne and Franche-Comté in the east of the country count only around 400 British residents.

And only around 850 Brits have set up home in the eastern region of Lorraine and at least one of them is quite happy to be there.

“I'm delighted to be one of the 850 Brits who live in Lorraine. It's a great area with all the variety of British weather with a few occasional extremes of heat and cold,” Rebecca Pintre told The Local.

READ ALSO: The four mistakes made by French property buyers

France-based estate agent Joanna Leggett tells The Local the reasons these regions appear to be no-go zones for Brits are simple.

“The number one factor for where Brits choose to go is the weather,” she says. “In Poitou-Charentes in the west, they get around 2,400 hours of sunshine each year, but in a region like Lorraine, the temperatures are lower and they get a lot of rain.

(The town of Nancy, in Lorraine, is beautiful – but often wet. Photo: MorBCN/Flickr)

“Places like Champagne-Ardenne are cooler and there is also not great infrastructure available in transport links to get them there,” she added.

Whereas those living in Ile-de-Ré or La Rochelle in the Poitou-Charentes region can soak up 2,400 hours of sunshine each year, those in Lorraine have to make do with 800 hours less.

In the Champagne-Ardennes region the sun shines for an average of 1,500 hours each year.

And in the regions of eastern France can suffer from long winters which may put off many Brits from setting up there.

However these regions are popular with Germans, Belgians and Swiss expats.

“Brits also tend to go to the more scenic areas. They also love the Dordogne because it looks like home,” Leggett says.

Despite Corsica having the weather and the scenery, transport between the island and Britain does not come cheap.

One area that Britons are also avoiding is Burgundy, where there are around 2,300 Brits. But given the scenery, cuisine and great wine on offer, estate agents are baffled that there are not more.

“Burgundy used to be really popular but people just don’t seem to be interested in it and I’ve no idea why. Perhaps they’ve just found other areas where the prices are better,” says Leggett.

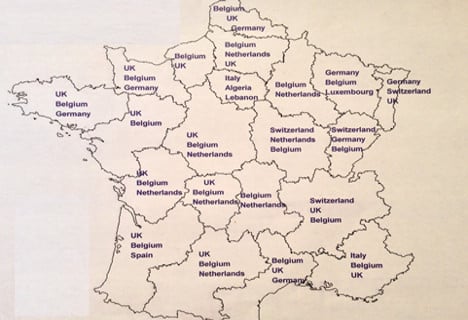

(This map from Leggett shows where different nationalities like to buy in France)

One other reason why so many Brits end up in the same areas is the desire to be with other expats, which although many try to avoid it, does make settling in that little bit easier.

“People often say that they don’t live want to live in an area with other Brits, but actually they do.

“I say to them, do you speak French? And they’ll often say they will pick it up but they don’t realize how hard it is to learn another language, especially when you’re older.

“When they get to their new home, they realise it’s mostly English speakers who help them out when they need it and it’s the other expats that give them support.”

However the reputation that certain areas of France are like “Little Britain” is unfair says Leggett.

“People talk about “Dordogneshire”, but it’s a huge area and there are villages where there are no Brits at all. In some of the bigger towns, around ten percent of the population is British. That’s still a small amount.

(The skies above the town of Dole, in Franche-Comté, are often dreary. Photo: Math Puente/Flickr)

The country welcomed 84 million visitors from abroad last year who as a whole splashed out €141 billion, INSEE revealed.

While Ile-de-France topped the table second to the bottom of the table comes Champagne-Ardennes in the north east of the country, which earned €1.48 billion through tourism. In third from the bottom position was Franche-Comté, where the takings were €1.5 billion.

However bottom of the table for tourist revenue was Limousin, which has proved a popular destination for British expats.

Are you an expat living in one of the sparsely populated areas mentioned above? We'd love to talk to you. Email us at [email protected] or get in contact with us on Facebook.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments