Shares on the stock exchange dived in Milan on Tuesday morning and borrowing costs in the country rose over concerns about the ability of the Italian government to function.

In particular, investors appeared to be concerned about the future of an austerity programme launched by the previous government in a bid to reduce Italy’s debt.

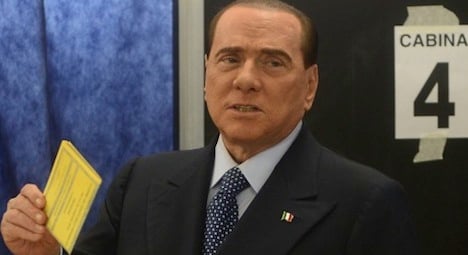

The possibility of former prime minister Silvio Berlusconi leading a right-wing coalition is among the scenarios emerging.

However, the strong performance of the Five Star Movement, led by populist Beppe Grillo, is the major reason for uncertainty.

The party, which finished with the third-highest number of seat in the lower house of parliament behind Berluscon's alliance and the centre-left, has said it will not work with other parties.

It holds the balance of power in the Italian senate where no single party has a majority.

Grillo, a former comedian who ran a campaign against the establishment parties, has called for a referendum on Italy’s use of the euro.

The result of the stalemate has been a sell-off of the European common currency and a move into safe havens, including the Swiss franc.

The euro, which rose to 1.25 francs on January 28th fell to just over 1.21 francs in early Tuesday morning trading on foreign exchange markets.

This is close to the 1.20 floor set by the Swiss National Bank, which last year actively intervened in currency market to ensure the franc did not appreciate beyond that level.

A strong franc, valued against the euro, causes problems for Swiss exporters, whose biggest market is the eurozone.

The downward “correction” in the value of the euro “is much more significant than was expected,” Sébastien Galy, analyst from Société Générale told the ATS news agency.

greater than was expected.

Galy said the prospect of an eventual return to power of Berlusconi prompted a “panic sell-off” and weakened the euro against all currencies.

Even though the risk of Berlusconi’s reappearance on the scene was known it was not factored in by traders, he indicated.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments