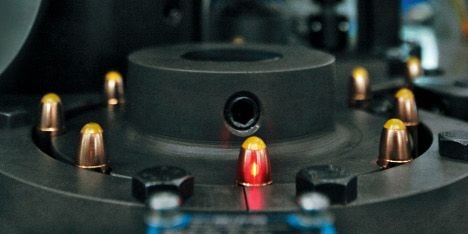

According to a report broadcast last week on Swiss TV station SF, Qatar has apparently broken end-user agreements by re-exporting the Swiss bullets, made in Ruag’s Ammotec plant in Thun, south of Bern, to Libya.

Swiss law forbids any weapons to be sold to countries in conflict, while the United Nations has placed an arms embargo on Libya.

The State Secretariat for Economic Affairs (SECO), which handles export agreements, has now reacted to the report by stopping all weapons exports to Qatar, pending an investigation into how the bullets landed in Libyan rebel hands.

It is thought that the ammunition originates from 2009, when Switzerland sold 1.85 million francs ($2.3 million) worth of ammunition to Qatar. Last year, Swiss weapons-makers made deals with the gulf state worth over half a million francs.

But Swiss opposition parties are not satisfied with SECO’s decision. The Green Party’s Jo Lang, a member of a security policy committee of the Swiss parliament, is calling for a total ban on weapons exports to the entire Middle East and the Maghreb region.

Lang fears Swiss weapons could also be used to suppress democracy movements in the region.

Christian Democrat Jakob Büchler, speaker of the security policy committee, called the re-export of Ruag ammunition an “unpleasant isolated case.”

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments