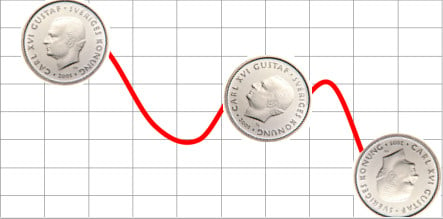

Sweden’s currency has weakened by 12 öre against the euro and 36 öre against the dollar since Tuesday afternoon and is now trading at levels not seen since 2002.

“It’s a result of technical factors. It doesn’t have anything in particular to do with news from Sweden, but rather is a reflection of the financial uncertainty,” said Robert Bergqvist, the chief economist with SEB bank, to the TT news agency.

According to Berqvist, the dollar’s surge in value relative to the krona is a result of large capital flows heading back into the United States as different financial institutions have made adjustments in their portfolios.

“And that means there’s more demand for dollars. When you have powerful movements against the dollar, the krona to euro [exchange rate] usually follows suit. There’s nothing specific,” he said.

Nevertheless, Bergqvist describes the drop in the krona’s value as rather large.

“If you put it in perspective with what’s happened in recent months, it’s a pretty strong shift we’ve just had, in particular against the dollar,” he said.

The krona hasn’t been this weak since the summer of 2002, according to the Total Competitiveness Weights (TCW) index which measures the krona’s value against a basket of other currencies.

“And the fall against the dollar will likely continue,” said Swedank currency analyst Karl-Johan Bergström.

The reason is that the outlook for the global economy has weakened substantially, which causes investors to move their money to dollar-denominated investments.

He adds that the krona’s weakening against the euro is due to the fact that Sweden’s growth forecasts have been lowered further than that of the Eurozone.

“This is been happening continuously for the last six months,” said Bergström.

However, he thinks that the krona’s drop against the euro has started to go too far.

“Against the euro, the krona feels undervalued now,” he said.

He doesn’t think the unusually weak krona will have any large effects on inflation or Swedish exporters ability to sell more their wares abroad.

“It could strengthen exports but at the same time demand is weak,” said Bergström.

And when it comes to inflation, Bergström believes that the falling price of raw materials will counteract any rise in import prices, which one might expect to also generate domestic inflationary pressures.

“The net result ends up being that inflation drops back,” he said.

In addition, belives Bergström, the Riksbank has other considerations besides inflation ahead of Wednesday’s interest rate decision, which will be made public on Thursday.

Please whitelist us to continue reading.

Please whitelist us to continue reading.