“This is expected to contribute to inflation being close to the target of 2 per cent next year and onwards, and to production and employment developing in a balanced manner,” the bank said in a statement.

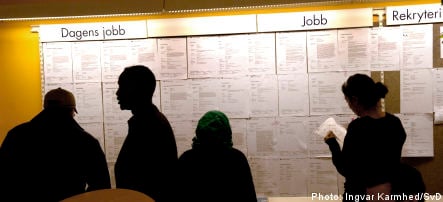

The bank added that Sweden’s economy was developing strongly, and that while signals from abroad were mixed, developments have generally been positive. GDP growth in Sweden was higher than expected in the second quarter and the labour market is “tighter than the Riksbank anticipated in June,” the statement said.

Lending and house prices have increased rapidly, it added.

Cost pressures have been higher than expected, the statement continued. Rising food prices have put pressure on inflation.

The bank said the recent market turbulence would have “some negative consequences for growth abroad and in Sweden.”

“It is as yet too early to determine the extent and duration of these effects.”

Please whitelist us to continue reading.

Please whitelist us to continue reading.