The price of residential property peaked in Sweden and Denmark in June last year, and in August in Norway.

Since then, Sweden has seen the biggest falls, with the price of homes overall dropping by 16.8 percent, detached houses by 18.6 percent, and apartments by 13.8 percent, according to the Booli! price reporting service.

Norway has seen slightly less steep falls, with the average price of a home falling from 4.6 million kroner in August 2022 to 4 million kroner at the end of December, a fall of about 13 percent. The seasonally adjusted figures used by the country’s national bank indicate a much lower 2.6 percent fall between August and December 14th.

Denmark has so far come off the most lightly, with the price of apartments down 10 percent and the price of houses down 9 percent.

“It’s really the effect of higher interest rates that is driving down house prices, which is completely by the book,” Las Olsen, chief economist at Danske Bank, told The Local. “Higher funding costs naturally lead to lower house prices. And the increase in interest rates that we’ve seen over the last year is very large and that means that the pressure on house prices is also very high.”

Housing costs in all three Scandinavian countries were high by European standards before rates began to rise, explaining why the region has been relatively hard hit.

An analysis by Eurostat, using 2021 figures, showed that housing costs, including gas, electricity and water, were higher than in most other comparable countries, with housing costs in Denmark beaten only by countries like Switzerland and Ireland. Housing costs in Sweden and Norway were slightly lower.

When Eurostat looked at what percentage of household disposable income was spent on housing in 2021, Denmark and Sweden were also both at the high end. Norway was not included in the study.

Olsen said the situation in the housing market before rates started to go up explained why prices had so far fallen most heavily in Sweden.

“Swedish house prices have dropped quite a bit more than what we see in Denmark and Norway, even though the Swedish interest rate increases are not substantially bigger,” he said. “This reflects, for one thing, the fact that Swedish house prices were probably a bit more highly valued going into this period of higher interest rates.”

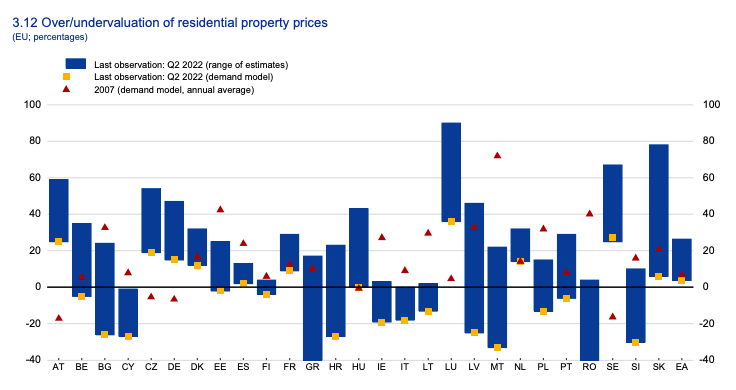

A report by the European Systemic Risk Board, published in December 2022 and based on data from the second three months of 2022, estimated that apartments and houses in Sweden were potentially more overvalued than any other country in the European Union apart from Slovakia and Luxembourg.

The board judged that residential property in Sweden was between about 25 percent and a little over 60 percent overvalued.

Residential property in Denmark, meanwhile, was only judged to be between 15 percent and a little over 30 percent overvalued. Norway was not included in the survey.

Olsen noted that Swedish households are also “a bit more vulnerable”, as they have not been supported with government money during the pandemic and the more recent inflation crisis to the same extent as households in Denmark and Norway.

Danish households also have an advantage over their Swedish and Norwegian counterparts because more than half of Danish mortgages are fixed for the entire 30-year duration of the loan, whereas variable rate mortgages are much more common in Sweden and Norway.

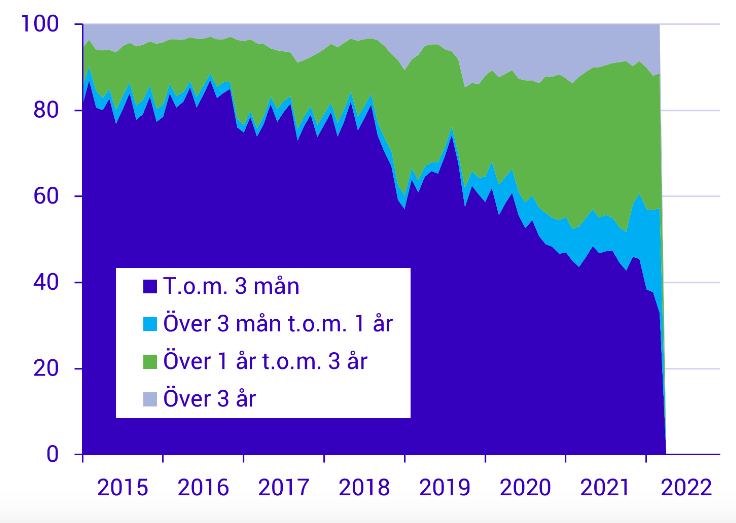

Up until the middle of 2018 around 80 percent of new Swedish mortgages were only fixed for three months or less, while only a few percent were fixed for more than three years.

“Swedish households are very sensitive to movements in interest rates. They have variable loans, in general, so it’s feeding through very rapidly,” he said.

At the start of 2022, the number of new mortgages fixed for three years or more in Sweden soared to more than 80 percent, but according to the government-owned lender SBAB, a full 80 percent of customers still chose variable rate mortgages in December.

How many new Swedish mortgages are variable rate?

Purple = fixed for three months or less. Blue = between three months and a year. Green =

fixed for between one and three years. Grey = fixed for more than three years.

Norway also has a large proportion of variable-rate mortgages, but Olsen suggested they were still less vulnerable.

“Norwegian households have some other strengths: they have received a lot of support during Covid, especially. And also electricity bills are more or less capped in Norway, which they certainly are not in Sweden.”

How indebted are Scandinavian populations?

Households in Denmark, Norway and Sweden have among the highest level of loans outstanding compared to their gross disposable income of any of the counties covered by The Local’s network, according to a survey by Eurostat.

The high apparent indebtedness of Danish households, however, is partly warped by loans taken out by farmers, which are included in household debt statistics. Olsen estimates that the real level of indebtedness in Denmark, while still high, is closer to that of Sweden.

In addition, household indebtedness as a share of income in Denmark has fallen steadily since it peaked in 2014.

“Households in Denmark have been saving quite vigorously ever since the financial crisis, so the level of debt is high but the direction is down,” Olsen said.

So what will happen over the next year or so?

The official prognoses are for a soft landing rather than a full-on market crash.

Denmark’s central bank, Nationalbanken, expects house prices to fall by about 5.6 percent in 2023.

Adjusted for the season, Norway’s central bank, Norges Bank, expects house prices to fall in total by about 6 percent from August 2022 to August 2023, before starting to rise again.

Sweden’s Riksbank central bank, using the Hox Sverige housing index, in a report out in November, predicted that the 11.75 percent annual fall seen at the end of 2022, would be repeated by a further 8 percent fall in the year leading up to the last quarter of 2023. This represents a total fall of about 19 percent.

Some economists are more pessimistic, however.

“If interest rates go the way everyone expects, then it’s quite reasonable to see housing prices going down 8 percent in 2023,” Tor Borg, head of analysis at CityMark, told The Local, referring to the Swedish market. “But I think it could be worse, as I’m not that convinced that inflation will come down as quickly as everybody thinks and I’m not sure the Riksbank will stop increasing rates as soon as everybody else thinks.”

Las Olsen at Danske Bank said that even if the fall in property prices did turn out to be deeper and more prolonged than currently predicted, Sweden, Denmark and Norway were all “fairly well prepared for such a scenario”.

“We have after all been through the financial crisis and also through the crisis before that and hopefully we have learned something from those events so that the economies are more robust.”

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments