For those who move to France when they are of working age, it’s common to have worked – and contributed to a pension – in several countries. So what happens to combining all those pensions when you come to retire?

The short answer is that periods of employment outside France can be combined with years worked in France to boost or qualify for the French state pension – but it depends on which country you have worked in, whether that country is in the EU/EEA or whether that country has a social security agreement with France.

READ MORE: EXPLAINED: The website to help you calculate your French pension

The EU and EEA countries, and Switzerland have social security coordination which means that pensions can be easily combined.

For those who worked in France and another non-EU/EEA country (eg the USA, Australia or Canada) – the pension calculation is a bit different.

For Brits it depends on when you arrived – those who lived in France before December 31st 2020 (ie those covered by the Withdrawal Agreement) benefit from the same arrangements as EU/EEA countries. Those who arrived after that date fall under the general rules for non-EU countries.

The key is whether the countries you worked in – listed here – also have social security agreements with France that will allow you to combine work periods.

A calculation will be done between the two countries to determine the amount of the French pension you qualify for and the amount of the pension you qualify for from your home country. Then, you will receive these payments separately.

A few countries – listed here – have agreements with France for self-employed workers.

READ MORE: Ask the experts: What do Americans in France need to know about investments and pensions?

The situation for Americans

Americans living and working in France benefit from the Franco-American Social Security Agreement (SSA). Essentially, this allows Americans who have worked in France to have their pension calculated on a pro rata basis. The agreement specifies that this calculation will be done by multiplying the theoretical amount by the ratio of the periods of coverage under French laws to the total periods in both countries.

Take the example that France’s state agency Assurance Rétraite wrote for “Michael”, born in 1955, who worked in both the US and France to demonstrate how the SSA is put into action.

To retire by French standards, Michael would need 166 quarters to have a full rate. If he has contributed 150 trimestres in France, and 18 in the United States, that means that once he has reached the age of 62 (Note: This reference is to France’s previous minimum retirement age, it will progressively rise to 64 starting September 2023), he can apply for his French pension (as he has a total of 168 trimestres worked between the two countries).

READ MORE: Reader Question: How long do I have to work to qualify for a French pension?

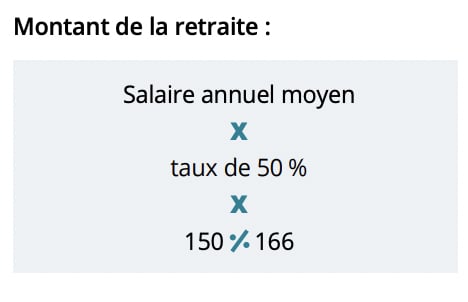

The calculation would be as follows:

In English, the formula to calculate the amount of Michael’s French pension would be: Michael’s average annual salary X The full pension rate of 50 percent X 150 (quarters contributed in France) / 166 (Total quarters worked).

The reason the calculation uses 166 instead of 168 quarters is that the Franco-American agreement states that to “avoid an excessive pro rata reduction for workers with many years of coverage under the US and French systems, the denominator of the ratio is limited to the number of quarters of coverage required for a full old-age pension under French laws.”

Keep in mind that the number of quarters referenced for a minimum is also reflective of the previous pension standards in France. For anyone born after 1973, the minimum number of quarters in France is set to 172.

Essentially, the agreement allows you to combine years of work in France and the United States, which can count toward your American retirement too.

According to Tax Partner, Jonathan Hadida, who works for Hadida Tax Advisors, a company that specialises in tax consulting and helping Americans living in France to be tax compliant in both countries, Americans looking for assistance with their social security should contact the US Embassy in Dublin, which has a dedicated team to assist with social security questions for Americans abroad.

For Americans looking for more information about saving money and investing while in France, as well as the rules for continuing to access private pension plans, such as a 401K or IRA, you can learn more HERE.

The situation for UK nationals

For Brits who have moved to France post-Brexit, as of 2023, it was still not clear whether an updated social security agreement between the two countries had been put into place.

Those who moved prior to Brexit – as mentioned above – continue to have their pension contributions made in France calculated in the same way that EU/EEA countries have theirs calculated. You can learn more about this HERE.

Keep in mind that you may need a bank account in the United Kingdom to access your UK pension. This has been an issue for some Brits living in France.

READ MORE: Brexit: How to avoid bank account closures by opening a French bank account

The situation for Australians

If you are Australian, you should beware the ‘pensions trap’ resulting from the lack of an international social security agreement.

The lack of a bilateral social security agreement has made it so that many Australians of retirement age who live in France cannot claim an Australian old- age pension, even if they have spent their lives working and paying taxes in Australia. You can find the full details here.

READ MORE: Australians planning to retire to France warned over little-known pension trap

A final key point is for foreigners who receive a state pension from their home country, you may need to have access to a bank account in that country to collect the funds.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments