War in Ukraine has pushed electricity prices in Spain to the highest rate on record – €544 per megawatt hour (MWh) on Tuesday February 8th.

Between 7pm and 8pm on Tuesday, Spaniards will pay €700/MWh for electricity, truly outlandish rates.

A year ago, the average price per megawatt hour was just €45.44, although over the course of 2021 the price did first double and then quadruple that rate as the Covid-19 pandemic, inflation, adverse weather and a volatile natural gas market all formed the perfect storm for consumers.

And yet, those sky-high rates pale in comparison with what people in Spain now have to pay, with Russia’s invasion of Ukraine proving to be the straw that broke the camel’s back.

Logically, Spain’s 47 million inhabitants are now looking for ways to keep a watchful eye on how much electricity they’re consuming at home and at their businesses.

If this is the case for you, here’s how you can monitor your home consumption in real-time over the internet.

Firstly, please be aware that your home must have a smart meter installed in order for this to work.

These are the new models that have replaced the old traditional ones and are being installed and transmit the data so that you can follow it online.

All you need to do is to go to the customer area of the distributor that provides your electricity or its corresponding app. This should be the company that sends you electricity bills each month.

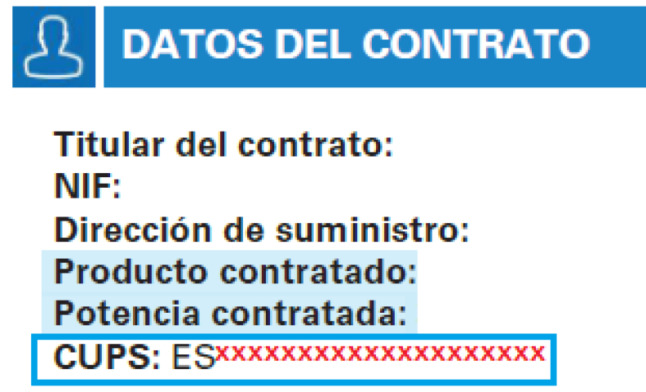

If you don’t know your distributor, then you can look for the CUPS (Universal Supply Point Code) code on your bill – this is a series of numbers in which the first digits indicate the distributor.

Here are some examples of codes that correspond to different distributors: Nedgia ES0230, Nortegas ES0229, Redexis ES0238, Endesa ES0031, Iberdrola ES0021, and Union Fenosa ES0022.

You can check here to see Spain’s 333 different electricity distributors.

Once you have identified your distributor, you can access the website and log on. If you are not yet registered online, you can go ahead and do so. You may need to input some information which should be included on your most recent bill, such as your CUPS code and other identifying numbers.

You may also need to scan in and upload an ID document in order for them to identify you.

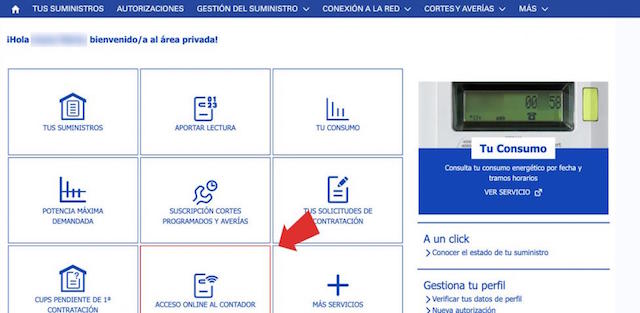

Once you have registered and logged on you will need to click on the button that says something similar to ‘meter consultation’ or ‘online access to the meter’, which will give you access to the data.

Whether on the web or via the app, you will be able to see the power capacity you have contracted and the power you are consuming displayed in real-time and letting you know how much you’re spending on electricity at that given moment.

If you don’t have a computer or access to the app, or you don’t have a smart meter installed at your home, you can also always call your company and request information on your current electricity consumption.

READ ALSO: 11 ways to cut costs as Spain’s electricity rates beat all-time price records

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments