Spain’s property market has not yet experienced the drop in prices that many budding house owners were hoping for in 2021.

Some may therefore prefer to not wait for any potential downturn in the market and just go for it and purchase the Spanish property of their dreams.

But what’s a normal price to pay for a property? This of course depends on numerous factors but Spain’s Property Appraisal Society recently shed some light on what you can expect to pay for a 90 square meter home in Spain – approximately the average size of a residential flat – depending on whether it’s completely new or it’s second hand.

How much can you expect to pay for a brand-new property in Spain in 2021?

According to Spain’s Property Appraisal Society, the average price of a new home in Spain so far in 2021 is €223,380.

That’s equal to $263,169 or £191,683.

The average per square metre price of new homes in Spain stands at €2,482 sqm after a slight annual variation of 0.4 percent and a six-month variation of 0.2 percent across 16 of Spain’s 17 regions.

This is the highest value new builds in Spain have achieved since 2010, when the average square metre was going for €2,537/sqm.

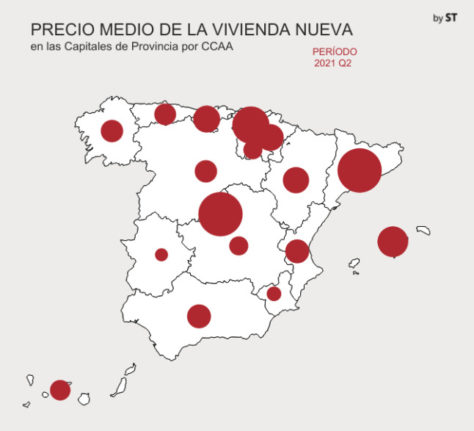

As the map below reflects, the Spanish regions where the value of new builds is highest are Catalonia (€3,992/sqm), Madrid (€3,682/sqm) and the Basque Country (€2,762/sqm).

On the other side of the spectrum are regions like Extremadura in southwestern Spain and Murcia in the southeast, where the average square metre price is €1,209/sqm and €1,265/sqm respectively.

Spain’s Property Appraisal Society collected data between March and June 2021, using the values of nearly 38,000 homes from 2,900 new developments across the country.

What’s the average price of a property in Spain overall in 2021?

Spain’s Property Appraisal Society doesn’t have data exclusively for second-hand homes for 2021, instead calculating the average price of new and second-hand homes together.

This at least serves to know what the average price of a 90 sqm property in Spain is.

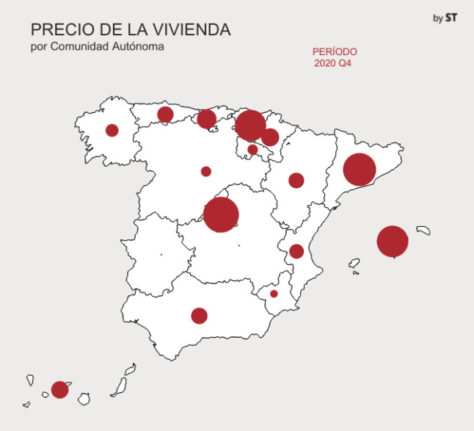

The average cost of a residential property in Spain in Q4 2020 was €150,750, the latest available data shows. That’s equal to $177,470 or £129,483.

The average per square metre price of all types of homes in Spain stands at €1,675 sqm, representing a drop of 0.4 percent in the first six months of 2021 but an annual increase of 0.7 percent on last year’s average price.

Madrid, Catalonia and the Basque Country again have the highest prices for second-hand properties, followed closely by the Balearic Islands.

The average price per square metre for residential properties is below the national average of €1,675 sqm in all of Spain’s other 13 regions.

What’s the average price of a second-hand property in Spain in 2021?

According to leading Spanish property search engine Idealista, the price of second-hand homes has increased by 10.1 percent during the past 12 months.

As of July 2021, the average price for a second-hand property in Spain stood at €1,816/sqm.

For a 90sqm used property in Spain, the price is therefore an average of €163,440 – equal to $192,472 or £140,253.

The Balearic Islands, with an annual increase of 2.7 percent, is the Spanish region with the highest price for second-hand housing: €3,169 euros/sqm.

Next in line are Madrid with €2,945/sqm, the Basque Country with €2,668/sqm and Catalonia with €2,325/sqm.

On the opposite side of the table, the cheapest regions to buy a second-hand property are Castilla La Mancha (€875/sqm), Extremadura (€933/sqm) and Murcia (€1,056/sqm).

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments