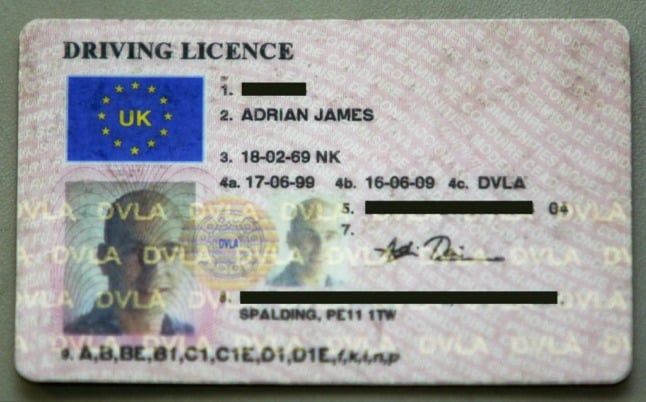

For several years UK driving licence holders living in France have been in limbo – told that they need to exchange their licence for a French one but unable to complete the exchange due to the lack of a post-Brexit agreement between the French and UK governments.

However, on Thursday the British Embassy in Paris announced that an agreement had finally been reached.

The announcement from the UK government stated: “The UK and France have agreed new arrangements for recognising and exchanging UK driving licences in France.

“Under the new arrangements:

“If your UK driving licence was issued before January 1st 2021 – Your licence is recognised in France for as long as it is valid.

“If your UK licence has expired, or is due to expire, you will be able to exchange it for a French licence. When you have applied you will receive your attestation de dépôt sécurisée. You can use this document to drive in France until your new licence arrives.

“If your UK driving licence was issued on or after January 1st 2021 – You will be able to continue using your licence for up to 1 year from the date of issue of your residency permit. If you intend to stay in France longer than 1 year, you must exchange your UK licence for a French licence during this first year. You will not need to take a driving test.”

For a detailed breakdown of the new rules and system, click HERE.

This information refers to both the expiry of photo card and original paper driving licences issued in the UK (more info below).

The system to exchange for people who do need to do so is not yet live, but this is expected to be so in the next few weeks.

This applies only to UK licence holders living in France, British tourists and visitors can continue to drive on their UK licence, do not need to exchange it and do not need an International Driver’s Permit.

UK licence holders living in France had previously been told they would need to exchange their licence by the end of 2021 in order to avoid having to take a French driving test.

The new arrangements appear to mean that the majority of Brits living in France will now not have to make an exchange immediately, and can instead wait until their licence is near to expiry to make the swap.

More detail was provided by Kim Cranstoun, who runs the Facebook group Applying for a French Driving Licence.

She said: “Licences and Photocards issued before December 31st 2020 will continue to be recognised as legal and will be eligible for exchange six months before the expiry date of :

-

Photocard 4b

-

Photocard column 11

-

Original paper UK licence at 70

“A WARP Withdrawal Agreement Residence Permit (Article 50 Tue) will be required for UK citizens, or a carte de séjour if you are required to hold one for application. If you hold EU citizenship, no changes to existing exchange procedure.”

The driving licence issue has been a long, confusing and highly frustrating saga, marked by several changes in the official advice.

In the aftermath of the 2016 Brexit referendum, the British government told all British people living in France that they would need to exchange their driving licence for a French one.

Thousands of people did so, completely overwhelming officials in the small department at Nantes préfecture which processes all requests for foreign licence exchanges. It resulted in a massive backlog of applications as well as many “lost” ones.

In 2019, French authorities issued a new directive – only people who fell into certain categories (such as those whose licence was lost or about to expire) needed to exchange their licence, everyone else could carry on driving on their UK one.

They then began work on clearing the backlog and also created a new online process to make applications easier.

This meant that anyone who moved to France after 2019 has never been allowed to make an application to exchange their licence.

When the Brexit transition period ended on January 1st, 2021 a complete block came in on exchanging licences while the two governments attempted to agree a reciprocal agreement.

This left people whose licence was about to expire trapped, unable to either renew their UK licence or exchange it for a French one.

The Local heard from many people, often elderly, who were left stranded in rural France with no driving licence.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Finally some good news!

if my uk driving license expires next year do i have to apply for a french one or can i renew my uk license?

No because it will be issued after December 2020, you will have to exchange your UK licence for a French one. That’s how I read it.

So if I read the article & information correctly all those British residents in France who applied by Ants site before December 2020 and who obtained official acknowledgment with a reference number are likely to be refused an exchange of licence. This is because of the new requirement (listed in article) to have a “Certificate of Entitlement” issued by the DVLA in UK. I have “googled” this document and cannot locate anything specifically applying to our position. As my DVLA licence expires in January 2022 I suppose I will have to submit a fresh application with the above additional document? If anyone has any information about where to locate this form on line I will appreciate that.

This sounds good, but it leaves one problem. Our UK driving licences will show a British address. In my case this address is the one I moved from and sold when moving permanently to France. The DVLA insist on an address that you can be contacted at. However, I cannot change this address to a French one. Catch 22. This would make driving in the UK illegal. Any thoughts?

DVLA is currently on strike. This possible requirement of a DVLA Certificate of Entitlement is strange. I still cannot find any applicable reference to this so called document and what purpose it serves ? After all you either have a valid DVLA Driving Licence or not to swap. I think the author of this article should explain in more detail and indicate why current applications to swap which have been acknowledged by e mail should not be processed ? Frankly The Local in this important matter is not serving subscribers well.

When my wife and I exchanged our licences back in 2017 we applied to DVLA and received our certificate of entitlement, so this does exist. However, our tow sons are now going through the process and we as yet have found no reference to the certificate on the DVLA website. I can only assume that back in 2017 I just wrote to DVLA and that’s what we will be doing now.