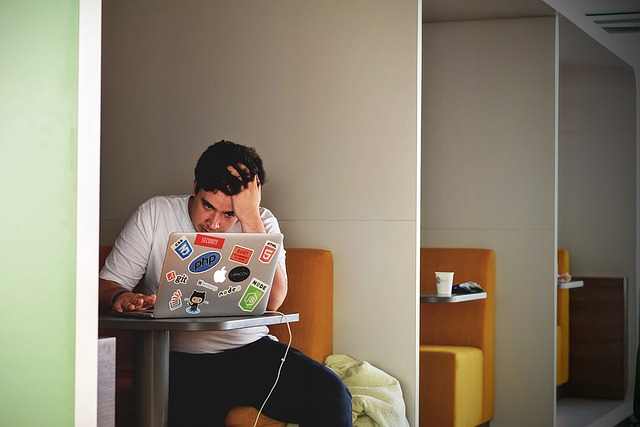

Official freelance processes in Spain can be challenging, even getting yourself off the system can be complicated.

But learning how to do the ‘baja’ from Spain’s self-employment system is definitely worth it.

You are able to deregister from the autónomo system up to three times per year without having to pay the full social security fee for that month.

You will only pay the portion up until the day you get yourself off the system. If you deregister a fourth time, however, you will be liable to pay the full fee.

This can be useful to know because it means you can temporarily stop trading and avoid having to pay the social security fee if you’re not earning.

You might need to temporarily unregister if you know you are not going to get any work for a couple of months, but will have a bigger project later on in the year or if you have lost some clients and need to wait until you can get some new ones.

READ ALSO: Spain’s new tax rates for the self-employed from 2023 onwards

Or perhaps your work is seasonal, maybe you’re a freelance teacher who won’t get any work during the summer months. In this case, you can do the baja from the system for the months of July and August only. Similarly, you can also re-register as an autónomo up to three times per year.

If you have a digital certificate, you can do the baja online yourself, and there is no need to wait ages for appointments to become available and go into the offices.

If you don’t have a digital certificate, you can ask your gestor to submit them for you.

READ ALSO: What does a gestor do and why you’ll need one

Keep in mind, deregistering online is only for people who are sole-traders and not for anyone who also employs other people. In order to deregister when you employ others, you will have to go in person to both the Hacienda and the TGSS Social Security office.

How to deregister from Hacienda

The first step is to make Hacienda, Spain’s official tax body, know about your plans. In order to stop being deemed as self-employed, they will have to remove you from RETA (Régimen Especial de Trabajadores Autónomos) or the Special Scheme for Self-Employed Workers.

It’s very important to let the tax office know that you are not going to be working so they don’t expect you to present future quarterly tax returns. If you stop working in the middle of the financial quarter, you will still have to declare what you earned in that quarter ie) If you deregister in April, the first month of Q2, you will still have to do your declaración.

Once you’ve gone on to the tax office website, type Modelo 037 into the search box or click on this link. This is the form you’ll need to deregister. Alternatively, you can also fill out the other version of the form – the Modelo 036 for the ‘Declaración censal de alta, modificación y baja’.

Next, click on ‘Trámites’ and select ‘Cumplimentación y presentación telemática 037’ (Online completion and presentation of 037) or 036, if you are choosing that form.

The system will then ask you to log on using your digital certificate or your Cl@ve pin.

READ ALSO: Spanish bureaucracy explained: Saving time through the Cl@ve system

Fill out all your details on the form, making sure to select box 150 (baja) to deregister or unsubscribe. You will also need to fill out the date that you ceased trading or stopped working and the reason why.

Once the form has been filled out, you can send it for processing. You can check this has been done correctly by going back to the home page and logging on with your digital certificate, before selecting ‘Mis Expedientes’ or My Files.

How to deregister from Spain’s Social Security system

Remember, it’s also very important to deregister from Spain’s Social Security system. If you don’t do it with both Hacienda and the Seguridad Social, they will not accept your deregistration and you will have to continue paying the Social Security fees every month, despite not actually earning anything.

Once on the Social Security website, you can search for and select ‘Solicitud de baja en el Regimen Especial de Trabajadores por Cuenta Propia o Autónomos’ or Withdrawal from RETA.

You’ll then be prompted to log on with your digital certificate and make sure all your personal details are up to date.

The next step is to fill in your IAE code. This is the code that corresponds to your profession. You can find it on the original RETA certificate you received when you registered as autónomo in the first place.

You will also need to fill out the date that you stopped working, making sure it’s the same date that you put on the Modelo 037 that you sent to Hacienda.

When you have finished filling out the form, press confirm to generate a PDF certificate to show that you’ve deregistered. Save this just in case you might need it later as proof.

It may take a few days for the system to recognise that you’ve deregistered and once it has, you will receive an e-mail or text message to say that everything has been done correctly.

READ MORE:

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments