First, an explanation.

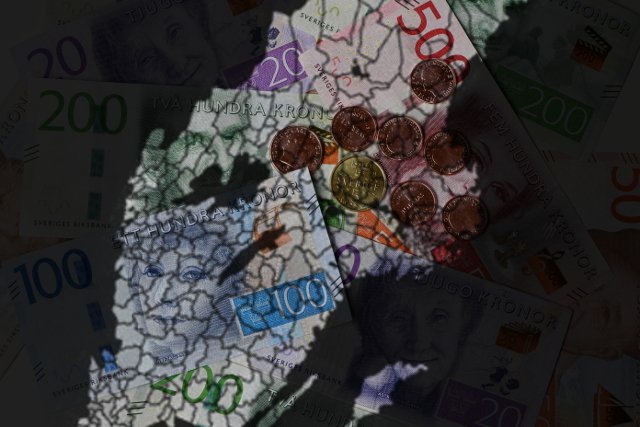

In Sweden, your total local tax rate consists of two parts: the tax you pay to the municipality (kommun) where you live and the region (landsting). So if you for example live in Malmö, your taxes go to Malmö City Council and are used to fund, for example, schools, and Region Skåne, which is responsible for healthcare.

National tax is only paid on annual income over a certain amount – this was 490,700 kronor ($52,400) in 2019, but due to deduction rules you can earn a fair bit more without actually having to pay state tax.

This article only looks at the total local tax rates, which are set to increase next year.

EDITOR'S PICKS:

In total, residents in 61 municipalities across Sweden will see their total local tax rate increase next year, and in a total of seven municipalities this increase will be more than one krona or one percentage unit.

This includes Ödeshög, which gets the sharpest tax rise with their total local rate climbing to 34.15 percent, or 1.85 kronor more than last year. Hammarö, Ydre, Danderyd, Åtvidaberg, Mönsterås and Mörbylånga make up the rest of the top seven, with a tax rise of at least 1.29 kronor.

How much can you expect to pay in tax next year? Check out the map below to find your local tax rate.

!function(){“use strict”;window.addEventListener(“message”,function(a){if(void 0!==a.data[“datawrapper-height”])for(var e in a.data[“datawrapper-height”]){var t=document.getElementById(“datawrapper-chart-“+e)||document.querySelector(“iframe[src*='”+e+”‘]”);t&&(t.style.height=a.data[“datawrapper-height”][e]+”px”)}})}();

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments