If you use online service methods (for which you need a digital identification certificate), SMS or telephone methods – and do not need to make any changes to the details already filled in by Skatteverket – you will get any money you are owed back by April 9th-12th.

But the tax agency reported on Tuesday morning that some of its most dedicated customers who tried to file their taxes first thing before breakfast had encountered tech glitches.

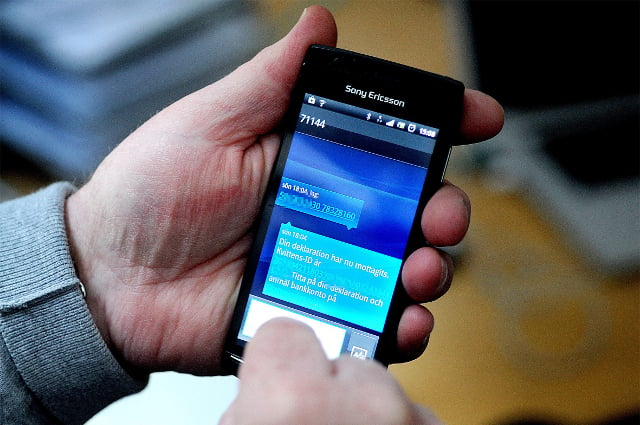

“There is a range of ways to declare digitally. The apps have had a problem with long response times,” Skatteverket expert Johan Schauman told the TT newswire.

READ ALSO: Nine things to know about your Swedish tax return

A new addition this year is the agency's online assistant, the chat bot Skatti who answers customers' questions about their tax return. Its English language ability is however so far limited.

When The Local tried to communicate with Skatti on Tuesday, it said it understood “some English but will reply in Swedish”, but most of our questions received a “I'm sorry, I don't understand what you mean – please try to rephrase your question if you can”.

Screenshot of Skatteverket's AI assistant Skatti.

The paper version of your tax form will be sent out between March 15th and April 15th. If you file your declaration this way – or have to make changes to your form and declare digitally by May 2nd, you will get your tax refund by a still not too shabby June 7th.

But before you hasten to tick “send” on your pre-filled out online tax form it is worth investigating if you are able to claim any deductions, for example for travel to and from work. Here's a list of some of the most common ones.

LOOKING FOR A JOB IN SWEDEN? Check out The Local Jobs for thousands of English-language vacancies

Please whitelist us to continue reading.

Please whitelist us to continue reading.

I had to pay for 3rd consecutive year this time 🙁