Skiing can be an expensive hobby so a new league table listing the country's cheapest ski resorts could come in handy for those on a budget.

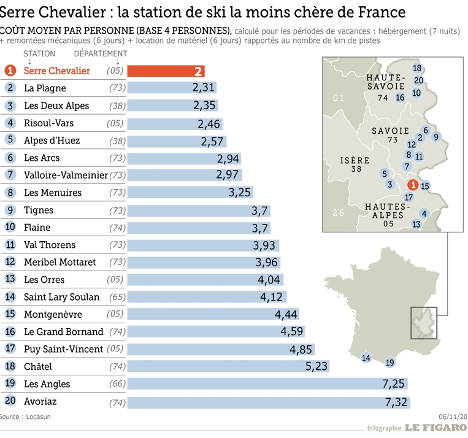

Accommodation site Locasun has come up with a pricing classification system for 20 of the most popular ski resorts in France based on the cost per kilometre. And the title for the cheapest resort goes to Serre Chevalier in the southern French Alps, where the price of speeding downhill works out at just €2 per kilometre.

Resorts were ranked by taking the average cost per person, based on four people sharing seven nights' accommodation during the school holidays, plus lift pass and ski hire for six days, divided by the number of kilometres of pistes in the resort.

Serre Chevalier's low cost was, however, partly down to its huge ski area, as well as its prices – its 250 km of slopes ties it with Les Arcs in Savoie and Alpe d'Huez in Isère for the largest resort.

La Plagne was named as the second cheapest place to ski, at €2.31 per km, with Les Deux Alpes coming third at €2.35.

Avoriaz in Haute Savoie, which has a less developed ski area, came out as the most expensive resort in France, at a cost of €7.32 per kilometre. Les Angles was the second priciest, while Châtel was third.

However, if size is taken out of the equation and the resorts are ranked on cost alone – including accommodation, lift passes and equipment hire – Serre Chevalier drops to the middle of the table, with a week's stay costing on average €499 per person, while Puy-Saint-Vincent in the Hautes Alpes comes out cheapest, with a week's stay costing €363.72.

Second cheapest is Cauterets in the Hautes Pyrénées at €369.34 per person, while on this basis Alpe d'Huez emerges as the most expensive at €642.10.

French newspaper Le Figaro printed the rankings and produced a league table of the results. See below.

by Lindsey Johnstone

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments