Spain’s High Court told the country’s richest man that he would have to pay up the back taxes for the years 2001 to 2003.

The court stressed the Zara founder was not guilty of fraud, and that the decision was about interpretation of tax rules, Spain’s El País newspaper reported on Friday.

In 2001, Ortega flogged off a bundle of Inditex shares pocketing €1.3 billion as a result.

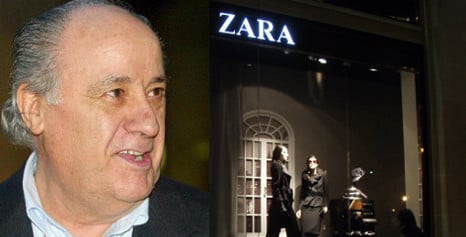

Read The Local’s profile of Amancio Ortega: the richest man you’ve never heard of

He then reinvested the money via family-run companies in two property firms.

Such family investments are generally tax-exempt in Spain as a way to promote business activity.

But the High Court argued Ortega financial advisers had actually set up a “an artificial family network” and the clothing tzar would have to pay tax on assets earned.

Sources close to the massive clothing group said the issue was one of “technical discrepancies about interpretation” of the law, according to El País.

Inditex is the largest fashion retailer globally, with some 6,000 stores in 86 countries.

In March, Forbes magazine listed Amancio Ortega as the third richest man in the world with a fortune of $57 billion.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments