At the time, it seemed like the perfect solution to a simple problem. Back in 2009, when the Federalism Committee met to discuss finance, it concluded that dividing car tax and a special insurance tax between state and federal bodies was a silly idea.

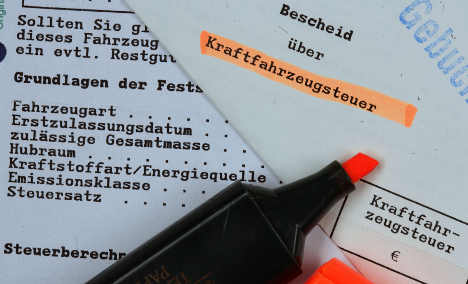

Much better, it thought, was for the federal states to collect the insurance tax (which is levied on insurance payments instead of value added tax) and for the federal government to take over responsibility for collecting car tax. That car tax pumps some €8 billion into the German economy each year.

But collecting car tax is tedious. Each year, 50 million tax notices and a further 8 million reminders have to be sent out – a mammoth task which will be taken over by federal bodies in July 2014. The problem is that they need twice as many employees than they presently have, to do the job.

In documents seen by the Süddeutsche Zeitung newspaper, Finance Secretary Werner Gatzer writes “Only 641 of a total of 1,771 positions have so far been filled.” The government had planned to fill the positions with staff who had previously worked in areas related to compulsory military service, which Germany abolished in 2011.

But the smooth transition that officials had been expecting did not materialize as many staffers did not relish the prospect of working in finance.

And although a statement reads “The prospect of continued employment in the federal service is very attractive to Bundeswehr employees,” it acknowledges that the recruitment of sufficient personnel “will not be achieved on time.”

New staff will have to undergo intensive training of between six and nine months. Gatzer has proposed to employ people through Vivento, an agency associated with Deutsche Telekom and which organized work for ex-Bundespost employees. But this could cost millions.

The opposition says the buck stops with finance minister Wolfgang Schäuble. “Mr Schäuble’s superiority is at odds with his ability to get his own affairs in order,” Social Democrat economic expert Carsten Schneider said.

The Local/kkf

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments