“We have 28 days to complete the operation,” a close associate of EADS chief executive Tom Enders told AFP as the talks must meet the tight schedule imposed by the London stock exchange, but he expressed confidence that the deal would be reached as high level talks were “on the right path”.

But despite the optimism, shares in the companies plummeted on Thursday, with the stock price of EADS, the maker of the Airbus plane, down by 10 percent and weapons maker BAE Systems losing more than 7 percent.

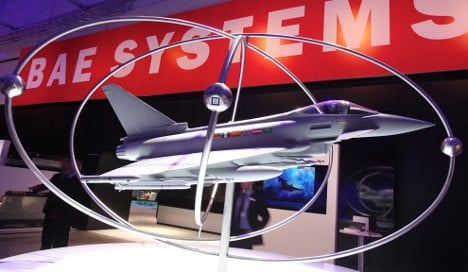

EADS and BAE have until October 10 to seal the takeover and create what would be the world’s biggest aerospace company and a major shake-up in a fast hanging industry.

“This timing is untenable,” said a person close to the negotiations.

“Whatever the case, we must move quickly” because the more time passes, the more likely another player could to get into the mix, the source said.

“The two groups are in agreement on the overall philosophy of the deal,” the source added.

All that remains now are the politicians.

EADS is an industrial champion in Germany, Spain, and especially France, where the Airbus passenger jet is still hailed as a national champion despite its multinational pedigree.

Meanwhile Britain holds a preferential stake in weapons builder BAE.

Under the plan being discussed, the two groups would issue special golden shares in BAE Systems and EADS to each of the French, German and British governments.

The talks envisage BAE Systems owning 40 percent of the enlarged group, with EADS holding a majority 60-percent stake.

The source close to Tom Enders added that executive boards would be staffed with European members.

In Paris, officials were mum on government strategy in the blockbuster deal, while German government sources sent mixed signals, doing little to assuage market jitters.

“It is questionable whether the proposed structure can actually be agreed to,” news agency DPA said citing government sources that spoke of “serious reservations”.

“Alongside questions of European law, there is also the question as to the value of such an arrangement,” DPA cited the source as saying.

But a separate source told AFP that Berlin was in “constructive talks” with EADS and also envisaged “close consultation with the French government.”

Lagardere, the French conglomerate that owns 7.5 percent of EADS and whose head Arnaud Lagardere is EADS chairman, said it would decide on the merger proposal once “all the conditions” were settled.

Despite Fitch rating agency saying an eventual deal would have a positive impact on the debt ratings for the groups, investors continued to shun their shares.

“Markets have a short term vision,” aerospace consultant Philippe Plouvier of Roland Berger said.

For Plouvier, the deal would be a “perfect stroke” for EADS.

“EADS could not hope for better as it had three clear objectives: reshape its portfolio, enter the US and reinforce its defence electronics business since its Cassidian (system) is suffering on an international level.”

The deal would bring “huge growth potential” to the European airspace industry, Plouvier said, and offer BAE, whose defence electronics systems are sector leaders, a much needed impetus after a series of poor earnings.

Plouvier said he saw little chance of regulators in either Brussels or the US blocking the deal as few of their businesses overlapped and the merger would bring only more competition to the US defence industry, Airbus CEO Fabrice Bregier said Airbus employees would have nothing to

worry about from the tie-up.

AFP/hc

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments