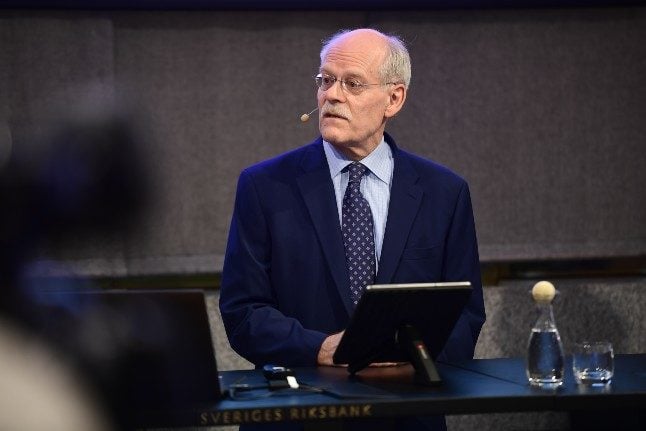

Governor Stefan Ingves defended the Riksbank’s policies, despite concerns that banks are not passing on lower interest rates to borrowers:

“Our interest rate decisions have an impact, even if they do not have an immediate effect. The monetary policy of Riksbanken is still effective in terms of capital management,” Ingves told the Dagens Nyheter daily.

But, he said, banks should have “clearer policies as to how they declare their margins.”.

Concerns were raised after last December’s interest rate cut, as banks were slow to follow suit and cut mortgage rates.

On the broader economic outlook, Ingves said Swedish banks’ reliance on international loans made it harder to maintain stability. However, he said Swedes had reason to be optimistic about the year ahead, despite great financial turmoil in the world.

“Sweden has a steady position with low debts and a balanced government budget. Expectations both for inflation and long-term inflation remain under control. Meanwhile, financial growth and productivity have developed well,” he told DN.

While Sweden’s export figures represent half of its gross domestic product it also has strong capital flows, which strengthens the positive outlook, according to Ingves.

The purchasing index in Sweden, which reflects industrial economic activity, was on the up in December coming in at 48.9 percent, compared to 47.6 percent the previous month.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments