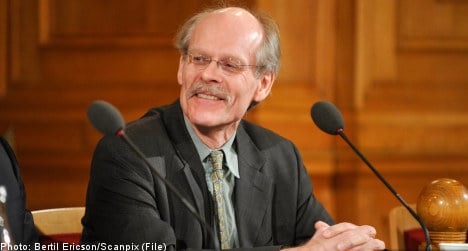

“We are pleased and honoured that Stefan Ingves has agreed to stand for re-election for a further term of office. This ensures good continuity in the work of the Riksbank,” said Johan Gernandt and Sven-Erik Österberg, chairman and vice chairman respectively of the bank’s General Council, in a statement on Tuesday.

The bank cited Ingves’ record since being appointed governor in 2006 as reason for his re-appointment.

”Stefan Ingves has done invaluable work as governor of the Riksbank since 2006. He is highly competent and able and has a valuable international network of contacts,” the statement read.

Although Ingves’ term does not finish until the end of the year, the Riksbank was keen to make an early announcement.

Deputy governors Svante Öberg and Lars Nyberg have previously informed the General Council that they intend to leave the Riksbank when their terms are up at the end of the year.

“The process of appointing two new Executive Board members has begun and an announcement will be made during the autumn,” Gernandt and Österberg advised.

Aside from his role as governor of the Riksbank, Ingves is also a member of the ECB General Council and a member of the board of directors of the Bank for International Settlements (BIS).

Prior to his current role he has been employed at the International Monetary Fund and has served as director-general of the Swedish Bank Support Authority.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments