Moody’s said it would review their exposure “to Greek government debt and the Greek private sector and the potential for inconsistency between the impact of a possible Greek default or restructuring and current rating levels.”

“Today’s actions reflect Moody’s concerns about these banks’ exposures to the Greek economy…” the statement said.

“The magnitude and composition of these exposures differ substantially across these banking groups,” it added.

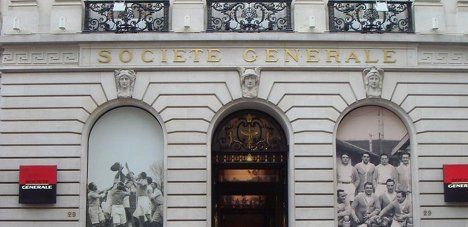

The statement said Credit Agricole’s Aa1 long-term rating and BNP’s Aa2 rating faced a downgrade of one notch while Société Générale’s Aa2 ratings could fall by two notches.

The announcement came as European leaders failed to agree on the terms of a possible second bail-out for Greece after talks in Brussels late Tuesday to avert a possible default.

Already on June 3, Moody’s downgraded the deposit and senior debt ratings of eight Greek banks, having downgraded Greece’s sovereign ratings just days earlier.

It said Credit Agricole and Société Générale both had banking subsidiaries in Greece which had already been downgraded.

BNP does not have a banking subsidiary in Greece and its exposure to the country was “more modest,” the statement said, although it held Greek government debt of around 5.0 billion euros as of December 31, 2010.

Moody’s said that Franco-Belgian bank Dexia could also face a downgrade due to its exposure to the Greek market.

Please whitelist us to continue reading.

Please whitelist us to continue reading.